Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Hong Kong, India and Malaysia gained more than 1%; Australia and New Zealand also did well. Europe is currently posting mostly solid, across-the-board gains. London, France, the Netherlands, Norway and Spain are up more than 2%; Germany, Austria, Sweden, Switzerland, the Czech Republic, Russia, Turkey, Denmark, Finland, Italy, Belgium and Portugal are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up a small amount. Oil and copper are up. Gold and silver are down. Bonds are down.

—————

VIDEO: Leavitt Brothers Overview

—————

The market is doing what it does best this time of year…drift up.

December is the strongest month of the year, and all the gains are concentrated in the last two weeks, which are the best back-to-back weeks of the year.

Don’t fight the move – heck, make some money if you’re inclined – but I wouldn’t get lured into the hoopla. Absent significant improvement from the internals, this move won’t go too far. Yes it can travel back to the highs. It can follow through as some sideline money panics and gets back in the game. But overall, I’m not anticipating a lasting move without broad-based support.

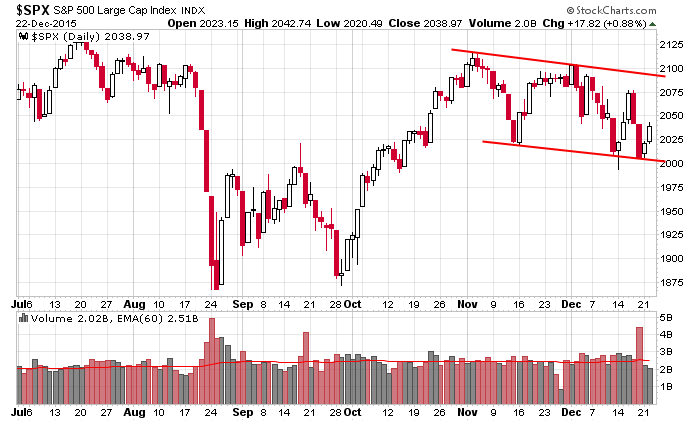

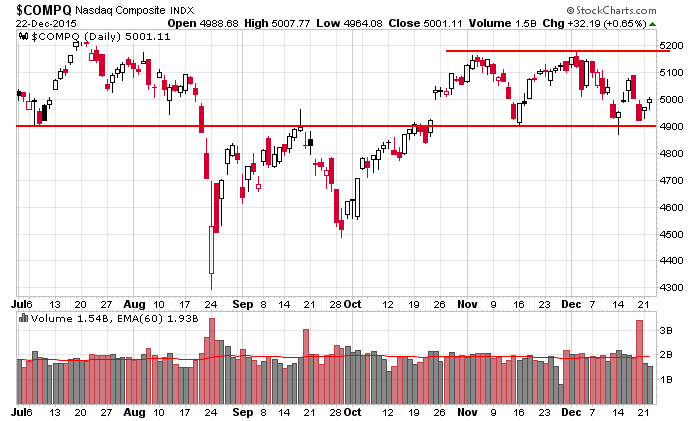

That’s it for now. Here are the daily S&P and Nas charts. Relative to the September lows, the current pattern could be considered a consolidation pattern within an intermediate term uptrend, but backing up the chart, the overall picture is neutral.

Stock headlines from barchart.com…

Nike (NKE +1.58%) rose nearly 3% in pre-market trading after it reported Q2 EPS of 90 cents, higher than consensus of 86 cents.

Celgene (CELG +0.27%) jumped over 6% in after-hours trading after it settled patent litigation with Natco Pharma Ltd. relating to patents for REVLIMID (lenalidomide).

Delphi Automotive (DLPH +0.79%) was upgraded to ‘Buy’ from ‘Neutral’ at Sterne Agee CRT with a 12-month price target of $102.

Finish Line (FINL +9.79%) was upgradd to ‘Buy’ from ‘Hold’ at Brean Capital with a 12-month price target of $23.

Steelcase (SCS -22.93%) was downgraded to ‘Market Perform’ from ‘Strong Buy’ at Raymond James.

CUI Global (CUI -1.43%) was rated a new ‘Buy’ at Rodman & Renshaw with a 12-month price target of $12.

Lindsay Corp. (LNN +1.30%) reported Q1 EPS of 62 cents, better than consensus of 54 cents, although Q1 revenue of $121.5 million was below consensus of $127.7 million.

Micron Technology (MU -1.08%) slipped over 4% in after-hours trading after it said it sees a Q2 adjusted EPS loss of -5 cents to -12 cents, below estimates of a gain of 23 cents, and said it expects Q2 revenue of $2.9 billion-$3.2 billion, well below estimates of $3.48 billion.

Bullish newsletter writers tracked by Investors Intelligence fell to 36.7% fom 37.8%, the lowest in 10-weeks.

Galena Biopharma (GALE +1.87%) plunged over 15% in after-hours trading after it received a subpoena from the U.S. Attorney for District of N.J. for documents related to the product Abstral.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Durable Goods

10:00 New Home Sales

10:00 Reuters/UofM Consumer Sentiment

10:30 EIA Petroleum Inventories

11:30 Results of $13B, 2-Year FRN Auction

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 23)”

Leave a Reply

You must be logged in to post a comment.

The SPX quarterly chart is very distinguishable. Wed.9/30/15 (3rd Q), Thurs. 12/31/15 will be the year end 4th Q. with 6 trading days left. Before the open today we were 28.03 points from 3rd Q closing price of 2067.00 which would have to close at or above that price by year-end for a bullish engulfing pattern to unfold. Also on the quarterly chart a nice wedge pattern is in the making. I can see higher highs in the short term but thereafter things can and will get shaky through out 2016 towards the presidential elections. Quick note: The best scenerio for all investors has been a Democrat in the White House and a Republican control of Congress, with average gains of 19.5%.