Margin debt is dollar value of stocks held above and beyond the value of a portfolio. So if a $100K portfolio has $110K of stock, it’s said the investor is $10K on margin.

Margin debt grows as investors become more optimistic. In-and-of-itself, it’s not a bad thing. But if the market heads south, losses grow faster, so the unwinding of built up margin can lead to big and sustained downtrends. The Financial Crisis unwound like it did, largely because of all the margin and leverage that was in the system.

Margin debt has been high for a long time, so obviously the market isn’t sensitive to its level. But if some of this needs to be unwound, a correction could get ugly.

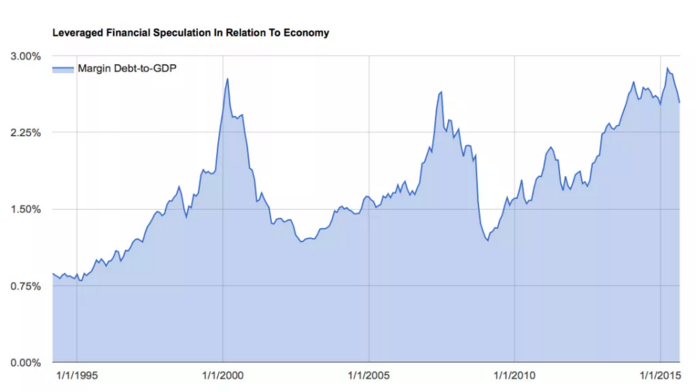

Here’s a chart showing margin debt to GDP.

Agree/Disagree? Comment below. And click here to join our email list to get reports just like this sent directly to you.

![]()