Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Australia, Indonesia and Taiwan rallied more than 1%; Hong Kong, Singapore and Malaysia also did well. Europe leans to the downside. Greece, Poland, Turkey, Germany, Italy and Czech Republic are weak; Russia, Denmark, Norway and Romania are doing well. Futures in the States point towards a down open for the cash market.

Join our email list and get reports and videos sent directly to you.

The dollar is up. Oil is up, copper is down. Gold and silver are down. Bonds are down.

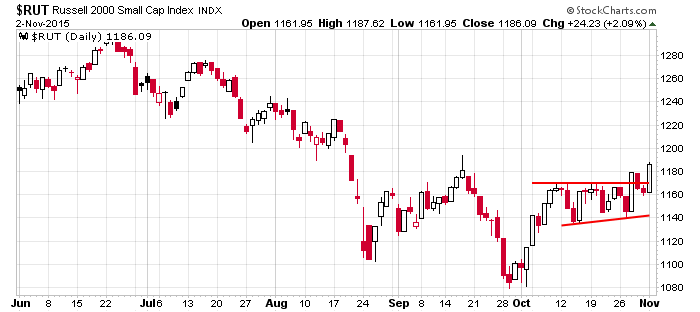

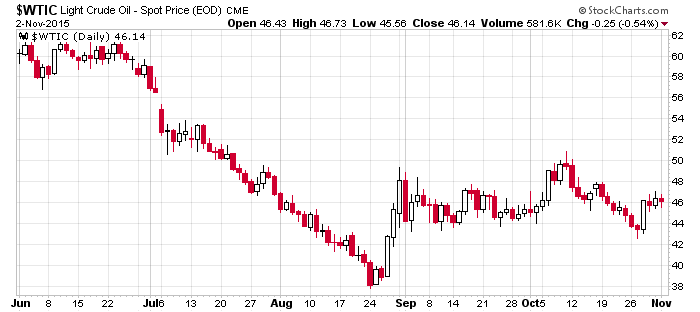

The two big questions I have heading into today are: 1) Can the small caps follow through, and 2) What comes of the divergence between oil and oil stocks.

The small caps broke out last week, retreated back into their range, and then busted out again yesterday. They have lagged and have been the only thorn in the bulls’ side. If yesterday’s breakout holds, forget new highs later this year or early next year, the S&P will hit a new high in the next couple weeks.

Oil didn’t do much yesterday overall. It gapped down, rallied to fill the gap and then gave everything back. It dropped about 0.7% for the day.

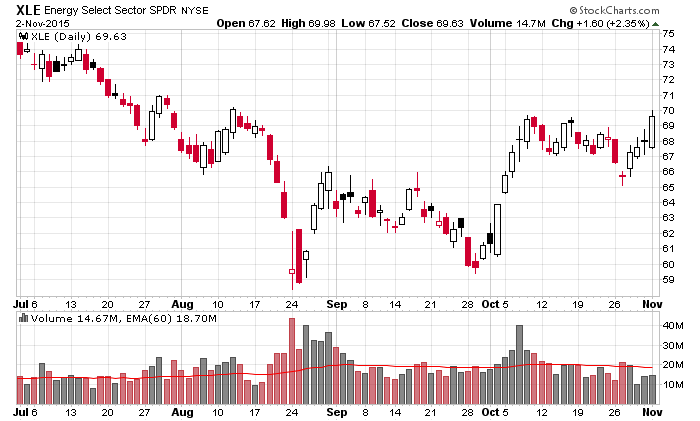

But oil stocks, via XLE, rallied 2.35% and touched a higher high. Big cap oil stocks have especially done well. Either oil is going to pull the stocks back down or the stocks know something and will pull oil up – even if they have gotten ahead of themselves. Here’s the daily XLE.

Stock headlines from barchart.com…

Archer-Daniels-Midland (ADM +1.36%) reported Q3 EPS of 60 cents, below consensus of 70 cents.

Allstate (ALL -0.13%) rose 1.3% in pre-market trading after it reported Q3 operating EPS of $1.52. better than consensus of $1.32.

King Digital Entertainment Plc (KING +3.88%) jumped 14% in pre-market trading after it agreed to a $5.9 billion takeover offer from Activision Blizzard.

AMC Entertainment (AMC +0.47%) slid nearly 2% in after-hours trading after it reported Q3 EPS of 12 cents, below consensus of 16 cents.

Avis Budget (CAR +4.73%) sank over 9% in after-hours trading after it cut guidance on fiscal 2015 adjusted EPS to $3.10-$3.25 from an Aug estimate of $3.15-$3.45, below consensus of $3.36

Fitbit (FIT +0.64%) slipped nearly 8% in after-hours trading after it reported Q3 EPS of 24 cents, higher than consensus of 10 cents, but then announced a secondary offering of 7 million shares of common stock.

Luminex (LMNX +5.71%) climbed over 10% in after-hours trading after it reported Q3 EPS of 15 cents, better than consensus of 10 cents, and then raised guidance on fiscal 2015 revenue to $235 million-$238 million from a previous estimate of $232 million-$236 million, higher than consensus of $234.7 million.

Texas Roadhouse (TXRH +1.92%) rose over 4% in after-hours trading after it reported Q3 EPS of 29 cents, below consensus of 30 cents, but said comparable sales for the first four weeks of Q4 are up +5.0% y/y.

American International Group (AIG +1.08%) slid 3% in after-hours trading after it reported Q3 operating EPS of 52 cents, well below consensus of $1.03.

Nautilus (NLS +0.35%) jumped over 11% in after-hours trading after it reported Q3 continuing operations EPS of 12 cents, higher than consensus of 9 cents.

Qualys (QLYS +1.61%) slumped nearly 12% in after-hours trading after it reported Q3 EPS of 19 cents, higher than consensus of 13 cents, but then lowered guidance on fiscal 2015 revenue to $164.1 million-$164.6 million from an Aug estimate of $165.0 million-$166.5 million, below consensus of $165.6 million.

Alon USA Energy (ALJ +2.15%) rose over 1% in after-hours trading after it reported Q3 adjusted EPS of 60 cents, well above consensus of 46 cents.

SS&C Technologies (SSNC +0.40%) climbed over 2% in after-hours trading after it reported Q3 adjusted EPS of 68 cents, higher than consensus of 62 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

Auto Sales

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

10:00 Factory Orders

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

//

0 thoughts on “Before the Open (Nov 3)”

Leave a Reply

You must be logged in to post a comment.

a little bit of intraday congestion [distribution ] before the down

all at ideal resistance for the bears to have a feast

transports are not following

can it be because oil is up 2 bucks today? i feel like i am writing the same response every time 🙂

u are and im not listening..thx ur probably right

lol, i don’t blame you jimmaya. i don’t listen to anybody either, i never have, and probably never will.

A few days back the futures [not cash] hit these levels as a spike –dow 17900 ish spx 2106

nas 4700

could be a top of importance

was that the wed. on fed minutes?

sorry disregard…

sorry jims,

it was on my cash futures contracts that i trade with cfd’s contracts for difference

similar to the ym or es but with fair value added to immitate the cash market but open 22 hours

the spike was in asian trading and yes just after fed in asian trade on thurs dow cash futures hit 18850 spx hit 2100

prior in one of my posts i said i had a target of 2106,well we got a few points above it today

and if we get confirmation it could be a nice corrective top

nas 100 obvious new top so it will fall harder and deaper

what would be your confirmation? it sells from here?

a trade under a intraday higher high or higher low is standard

anything less is a counter trend trade with its own rules