Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Australia rallied better than 2%; Japan, Hong Kong, Indonesia, South Korea and Taiwan did better than 1%. Europe is up across the board. France, Netherlands, Belgium, Switzerland, Russia, Greece, Spain and Portugal are up more than 2%; London, Germany, Austria, Norway, Sweden, Poland, Denmark, Finland, Hungary and Italy are up more than 1%. Futures here in the States point towards a positive open for the cash market.

—————

Join our email list and get reports and videos sent directly to you.

—————

The dollar is flat. Oil and copper are down. Gold is down, silver is up. Bonds are down.

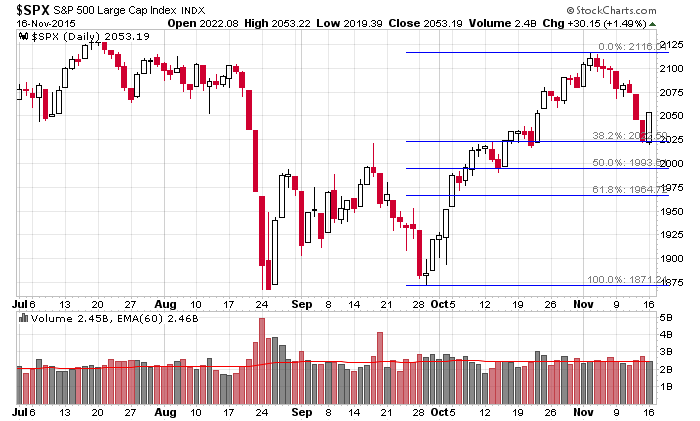

Big bounce yesterday. The S&P jumped off its 38.2% retracement level, which happened to be its mid-September high. Volume was average. The small caps posted a decent gain but lagged by a large margin.

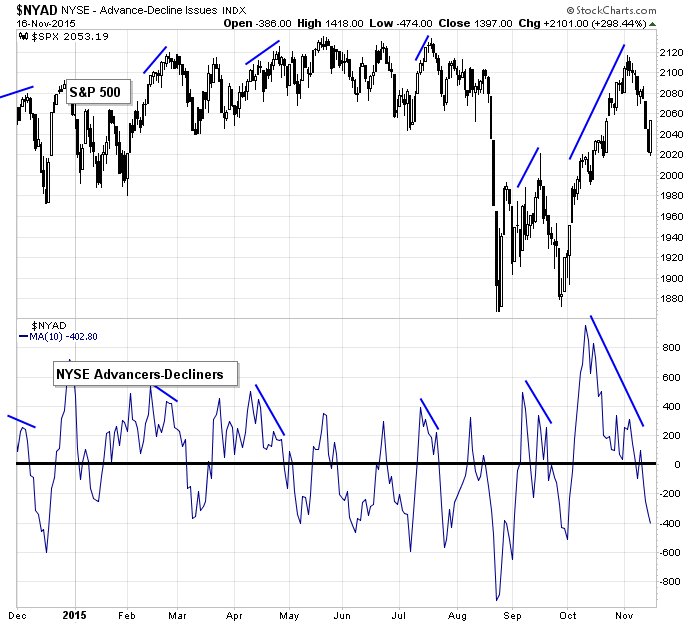

From here the question is whether the breadth indicators can also bounce and confirm the market’s move. Lack of confirmation will lead to the market coming right back down and retracing further. Confirmation leads to a rally that has legs…then we re-evaluate.

Here’s an example of what I’m looking for. The 10-day of the NYSE AD line diverged from the price action and told us the upside was limited and a correction likely. Now that a correction has played out and the indicator has dropped to a low-enough level to support a bounce we’ll see if it quickly reverses.

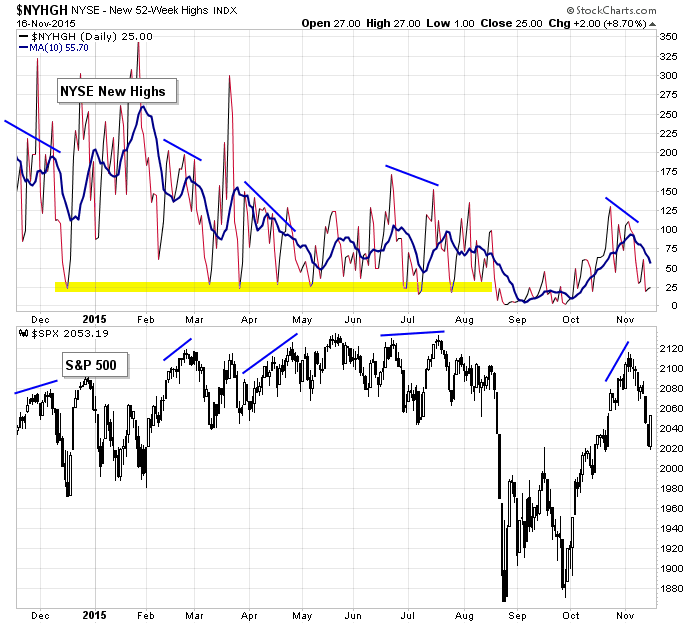

Here’s another example. New highs at the NYSE also diverged from the S&P, telling us to be very careful with new long set ups. Now the bulls want to see an expansion in new highs to confirm a rally attempt.

Let the indicators guide your intermediate activity. More after the open.

Stock headlines from barchart.com…

Wal-Mart (WMT +2.57%) climbed over 3% in pre-market trading after it reported Q3 adusted EPS of 99 cents, better than consensus of 98 cents, and then raised guidance on fiscal 2015 EPS to at least $4.50 a share, up from a previous forecast of $4.40.

Home Depot (HD +0.70%) rose over 2% in pre-market trading after it reported Q3 EPS of $1.36, better than consensus of $1.32.

Moody’s (MCO +1.23%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Chesapeake Energy (CHK +3.93%) slipped nearly 4% in pre-market trading after it was downgraded to ‘Neutral’ from ‘Buy’ at Sterne Agee.

Berkshire Hathaway reported a new stake in AT&T (T +2.26%) and said it boosted its stakes in Phillips 66 (PSX +2.23%) , Charter Communications (CHTR -0.42%) , Suncor Energy (SU +3.53%) and General Motors (GM +2.51%) and cut its stake in Goldman Sachs (GS +0.93%), Wal-Mart (WMT +2.57%) , Deere (DE +0.08%) , Chicago Bridge & Iron (CBI +0.05%) and WABCO Holdings (WBC -0.35%) .

Barron’s said on its website that Eli Lilly (LLY +2.11%) can keep rallying into next year given its promising pipeline of new products.

Nuance (NUAN +2.96%) climbed over 2% in after-hours trading after it reported Q4 adjusted EPS of 41 cents, higher than consensus of 35 cents.

Agilent Technologies (A +1.52%) fell over 1% in after-hours trading after it lowered guidance on fiscal 2016 EPS to $1.85-$1.91 from a previous estimate of $1.97.

Urban Outfitters (URBN -7.43%) dropped nearly 10% in after-hours trading after it reported Q3 EPS of 42 cents, right on consensus, but said Q3 comparable same-store sales were up +1.0%, weaker than expectations of +3.4%

Casey’s General Store (CASY +1.87%) reported October same-store-sales for prepared food and fountain were up +10.5% and October comparable sales for grocery and other were up +7.3%.

Matthews International (MATW +0.25%) reported Q4 adjusted EPS of 93 cents, higher than consensus of 89 cents, but reported Q4 revenue of $368.3 million, below consensus of $389.0 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Consumer Price Index

8:55 Redbook Chain Store Sales

9:15 Industrial Production

10:00 NAHB Housing Market Index

10:00 E-Commerce Retail Sales

4:00 PM Treasury International Capital

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

//

0 thoughts on “Before the Open (Nov 17)”

Leave a Reply

You must be logged in to post a comment.

The CPI numbers suggest no rate increase is merited in Dec 2015 but can be tolerated by the economy…for a while. Long bonds are probably safer and will avoid a later reversal of policy. Gary Shilling sees nothing positive for a while. I agree, but I made some day trade coin yesterday. Best to all.

This is a nice time to go long

the 38.2 % fib keeps the short term up in tact

but very short term has got easier–above 2070 spx we go to new highs–below spx 2020 we go to 666

feels like a opts ex bear trap –common in bear markets

gold broke to new multi-year lows, silver testing its lows. what a difference a month makes..