Good morning. Happy Friday.

The Asian/Pacific markets were quiet. Only South Korea (down 1.1%) moved 1%. Australia, Malaysia and New Zealand closed down; Indonesia and Taiwan closed up. Europe is currently down across-the-board. Belgium, Netherlands, Norway, Germany, France, Denmark and Spain are weakest. Futures here in the States point towards a down open for the cash market.

Subscribe to Leavitt Brothers today.

The dollar is up. Oil is down, copper is down. Gold and silver are down. Bonds are up.

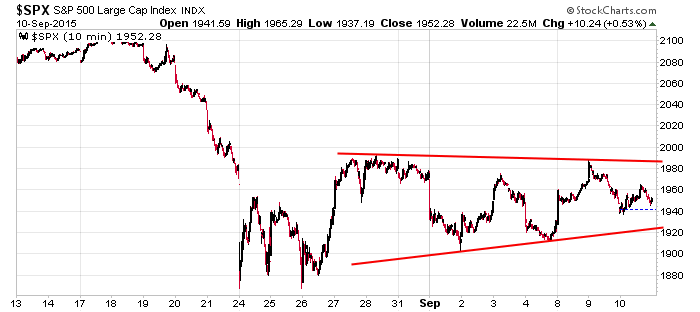

Here’s the S&P 500 over the last 20 days. A big drop in August…a bottom, which took three plunges to form…and now a triangle pattern characterized by converging trendlines is forming. Rallies get sold, dips get bought. Lots of gaps. Many sudden reversals. This is similar to the summer, but the intraday ranges are much bigger and the moves are lasting much shorter. Overall I still favor the downside, but the longer the market sits in this pattern, the more neutral it gets.

Trading in the middle of a range which is becoming more neutral is risky…simply because whatever momentum that existed when the range began is waning, so odds of a breakout in either direction move to the center and become equal. Trading at the extremes – shorting a rally or buying a dip – offers better risk/rewards and higher odds of success.

Trade but at this juncture, it may be better to wait for a move and then fade it rather than guess which way a move will go.

Again, trade, but don’t put yourself in a position to lose a lot of money when predicting the next move is coming down to a coin flip.

Stock headlines from barchart.com…

Mattress Firm (MFRM -0.43%) reported Q2 adjusted EPS of 67 cents, weaker than consensus of 72 cents and then lowered guidance on fiscal 2015 adjusted EPS view to $2.30-$2.45 from $2.50-$2.70, below consensus of $2.59.

Casey’s General Stores (CASY +0.23%) was upgraded to ‘Market Perform’ from ‘Underperform’ at BMO.

Premiere Global (PGI +2.07%) will be acquired by Siris Capital for $14 a share or approximately $1 billion.

Dow Chemical (DOW -0.07%) was initiated with an ‘Outperform’ at Bernstein with a price target of $57.

Monsanto (MON +0.56%) was initiated with an ‘Underperform’ at Bernstein with a price target of $85.

Nike (NKE +0.47%) was initiated with a ‘Buy’ at B. Riley with a price target of $126.

Goldman Sachs reported a 10.4% passive stake in Columbia Pipeline Partners (CPPL +1.34%) .

Red Hat (RHT +1.02%) was initiated with a ‘Buy’ at BTIG with a price target of $85.

Oracle (ORCL +1.40%) was initiated with a ‘Buy’ at BTIG with a price target of $44.

Salesforce.com (CRM +1.03%) was initiated with a ‘Buy’ at BTIG with a price target of $88.

Restoration Hardware (RH -1.59%) reported Q2 adjusted EPS of 85 cents, better than consensus of 84 cents.

Wendy’s (WEN -0.88%) was initiated with a ‘Buy’ at Guggenheim with a price target of $11.

Volt Information Sciences (VISI +1.27%) reported an unexpected Q3 continuing-operations EPS loss of -20 cents, below one estimate of a 31 cent gain.

Finisar (FNSR +1.08%) reported Q1 EPS of 23 cents, below consensus of 26 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Producer Price Index

10:00 Reuters/UofM Consumer Sentiment

2:00 PM Treasury Budget

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 11)”

Leave a Reply

You must be logged in to post a comment.

from your chart

1–as you can see the bottom did not form right and was only 3 waves down

5 wave sideways triangles are typical of corrective wave 4

leaving the 5 th wave down already started with smal sub waves 1 and 2 complete ,with wave 3 crash of 1500 points down to come

or

2– wave 5 down was truncated and stopped at one of the bottoms and we are now in a ending diaginal

with one more move up to 1980-2000 to finish wave e of that 5 waves but that may have trunkated at 1964

AND A CRASH OF 4000 POINTS to finish wave 3 down may be starting now

or

3 –the bulls have deceived the bears and we are going to new highs—-LOL

if we are in a bear market lower double bottoms dont work

but lower double tops are quite common

yesterdays new lows in stocks and other internals are discracefull

its weekly opts ex and the cheif quad witch ”jesabell ” next friday

the fed is dead and unbeleivable as is all other central banks

and everyone see’s they have no cloths on—NO MORE FED PUT

The confusion over the Fed has peaked. Today we play blindman’s bluff until next thursday when we discover that the Fed’s gun is empty (.25bps???.). The bonds are the key source of information. Yesterday the bonds fell in price signaling risk aversion. The indices hung on to the old favorites, energy and health etfs. I suspect the wiseman is in cash, or near cash, avoiding a stamped by the HFT cattle that trade on the floor. What is happening? Your government is failing broadly in managing the federal budget, among its responsibilities. Shut down ahead/continuing resolution/ no, confusion Hang on. Best to all.

My the posters are bearish today.

Jason’s advice is great.

“Trade but at this juncture, it may be better to wait for a move and then fade it rather than guess which way a move will go.”

As I stated in an post a few weeks ago this looks like October -December 1987 and feels like such. Two months from mid to late August Puts us in October. If you are in for an intermediate term or longer go long. We need a retest of 1880 for me to go all in again.

If the feb put is no longer their and the world economy is stuffed am i supost to be exstaticly bullish

only thing keeping me awake tonite is the budget at 2pm and the close

how about we have another debt ceiling govt shutdown,comunist seperatists win greek elections and china announces its bankrupt over the weekend