Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. China rallied 2%, but Japan dropped 2.7% and Singapore, Australia and Taiwan fell more than 1%. Europe is currently down across-the-board. Belgium is down more than 3%, Germany, France, Austria, Norway, Greece, Finland, Spain and Portugal are down more than 2%, and numerous markets are down more than 1%. Futures here in the States point towards a positive open for the cash market.

—————

Join Leavitt Brothers – Top Notch Analysis and Trading Ideas

—————

The dollar is flat. Oil and copper are up. Gold and silver are down. Bonds are down.

Here we go again. Another positive open. Will the market tank again, or will the forth time the charm? Will the market finally catch a bid and force a little short covering? We’ll see.

There was some panic yesterday. When the market moves quickly, the technicals don’t mean squat. Yesterday felt different. The selling was so steady – the indexes could barely tick up until the end of the day. It was as if a big fund was liquidating…or margin calls were going out…or something that caused sellers to ignore everything and just hit the sell button all day.

The technicals have been oversold for a couple days, but there was no capitulation. Yesterday there was some capitulation.

My overall bias remains to the downside. Near term you have to be very careful. If you try to pick a bottom, being wrong by an hour could lead to a big loss. But being short is no guarantee either, especially given how overdone things are in the near term.

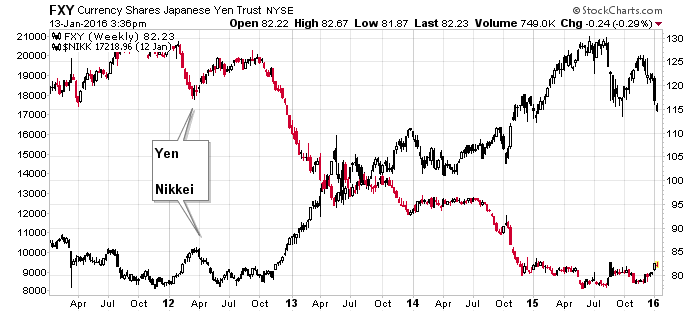

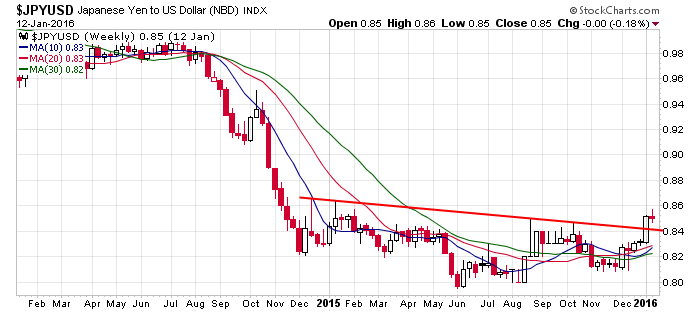

I posted these charts yesterday during the day. They worth posting again because of the implications.

Japan has moved opposite its currency the last five years.

The yen is in the process of breaking out vs. the US dollar. If successful, the Nikkei could come down hard and make it much more difficult for the rest of the world to move up.

Stock headlines from barchart.com…

Alcoa (AA -2.06%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

JPMorgan Chase (JPM -2.75%) climbed over 1% in pre-market trading after it reported Q4 EPS of $1.40, better than consensus of $1.27.

Fiat Chrysler Automobiles NV (FCA -4.40%) dropped over 4% in pre-market trading after Automotive News reported that two dealerships alleged the company offered dealers money to falsify sales,

CSX Corp. (CSX -5.70%) was upgraded to ‘Buy’ from ‘Hold’ at BB&T Capital Markets with a 12-month price target of $27.

Extra Space Storage (EXR -1.06%) rose 2% in after-hours trading after it was reported that it will replace Chubb in the S&P 500 after the close of trading this Friday, January 15.

GoPro (GPRO +0.07%) slumped over 20% in after-hours trading after it reported preliminary Q4 revenue of $435 million, below consensus of $510.9 million, and said it will cut 7%, or about 100 employees from its workforce.

Vail Resorts (MTN -3.84%) climbed over 3% in after-hours trading after it reported lift ticket revenue at its U.S. resorts was up +19% for the current season through Jan 10.

KB Home (KBH -2.95%) gained over 1% in after-hours trading after it said it will buy back up to 10 million shares.

JetBlue (JBLU -4.26%) rose over 1% in after-hours trading after it reported a +11.3% y/y increase in December traffic and a +9.5% increase in capacity, or available seat miles, to 4.6 million.

World Wrestling Entertainment (WWE -4.05%) climbed over 3% in after-hours trading after it was reported that it will replace Wausau Paper in the S&P SmallCap 600 on the close of trading Wednesday, January 20.

Aqua America (WTR -0.95%) fell nearly 2% in after-hours trading after it forecast 2016 EPS of $1.30-$1.35, below consensus of $1.36.

U.S. Concrete (USCR -3.90%) gained 4% in after-hours trading after it was announced that it will replace Extra Space Storage in the S&P SmallCap 600 on the close of trading this Friday, January 15.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:15 Fed’s Bullard:U.S. Economy and Monetary Policy

8:30 Initial Jobless Claims

8:30 Import/Export Prices

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $13B, 30-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 14)”

Leave a Reply

You must be logged in to post a comment.

Besides dax…ruts sucks…no bounce in the future…

Aussie, when does the instos come in and cook the shorts?

yesterday ,when they stole the longs positions on stops

the market says their opts ex target is spx 1952–will they make it in face of the japan liquidation

schedualded for jan 2016

japan,a major contributor to the bull fantasy market has refused to do any more QE –WHY

its broke and wollowing in debt

it allowed its massive govt pension funds to buy the heck out of the japan and world equity funds at the top of the markets last year

its not the only ones liquidating,so is saudi arabia and MI5’s james bond

the yen is a inverse currency to the usd–its getting weaker the higher it go’s

currency wars amounst other wars have been going on for some time now

obarma wants your 401k pension–dont give it to him

‘

nikkie 225 currently at 17444 near its aug lows and down from its 21000 highs and is a good indicator/barometer for asia and world

chinas markets are to irratic and controled

THX FOR THE HEADS UP…I LEARNED SOMETHING NEW TODAY…

tomorrow if spx gets to just above 1952 say 1955-60 for opts ex it will have done a little 5 day jaws of death wave 4 ,with massive wave 5 down to below aug lows to come

but as always the only reality is the 1 minute chart

if all markets go in sinc,then targets for fri opts ex

ftse 6000 ,dax 10000 that should pull dow up to 16600

aussie xjo 5000

what brokerage firm do u use…im using Interactive brokers …having a tough time with symbols for my ninjatrader platform

ninja has the best brokerage rate for futures spred

i use interactive charts with special propority inds or my own cfd brokers charts

there are many cfd brokers –cmc-saxo etc

i have been meaning to change over to just futures with ninja ,for years now, but dont like sending my money off shore from aussie

i use the ninja platform with continum data with ib data…i use tick data from contium and i lease the multibroker quarterly…ib futures are $4 rt…ninja is $3.80…i found i make more money with ib than the ninja brokerage firm…maybe it mental….i like ib..

Thx Aussie, that would be great…

Jason:

Sir I remember last fall you setting out

stairsteps for S&P like 1900,1920,1960,2000 etc.

Please refresh my recollection. Thank you.

SRD