Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up, but gains were small. Hong Kong rallied 1.1%; Indonesia also did well. Europe is mixed and little changed. Greece is down 2%, but otherwise there are no standout winners or losers. Futures in the States point towards a moderate gap up open for the cash market.

—————

Join our email list and get reports and videos sent directly to you.

—————

The dollar is up. Oil is down, copper is up. Gold and silver are up. Bonds are down.

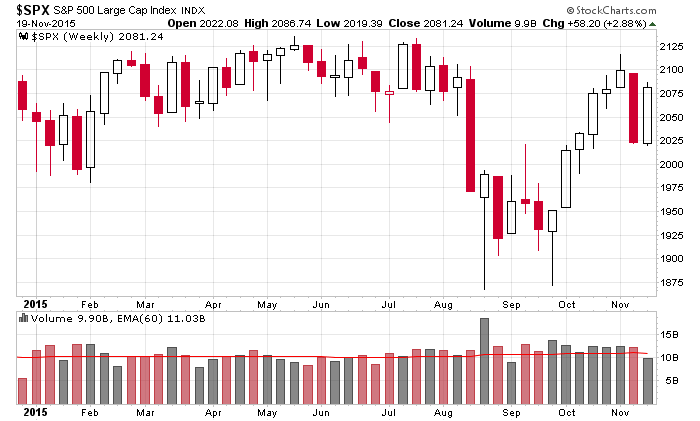

Here’s the year-to-date weekly chart heading into today. Last week was the biggest down week since the August plunge and the second biggest down week of the year. This week has almost recaptured the loss. But don’t be surprised. There have been several instances this year where big down weeks were followed by big up weeks and big up weeks by big down weeks. Not only has the market often failed to follow through, it has reversed quickly. Like I said yesterday (and have been saying) if you wait for a trend to develop, it’s too late. The move is over.

Trade but don’t over trade. Swing for singles…we’ll get chances to swing for doubles and triples in December.

Next week will be holiday-shortened. The market is closed on Thursday and will only be open a half day on Friday. Throw in very slow trading on Wednesday, and we’ll only have two legit days of trading. Then we get into the feel-good time of year.

Overall I like the market. Absent a big surprise (a rate increase would not be a surprise), the market should do well. My focus is on playing the long side and building a list of stocks I want to buy on dips. I’m not very interested in going short.

Stock headlines from barchart.com…

Nike (NKE unch) climbed over 3% in pre-market trading after its board approved a new 4-year, $12 billion share buyback program, and raised its dividend to 32 cents from 28 cents.

Intuit (INTU +0.83%) rose nearly 8% in after-hours trading after it said it sees fiscal year Q2 revenue of $880 million-$900 million, well above consensus of $826.7 million, and then raised guidance on fiscal 2016 EPS to $3.45-$3.50 from a previous estimate of $3.40-$3.45, above consensus of $3.43.

Autodesk (ADSK +1.86%) fell nearly 3% in after-hours trading after it reported Q3 adjusted EPS of 14 cents, better than consensus of 8 cents, but then lowered guidance on Q4 revenue to $620 million-$640 million, below consensus of $640.8 million.

Ross Stores (ROST -0.47%) jumped over 8% in after-hours trading after it reported Q3 EPS of 53 cents, higher than consensus of 50 cents, after Q3 comparable sales rose +3.0%, better than consensus of +2.3%.

The Gap (GPS -1.18%) slipped nearly 2% in after-hours trading after it lowered guidance on fiscal 2016 adjusted EPS to $2.38-$2.42 from an August estimate of $2.75-$2.80, below consensus of $2.50.

Williams-Sonoma (WSM -0.79%) dropped over 4% in after-hours trading after it reported Q3 comparable sales up +4.5%, weaker than consensus of +5.2%, and forecast Q4 net revenue of $1.575 billion-$1.63 billion, below consensus of $1.65 billion.

Centene (CNC -8.41%) rose nearly 3% in after-hours trading after it said its Health Insurance Marketplace (HIM) business “continues to perform in line with expectations.”

Nimble Storage (NMBL -0.78%) plunged over 30% in after-hours trading after it reported a Q3 adjusted EPS loss of -14 cents, a bigger loss than consensus of -8 cents, and lowered guidance on Q4 revenue to $87 million-$90.0 million, below consensus of $99.3 million.

Workday (WDAY +0.74%) dropped over 5% in after-hours trading after it reported a Q3 adjusted EPS loss of -41 cents, a much wider loss than consensus of -4 cents.

Cabela’s (CAB +0.94%) rose nearly 8% in after-hours trading after unidentified sources said the company is fielding potential takeover interest and weighing whether to begin a sales process.

Zoe’s Kitchen (ZOES +3.98%) slid over 4% in after-hours trading after it reported Q3 adjusted EPS of 5 cents, better than consensus of 3 cents, but said Q3 comparable sales were up +4.5%, less than estimates of +5.4%.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

11:00 Kansas City Fed Mfg Survey

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 20)”

Leave a Reply

You must be logged in to post a comment.

Nothing to like yet. Maybe Dec is a seasonal bet, but the technicals seem to say be in etf flash bets in the indices and dividends at good prices – after the fed who knows but a year end play seems good historically. 2016 is a ghost.