Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed with mostly big, across-the-board losses. China fell more than 4%, Japan and Taiwan more than 3%, South Korea and Indonesia more than 2%, and Hong Kong, Singapore and Australia more than 1%. Europe is currently mostly down. Greece is down 3%; London, Germany, France, Austria, Belgium, Netherlands, Sweden, Denmark, Switzerland and Russia are each down more than 1%. Futures here in the States point towards a down open for the cash market.

VIDEO overview of the Leavitt Brothers service…here

The dollar is down. Oil is down, copper is down. Gold is flat, silver is down. Bonds are up.

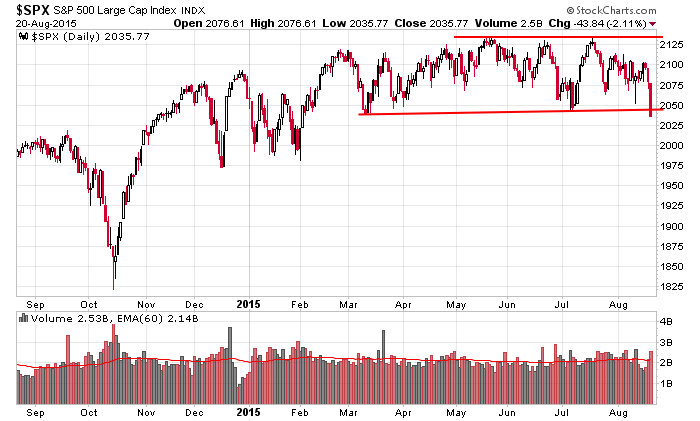

The market fell hard yesterday. It was the biggest down day of the year and puts itself on pace for the biggest down week of the year. The indexes closed at their lowest levels in several months. Oil dropped to a new low and is likely to register its 8th straight weekly decline – it’s longest such streak in 30 years. Here’s an update of the S&P daily. It took out support of the range it’s been in since February.

There isn’t much the bulls can hang their hats on.

Gold and utilities have done well to the upside while most other groups are getting hit hard.

Stocks that have been leading the way (AMZN, FB, GOOGL, NFLX, SBUX, DIS and a few others) are pulling back just as hard as lower-quality names.

The internals have been weak for a couple months.

News has been terrible.

There are no silver linings. Other than waiting for a complete washout, there’s no reason to buy.

My bias has been to the downside for a while. I’ve even said numerous times to short every rally until the internals improve. The internals are still not in good shape.

Options expire today. Considering markets around the world are falling hard, I’m not sure it matters. Whether the market has a tendency to move up or down around this day every month or whether it’s some sort of inflection point in time is secondary to the market’s emotional state right now.

Don’t be a hero. More after the open.

Stock headlines from barchart.com…

Lufthansa (DLAKY -0.39%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

Foot Locker (FL -3.16%) reported Q2 EPS of 84 cents, well above consensus of 69 cents.

Deere & Co. (DE -1.45%) reported Q3 EPS of $1.53, better than consensus of $1.44.

Adidas (ADDDY) was upgraded to ‘Neutral’ from ‘Sell’ at Goldman Sachs.

Biogen reported a 8.1% passive stake in Applied Genetic (AGTC -3.42%) .

The Fresh Market (TFM -2.42%) slumped over 10% in after-hours trading after it reported Q2 adjusted EPS of 36 cents, weaker than consensus of 40 cents, and then lowered guidance on fiscal 2015 adjusted EPS view to $1.55-$1.65 from $1.85-$1.93, below consensus of $1.85.

Ross Stores (ROST -0.81%) dropped over 8% in after-hours trading after it reported Q2 EPS of 63 cents, above consensus of 62 cents, but then lowered guidance on fiscal 2015 EPS to $2.40-$2.45, at the lower end of consensus of $2.45.

Hewlett-Packard (HPQ -1.41%) reported Q3 EPS of 88 cents, better than consensus of 85 cents.

Salesforce.com (CRM -5.86%) rose over 3% in after-hours trading after it reported Q2 adjusted EPS of 19 cents, higher than consensus of 18 cents.

Brocade (BRCD -3.19%) jumped 7% in after-hours trading after it reported Q3 adjusted EPS of 27 cents, better than consensus of 22 cents, and then Summit Reasearch upgraded the stock to ‘Buy’ from ‘Hold.’

Intuit (INTU -3.14%) slid 4% in after-hours trading after it reported a Q4 adjusted EPS loss of -5 cents, a smaller loss than consensus of -12 cents, but then lowered guidance on fiscal 2016 adjusted EPS to $3.40-$3.45, below consensus of $3.82.

Gap (GPS -1.29%) reported Q2 EPS ex-items of 64 cents, right on consensus.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

9:45 PMI Manufacturing Index Flash

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 21)”

Leave a Reply

You must be logged in to post a comment.

Going all in on the open.

just closed all shorts

may get a high noon bounce before DOW 16000

DOW and SPX need to go back to the base of this ending diaginal that started this fantasy ending movement at 16000

may get a slight deadcat for a few days before 16000

i noticed the german dax did not get all the way down to its low of 10061 hit in asian trading this morning

so maybe the nas 100 will force it there later today

ftse beat its asian low

going to sleep now