Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China rallied 1.85, and Japan moved up 1%. Australia, India and Indonesia did poorly. Europe currently leans to the upside. Germany, France and Denmark are up more than 1%; Switzerland and Russia are also doing well. Greece and Turkey are down more than 1%. Futures in the States point towards a moderate gap up open for the cash market.

———————–

Podcast with Chat With Traders

———————–

The dollar is flat. Oil is flat, copper is down. Gold and silver are mixed and flat. Bonds are mixed.

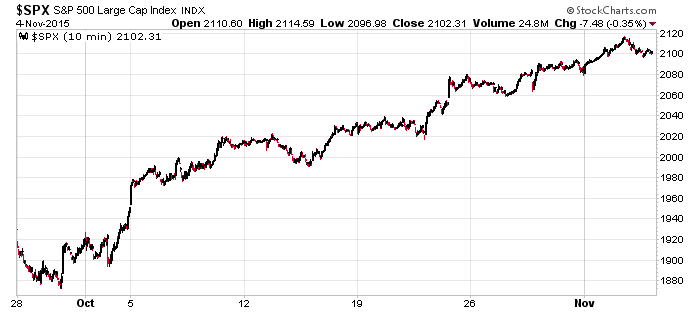

I’m not going to call the market a runaway freight train because over the last 18 days, 9 have been up and 9 have been. But since the ups have been much bigger than the downs, across-the-board gains are in place. Going back further to the late-September bottom, the S&P rallied about 240 points. Here’s an intraday chart. The longest losing streak has been two points, so it’s been a classic “bull markets don’t let you in” situation.

Don’t over-analyze. Don’t think too much. The trend is up and environment is right for a continuation of the trend into the new year. There may be hiccups along the way, but why fight what’s in place?

Stock headlines from barchart.com…

Molson Coors Brewing (TAP -0.55%) reported Q3 EPS of $1.40, better than consensus of $1.30.

Celgene (CELG +0.51%) reported Q3 EPS of $1.23, higher than consensus of $1.22.

Facebook (FB +1.33%) climbed over 4% in pre-market trading after it reported Q3 adjusted EPS of 57 cents, higher than consensus of 52 cents.

Gilead Sciences (GILD -0.11%) fell nearly 2% in after-hours trading after French doctors said that Gilead’s hepatitis C medicine Sovaldi may trigger an abnormally slow heartbeat and put patients at risk of passing out.

Qualcomm (QCOM -1.00%) slipped over 6% in after-hours trading after it reported Q4 adjusted EPS of 91 cents, better than consensus of 86 cents, but then lowered guidance on Q1 EPS to 80 cents-90 cents, below consensus of $1.08.

Marathon Oil (MRO -1.32%) fell over 4% in after-hours trading after it reported a Q3 adjusted EPS loss of -20 cents, better than consensus of a -41 cent loss, but reported Q3 revenue of $1.32 billion, below consensus of $1.38 billion.

CenturyLink (CTL -1.65%) rose over 1% in after-hours trading after it reported Q3 adjusted EPS of 70 cents, higher than consensus of 69 cents.

Bojangles’ (BOJA +4.43%) climbed nearly 5% in after-hours trading after it reported Q3 adjusted EPS of 23 cents, better than consensus of 18 cents, and then raised guidance on fiscal 2015 EPS to 79 cents-81 cents from a prior view of 75 cents-78 cents, above consensus of 76 cents.

Lannett (LCI -1.54%) tumbled 15% in after-hours trading after it reported Q1 adjusted EPS of 99 cents, higher than consensus of 89 cents, but said a “key customer has taken steps to transition its purchases of certain product lines” from Kremers Urban Pharmaceuticals, which LCI agreed to acquire on Sep 1.

SolarEdge (SEDG -8.76%) rose over 6% in after-hours trading after it reported Q1 adjusted EPS of 36 cents, better than consensus of 29 cents.

Select Comfort (SCSS -2.63%) jumped over 10% in after-hours trading after it reported Q3 EPS of 62 cents, higher than consensus of 41 cents.

FireEye (FEYE +0.66%) slumped over 15% in after-hours trading after it lowered guidance on fiscal 2015 revenue to $620 million-$628 million from an earlier estimate of $630 million-$645 million, below consensus of $640.4 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Gallup Good Jobs Rate

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 5)”

Leave a Reply

You must be logged in to post a comment.

Right On Jason

Yup Simple as…sell the rips and buy the dips (if there are any)

Fund managers putting all their money to work and shorts have been squeezed.

Jack

What is real? The chinese government has made some moves that might be helpful, CHAU? I don’t trust China, but they need some progress, so maybe they and HK will play it straight. Avoid Bitcoin. QTCQX, I can not understand what is going on, so I think, NOTHING for this animal.

The decision is the FED will do something, no idea when of course. I am still in the indices, dividends and a few bets on the ECB and China. We realized a bloom of dividends from Tax frees. Watching SPY, QQQ and IWM. No idea where this train is headed. Original?? Just can’t help myself.

i am contemplating more sales at these levels. 1200 TF is the polarity point on my charts and looking to shed more than half of TF and IWM-based positions if we get there this week.