Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China dropped almost 1%; India and Taiwan did well. Half of Europe was closed today. Greece is doing very well. Poland and Spain are down more than 1%; London, Turkey, Italy and the Netherlands are also weak. Futures in the States point towards a gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down. Bonds are up.

—————

VIDEO: Leavitt Brothers Overview

—————

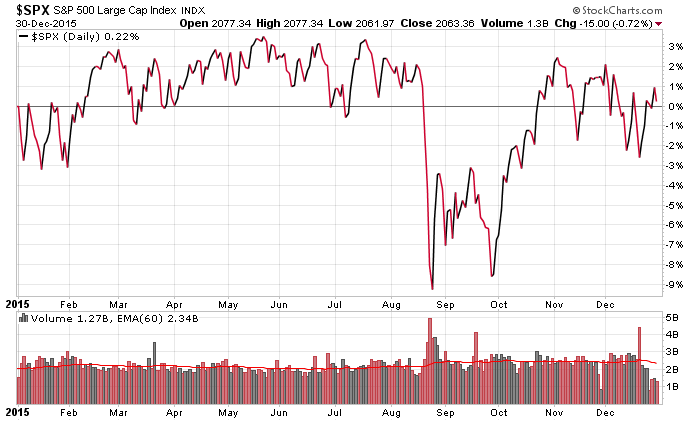

So here we go…last day of the year. The S&P closed 2014 at 2058.90. Yesterday’s close was at 2063.36, so as of now the index is up 4.46 points, or 0.22%, for the year. Here’s the S&P performance chart.

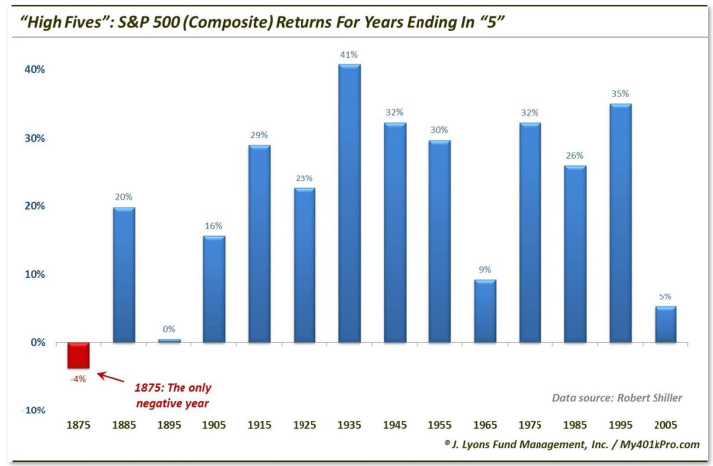

To resist being the first year since 1875 (do we even have data before than) that ends in a 5 to close with a loss, the S&P can’t fall by more than 4.46 points today. That’s a pretty small amount, and considering S&P futures are down about 5.50 as of this writing, it’s a toss up. Here’s an image with the performance of all years ending in a 5.

What would it mean if 2015 ended with a loss? I have no freaking clue. The presidential cycle makes sense to me. “Sell in May and go away” makes sense. This stat doesn’t make sense, and until someone can give me a decent explanation, I’m going to write it off as random dumb luck.

January will be active, volatile and very telling.

Be safe out there tonight. Lots of crazy idiots on the road.

Stock headlines from barchart.com…

Fidelity National reported that it increased its stake in Del Frisco’s Restaurant Group (DFRG -0.68%) to 9.31% from 8.10%.

Chimerix (CMRX +13.30%) jumped nearly 5% in after-hours trading after Point72 Asset reported an initial 5.3% passive stake in the company.

Lockheed Martin (LMT -0.30%) was awarded a $1.06 billion definitization modification pact for 32 C-130J aircraft from the U.S. Department of Defense.

Spectra Energy Partners (SEP +3.69%) said it shut its 932-mile Platte pipeline that carries 145,000 bpd of crude oil to wood River, Il., from Guernsey, WY., due to flooding along the Mississippi River

Fairholme Capital Management reported a 26% stake in Sears Holdings (SHLD -3.29%) .

The Daily Mail reported that “corporate financiers” have been working over the holiday on a possible merger between Vodafone Group Plc (VOD -0.86%) and Liberty Global Plc (LBTYA +0.47%) in early 2016.

Scorpio Bulkers (SALT -2.78%) announced the sale of 5 vessels, 3 Capesize dry bulk vessels and 2 newbuilding Capesize dry bulk vessels, for $167 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Initial Jobless Claims

9:45 Chicago PMI

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Baker-Hughes Rig Count

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers