Good morning. Happy Wednesday.

The Asian/Pacific markets closed with stiff, across-the-board losses. Hong Kong, Japan and Singpore dropped 3% or more. South Korea and Taiwan fell more than 2%, and China, Australia, India and Indonesia lost more than 1%. Europe is getting crushed. Greece is down almost 6%; London, France, Austria, Norway and Italy are down more than 3%, and Germany, Belgium, the Netherlands, Sweden, Switzerland, the Czech Republic, Denmark, Finland, Spain, and Portugal are down more than 2%. Futures in the States point towards a big gap down for the cash market.

—————

Join Leavitt Brothers – Top Notch Analysis and Trading Ideas

—————

The dollar is flat. Oil and copper are down. Gold and silver are up. Bonds are up.

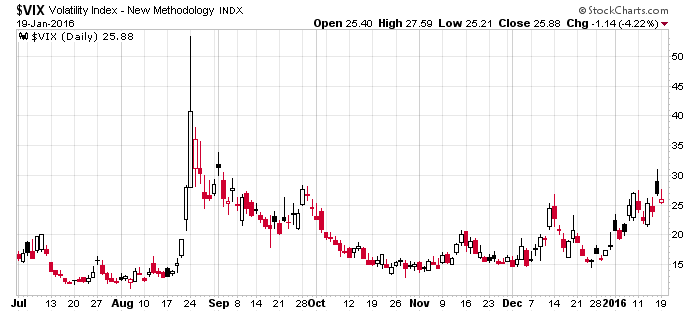

For the second time in three days we’re going to get a huge gap down to start the day. Perhaps some additional intense selling pressure will finally cause the VIX to spike. This has been the missing ingredient (if you have been looking for a bottom). Most indicators have moved to extreme levels and would support a bounce, but the selling has been mostly orderly and traders have not been overly concerned. Lack of concern is not a good climate for a bounce attempt. We need fear, but there hasn’t been much.

Here’s the daily VIX chart. Perhaps with today’s huge gap down we’ll finally get a spike.

A glance at social media tells me traders have been looking for a bounce. We need some panic first…and it looks like we may get some today. More after the open.

Stock headlines from barchart.com…

International Business Machines (IBM -1.48%) fell over 4% in pre-market trading after it said it sees 2016 operating EPS of at least $13.50, well below estimates of $15.00.

Lockheed Martin (LMT -0.32%) was rated a new ‘Buy’ at Guggenheim with a price target of $250.

Wells Fargo (WFC -1.25%) was upgraded to ‘Positive’ from ‘Neutral’ at Susquehanna.

Prudential Financial (PRU -1.25%) was downgraded to ‘Neutral’ from ‘Buy’ at Bank of America.

Sherwin-Williams (SHW -1.14%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Netflix (NFLX +3.70%) jumped over 3% in pre-market trading after it forecast Q1 EPS of 3 cents, higher than consensus of 2 cents, and said it sees Q1 international streaming net adds of 4.35 million, above estimates of 3.72 million.

Spirit Airlines (SAVE -1.76%) rallied over 5% in after-hours trading after it raised guidance on Q4 operating margin to 22.5%, more than a previous estimate of 17.5%.

Cree Inc. (CREE +0.62%) jumped over 3% in after-hours trading after it reported Q2 adjusted EPS of 30 cents, higher than consensus of 24 cents, and then raised guidance on Q3 adjusted EPS to 22 cents-29 cents, above consensus of 22 cents.

Advanced Micro Devices (AMD -3.94%) slid over 6% in after-hours trading after it estimated Q1 revenue would be down -11% to -17%, much weaker than estimates of down -6%.

SunEdison (SUNE -9.85%) rose 2% in after-hours trading after Luxor Capital reported a 5.3% stake in the company.

Microchip Technology (MCHP +2.91%) rose nearly 1% in after-hours trading after it acquired Atmel for $3.6 billion.

Synthetic Biologics (SYN -5.59%) surged 18% in after-hours trading after it said a Phase 2 clinical trial of its propriety SYN-010 for treatment of irritable bowel syndrome with constipation met its primary endpoint.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Consumer Price Index

8:30 Housing Starts

8:55 Redbook Chain Store Sales

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 20)”

Leave a Reply

You must be logged in to post a comment.

premarket spx hit key level 1836 cash –dow 15614

we may have to retest but we will follow ftse/dax till high noon

im watchin the dax for my scalping…

so far its a orderly decline because fed and central banks have told banks they dont have to mark to market their oil bad loans and losses

but also soverign funds are liquidating –saudi arabia ,japan china europe

which usa bank will go bust first or will all world banks go bust

closed my longs and now my shorts and waiting for a long ind again

If the VIX gets the spike it needs to cause a bounce, how much of a bounce could be expected? Thanks

would this be considered blood in the streets…

iv never seen so many -1k ticks…

You don’t say WHY you are “looking for a bounce”. Is this to feed your sentimental bias for markets which go up? Or is this for serious technical reasons?

bots are selling the snot out of this…

intraday trend now up

break of lower high

market moving to fast to talk

Rut looks like its stronger than rest

yes,

the volitile insto traders market

to risky for me

coming up will be a corrective rally [overlap chop ] and can last days and may be a reasonable

retracement

but we are still going to zero over next 10 years

zorro ,the cheif bear speaks