Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across-the-board. Japan rallied an incredible 7.7%. Hong Kong moved up 4.1% and Taiwan 3.6%. China, Australia and South Korea gained more than 2%, and Singapore, India, Malaysia and New Zealand rallied more than 1%. Europe is currently up across-the-board. London, France, Netherlands, Sweden, Switzerland, Finland, Spain and Belgium are up more than 2%; Germany, Austria, Norway, Poland, Greece Denmark, Italy and Portugal are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

Subscribe to Leavitt Brothers today.

The dollar is up. Oil is down, copper is up. Gold and silver are down. Bonds are down.

The big news comes from Japan where it was announced the corporate tax rate would be cut by 3.3 percentage points (from 35%), and it may be cut below 30% if needed to revive Japan’s economy.

China also plans on cutting taxes for small businesses and allocate additional funds for infrastructure projects.

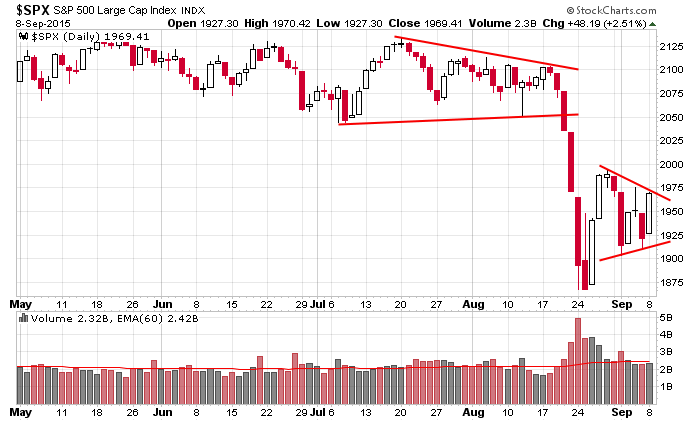

Heading into this week I felt we’d get a move up. Yesterday the S&P rallied 48 and today it’s up another 18 before the open. So far, so good. Here’s the daily S&P 500. A big break down in August was followed by a moderate bounce. Since then, even though volatility has remained high, the swings have dampened. A lower high and two higher lows are in place. Pressure is building. The bears, who’ve been pounding the table a massive move down is coming, have to be a little nervous here. The length of time that has passed between the big August breakdown and now is long enough to have somewhat neutralized the bearish sentiment. Instead of being screaming bears, their tone has softened. The bulls are getting more confident. Twice since the big plunge the market has dropped with force and both times the bulls have scooped up shares and driven prices higher. If they can follow up yesterday’s big gain with another one today, some bears may throw in the towel and some bulls, who’ve been on the sidelines, may start chasing. I’m not sure how far a move to the upside would go – I’d have to see how the breadth indicators act – but there certainly could be some follow through buying that pushes the market up a few extra days during this holiday-shortened week.

Stock headlines from barchart.com…

Intel (INTC +3.44%) was initiated with a ‘Buy’ at Sterne Agee CRT with a price target of $38.

Netflix (NFLX -3.89%) rose over 1% in pre-market trading after it announced plans to start operations in Hong Kong, Taiwan, Singapore and South Korea early next year.

Apple (AAPL +2.78%) climbed over 1% in pre-market trading ahead of its annual show where a new version of the iPhone is expected to be unveiled.

Men’s Wearhouse (MW +4.55%) reported Q2 adjusted EPS of $1.07, higher than consensus of $1.05, although Q2 revenue of $920.70 million was below consensus of $946.76 million.

Comerica (CMA +2.71%) was initiated with an ‘Underperform’ at BMO Capital with a price target of $44.

Soros Fund Management reported a 5.53% passive stake in PMC-Sierra (PMCS +3.05%).

Celgene (CELG +4.80%) was initiated with a ‘Buy’ at Jefferies with a price target of $140.

Biogen (BIIB +2.14%) was initiated with a ‘Buy’ at Jefferies with a price target of $348.

Macy’s (M +1.32%) said it will close 35-40 “underperforming” stores, representing approximately 1% of the total Macy’s sales, in early 2016.

Pep Boys (PBY +2.36%) reported Q2 EPS of 9 cents, below consensus of 13 cents.

Falcon Edge Capital reported a 5.5% passive stake in Pandora (P +3.45%).

CHC Group (HELI +2.56%) reported Q1 EPS of 62 cents, higher than consensus of 59 cents.

Casey’s General Stores (CASY +2.79%) reported Q1 EPS of $1.57, better than consensus of $1.39.

First Solar (FSLR +4.62%) was initiated with an ‘Outperform’ at Oppenheimer with a price target of $61.

Tesla (TSLA +2.58%) rose 1.6% in pre-market trading after it was initiated with an ‘Outperform’ at Oppenheimer with a price target of $340.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:55 Redbook Chain Store Sales

10:00 Quarterly Services Report

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $21B, 10-Year Note Auction

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 9)”

Leave a Reply

You must be logged in to post a comment.

Watch out for some surprises this week, the celebration is hanging on the Fed not doing much, 25BP. But what needs to concern is the market volatility which is driving trading volumes down, narrowing the leadership and trader participation in Western markets and China too. This could be the start of something bad; HFT in Tokyo pulled an amazing recovery last night (1300 pts), but why? Sort of insane and certainly not predicated on new markets, or sales expected. Escape from reality? I am holding a load of cash, and playing lightly on in the US indices. Best

we need some more bulls

i was looking for a bit higher –about spx 2000-2025 ish and equilivant in others

the big crash did not end well for a wave 1 down and whilst this could still be wave 4 up of this larger wave 1 down it probably now looks better as a corrective wave 2 up then a massive wave 3 down of 4000 dow points hopefully in oct on europe news

but not worry’ing to much about all that –just trading what the intraday gives and today may have been the high

glad to see japan and china govts finally get it

sad we dont have functioning sane govts in europe and usa

but its probably to late for europe in any case

and we still have currency wars

wow…!