Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the downside. Australia dropped 1.6%; Hong Kong, New Zealand and Taiwan were also weak. Indonesia, Malaysia and South Korea did well. Europe currently leans to the downside. Norway, Greece and Portugal are down more than 1%; Sweden, Poland, Turkey and Switzerland are also down. Futures here in the States point towards a moderate gap down open for the cash market.

—————

VIDEO: Leavitt Brothers Overview

—————

The dollar is up. Oil is down slightly; copper is up. Gold and silver are up. Bonds are up.

The market started the year with a big move down. The indexes closed off their lows but still down a bunch. It’s not a good sign when investors are running for the exits as soon as the tax year flips.

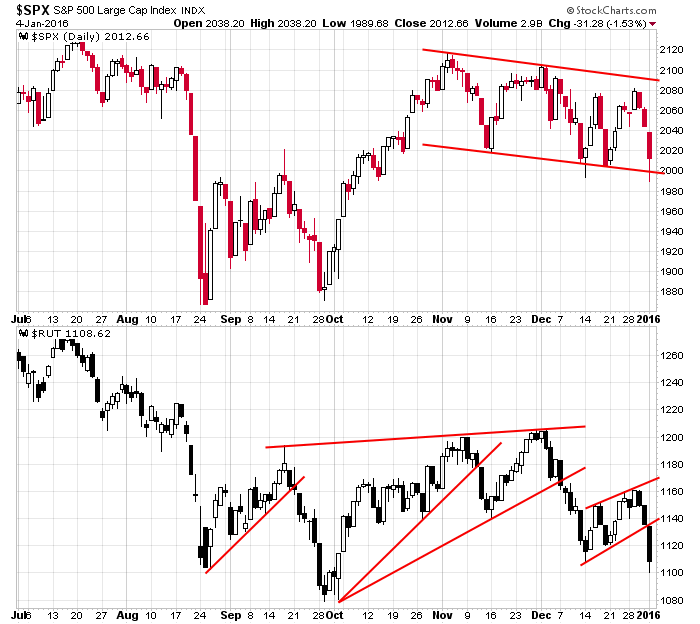

Here are the daily S&P and Russell charts. The S&P is trading in a large falling rectangle near its high. The Russell is consolidating near its low. Both are near the bottoms of their patterns, so neither have much room for error. Day to day anything can happen, but overall it’s hard to be optimistic about the market’s upside given the lagging small caps. They don’t have to lead, but until they catch up some, rallies will continue to get sold.

Today ends the “Santa Claus Rally” (the last 5 days of a year, followed by the first 2 of the next year). I’ll have to look up some stats regarding the year’s performance based on how the market does during this time.

My overall bias remains to the downside. There are lots of things that bother me about the market (I’m going to put together a report outlining my concerns), and until they subside and improve, I’ll be skeptical of any rally attempt. More after the open.

Stock headlines from barchart.com…

Nordstrom (JWN +0.64%) was downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

Eli Lilly (LLY -1.65%) may move lower at the start of trading today after it lowered guidance on fiscal 2016 EPS to $3.45-$3.55, below consensus of $3.65.

JC Penney (JCP +4.65%) was upgraded to ‘Neutral’ from ‘Sell’ at Citigroup.

First Solar (FSLR +1.11%) rose over 2% in pre-market trading after it was upgraded to ‘Buy’ from ‘Neutral at Goldman Sachs.

SolarEdge Technologies (SEDG -0.60%) rose nearly 2 % in pre-market trading after the stock was added to the ‘Conviction Buy’ list at Goldman Sachs.

Fresh Del Monte Produce (FDP -1.93%) was rated a new ‘Buy’ at Wunderlich Securities with a 12-month price target of $45.

DDR Corp. (DDR -1.72%) lowered guidance on its 2016 operating FFO to $1.19-$1.25 a share from a previous FFO estimate of $1.26.

Intercontinental Excahnge (ICE -1.90%) was reinstated a ‘Buy’ and added to the ‘Conviction Buy’ list at Goldman Sachs with a price target of $310.

General Electric reported a 33% stake in NeoGenomics (NEO -3.94%).

Smith & Wesson (SWHC +5.91%) rose over 4% in after-hours trading after it raised guidance on Q3 adjusted EPS to 39 cents-41 cents, higher than consensus of 29 cents, and then raised guidance on fiscal 2016 adjusted EPS to $1.36-$1.41 from a prior estimate of $1.26-$1.31.

Gilead (GILD -3.14%) climbed +0.4% in after-hours trading after its fixed-dose combination of Sovaldi and velpatasvir was granted priority review by the U.S. FDA for the treatment of Hepatitis C.

Acceleron (XLRN -8.00%) fell over 2% in after-hours trading after the company proposed a $150 million offering of common stock.

Progressive Waste Solutions (BIN -1.44%) jumped 6% in after-hours trading after it said it was exploring the prospects of a potential sale of the company.

Exelixis (EXEL -2.66%) climbed over 8% in after-hours trading after a Phase 3 study showed its Cabozantinib drug shrank kidney cancer tumors in 75% of patients tested.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

Auto sales

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers