Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Malaysia dropped 1.5%, followed by New Zealand (down 0.7%) and Australia (down 0.5%). India rallied 1.9%, and Singapore moved up 0.7%. Europe currently leans to the downside, but there aren’t many big movers. Greece is down 2.5%; Norway, Netherlands and Belgium are also down. Russia and Denmark are doing well. Futures here in the States point towards a down open for the cash market.

VIDEO overview of the Leavitt Brothers service…here

The dollar is down. Oil is up, copper is down. Gold and silver are up. Bonds are up.

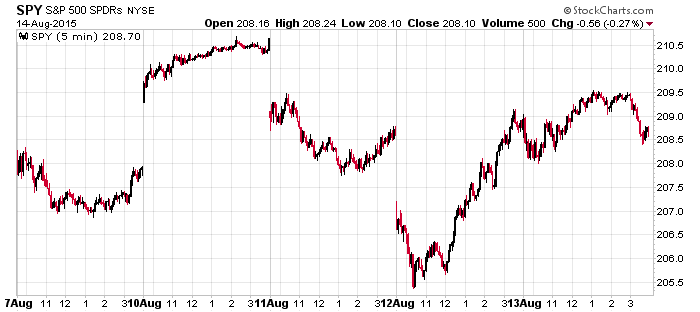

It’s been a heck of a week. Huge gap up Monday, big gap downs Tuesday and Wednesday. The range (SPX > 50 points) is big, although on par with what’s been happening this summer. One big intraday reversal and a couple smaller ones. Currently the S&P is up 5.8 for the week and is sitting slightly above the midpoint of its intraweek range. Here’s the 5-day SPY chart, to show the gaps.

With the tight range and all the sudden reversals, swing trading has been tough – I’m just calling it as I see it. Holding times are mostly short, and there aren’t many opportunities to ride a trend.

But with the big ranges, day traders have been in heaven.

All this has taken place while the market has needed to absorb a massive amount of negative news (which is good), but the internals are deteriorating (which is bad).

My stance remains the same. The market is under pressure, and until the internals improve, rallies will be shortable. There are buying opportunities for quick trades, but with a downside bias, I spend more time looking for good shorts than good longs.

Stock headlines from barchart.com…

Kohl’s (KSS -8.76%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Kinder Morgan (KMI -2.10%) was upgraded to ‘Conviction Buy’ from ‘Buy’ at Goldman Sachs.

DuPont (DD -0.47%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase.

CF Industries (CF +2.56%) was upgraded to ‘Overweight’ from ‘Neutral’ at Barclays.

PG&E (PCG +0.34%) announced that it has paid a $300 million fine levied by the California Public Utilities Commission in association with the 2010 natural gas transmission pipeline explosion in San Bruno, CA.

Reuters reports that 8 banks that include Barclays (BCS +0.17%), Bank of America (BAC +0.57%), BNP Paribas (BNPQY -0.59%), Citigroup (C +0.74%), Goldman Sachs (GS -0.19%) , HSBC (HSBC -0.02%), Royal Bank of Scotland (RBS -1.41%), and UBS (UBS +0.09%) agreed to pay $2 billion to settle a currency rigging suit.

Paulson & Co. reported a 19.4% stake in Overseas Shipholding Group (OSGB unch) .

Darling (DAR -0.65%) reported Q2 EPS of 2 cents, well below consensus of 7 cents.

Heritage Insurance (HRTG -1.49%) was approved to write property and casualty insurance in North Carolina.

Party City (PRTY -0.58%) reported Q2 EPS of 12 cents, right on consensus, although Q2 revenue of $495.50 million was below consensus of $507.75 million.

Nordstrom (JWN -0.78%) climbed over 5% in after-hours trading after it reported Q2 EPS of $1.09, better than consensus of 90 cents.

King Digital (KING -2.75%) reported Q2 adjusted EPS of 49 cents, higher than consensus of 43 cents.

Applied Materials (AMAT -1.45%) dropped over 2% in after-hours trading after it reported Q3 EPS of 33 cents, right on consensus, although Q3 revenue of $2.49 billion was below consensus of $2.54 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Producer Price Index

9:15 Industrial Production

10:00 Reuters/UofM Consumer Sentiment

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 14)”

Leave a Reply

You must be logged in to post a comment.

DOJI’S apear before a sudden rise or fall