Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed and with some notable movers in both directions. Japan, Hong Kong and Taiwan dropped more than 1%; China and Australia moved up more than 1%. Europe is currently mostly down. London, Germany, Netherlands, Sweden and Finland are down more than 1%; France, Norway, Switzerland and Portugal are posting solid losses too. Greece and Poland are up. Futures here in the States point towards a moderate gap down open for the cash market.

VIDEO overview of the Leavitt Brothers service…here

The dollar is down a little. Oil is down a small amount; copper is down. Gold and silver are up. Bonds lean to the upside.

There’s lots of talk about the September Fed meeting. Will rates get raised or will they stay put. Today we get the minutes from the last Fed meeting. They’ll give us a glimpse into what the Fed is thinking, but some things have changed since the last meeting in July. Mostly, the continuous drop in commodity prices hints at deflation, something the Fed fears. This alone could keep rates low for a while longer. Still, the minutes have the ability to move the market.

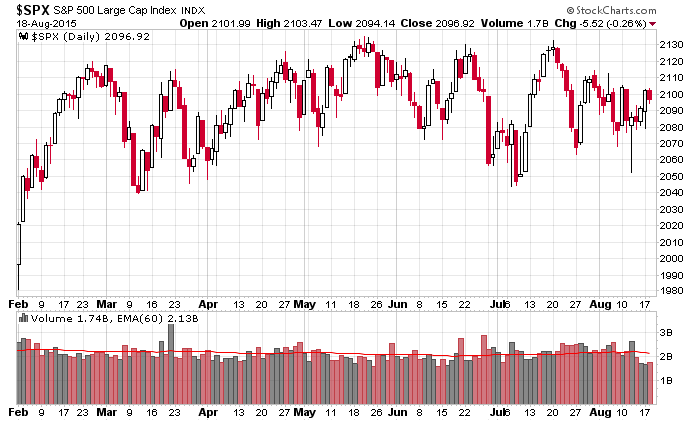

Let’s remind ourselves what the the S&P 500 has been doing. Nothing! A big, fat, sloppy mess. If you like playing the pin pong movement, you’ve been in heaven. We’ve gotten some good swing trades off – not as many as we’d like – but we’ve needed to keep our expectations realistic.

The market is very tradable…but we haven’t been able to hold for as long as we’d like. In most cases we’ve had to be content with 5-10% gains instead of shooting for bigger moves. And the opportunities to size up have been lacking. Oh well. It is what it is. Swing for singles and doubles. They add up, and at some point we’ll get a trending move.

That’s it for now. Don’t get chopped up in this range. More after the open.

Stock headlines from barchart.com…

Lowe’s (LOW +0.75%) reported Q2 EPS of $1.20, less than consensus of $1.24.

Staples (SPLS -0.56%) reported Q2 EPS of 12 cents, right on consensus.

Hormel Foods (HRL -1.37%) reported Q3 adjusted EPS of 56 cents, higher than consensus of 55 cents.

Intuit (INTU +0.15%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Google (GOOG -0.72%) was upgraded to ‘Overweight’ from ‘Neutral’ at Atlantic Equities.

International Game (IGT -0.87%) was initiated with a ‘Sell’ at Goldman Sachs.

Aflac (AFL +0.08%) was downgraded to ‘Underperform’ from ‘Neutral’ at BofA/Merrill Lynch.

C.H. Robinson (CHRW +0.09%) was initiated with a ‘Buy’ at Evercore ISI with a price target of $81.

Knight Transportation (KNX +0.29%) was initiated with a ‘Buy’ at Evercore ISI with a price target of $32.

Con-way (CNW -0.40%) was initiated with a ‘Buy’ at Evercore ISI with a price target of $44.

Seagate (STX -0.76%) said it will acquire Dot Hill Systems (HILL -4.78%) for $9.75 per share, or $694 million.

The WSJ reported that JPMorgan Chase (JPM +0.21%) is in advanced discussions with the SEC to settle investment bias charges for $150 million that it inappropriately guided clients to its own investment products.

DeVry (DV -2.03%) slid over 6% in after-hours trading after it reported Q4 EPS of 57 cents, below consensus of 61 cents.

La-Z-Boy (LZB -0.11%) rose over 1% in after-hours trading after it reported Q1 EPS of 27 cents, higher than consensus of 21 cents.

Analog Devices (ADI -2.69%) jumped over 7% in after-hours trading after it reported Q3 EPS of 77 cents, better than consensus of 74 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Consumer Price Index

10:30 EIA Petroleum Inventories

2:00 PM FOMC minutes

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 19)”

Leave a Reply

You must be logged in to post a comment.

John Unitas once said take what the defense gives you. Same whit the market. You don’t always get the long bomb but I will take 8 yards a pop every time.

I think this AM’s gap down presents a quick buy.

yes, especially before 1030 fed minutes

Beware that the Fed is scared to do anything. But expect a seasonal correction. Planning a short positions to last into black Monday at Christmas. Seasonality is the path for my current strategy.

the markets are being controlled by magic

nice run down

best shorts are europe and pos the euro

high noon time to go up

depending on who controls the magic

right on que…1200 run up