Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed up across the board. Hong Kong, Australia, Indonesia, Malaysia and Taiwan each gained more than 1%. Europe is currently mostly down, but movement is minimal. Norway, Spain, Italy, Sweden and Switzerland are down; Denmark is up. Futures in the States point towards a gap down open for the cash market.

The dollar is down. Oil is down, copper is flat. Gold and silver are down. Bonds are mixed.

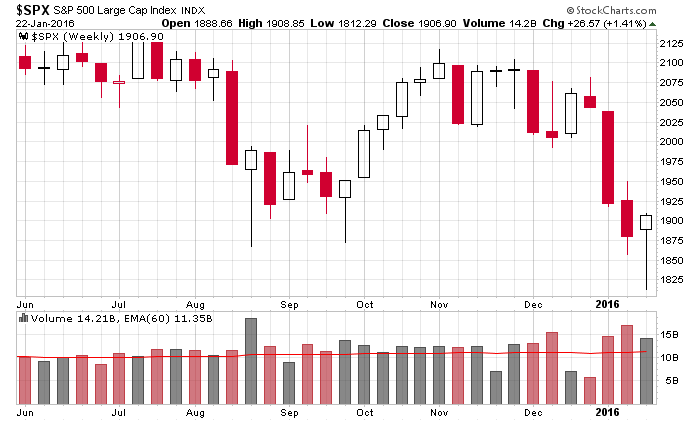

We got a big reversal last week. The market was weak Tuesday and early Wednesday, and then it staged a big rally and recaptured the entire loss. The S&P moved about 90 points off its low. All the indexes close in positive territory and well off their lows. Volume was strong. Here’s the weekly S&P chart.

The breadth indicators had been oversold for several days, and for the first time since the intense selling began to start the year, there was some real fear and panic. There were comments from Ray Dalio about a Depression, unless the Fed did QE4, and comments from George Soros about a hard landing in China.

The combination of extreme headlines, breadth indicators falling to their lowest levels in years and some panic selling provides a nice environment for a bounce.

The Fed takes center stage this week. They meet Wednesday and announce their latest target for Fed Fund Futures. Nobody expects them to tinker with rates. Given what has taken place since they raised in December, there’s no chance they raise more. And there’s virtually no chance they lower because they’d lose all credibility. Wall St. is, however, looking for clues they have other bullets in their arsenal, should the economy and market head south. The market is likely to trade this week based on what it expects/wants from the Fed and what it actually gets.

Near term I favor the upside, but overall by bias is to the downside. This bounce should have legs, but even it if lasts a few weeks, I would expect prices to head down again. More after the open.

Stock headlines from barchart.com…

JPMorgan Chase (JPM +3.08%) was downgraded to ‘Neutral’ from ‘Buy’ at Nomura.

Halliburton (HAL +3.07%) reported Q4 EPS of 31 cents, better than consesnus of 24 cents.

Kimberly Clark (KMB +1.42%) reported Q4 EPS of 92 cents, below consensus of $1.43.

DR Horton (DHI +3.98%) reported Q1 EPS of 42 cents, higher than consensus of 41 cents.

Goldman Sachs (GS +3.44%) was upgraded to ‘Buy’ from ‘Neutral at Nomura.

Whole Foods Markets (WFM +4.57%) was downgraded to ‘Underperform’ from ‘Market Perform’ at BMO Capital Markets.

Sandisk (SNDK +1.80%) was downgraded to ‘Underperform’ from ‘Outperform’ at CLSA.

Pinnacle Financial Partners (PNFP +2.07%) was upgraded to ‘Market Perform’ from ‘Underperform’ at Hovde Group with a 12-month price target of $51.

JB Hunt Transport Services (JBHT +1.84%) was upgraded to a ‘Buy’ from ‘Hold’ at BB&T with a price target of $83.

Tyco International Plc (TYC +2.00%) jumped over 7% in pre-market trading after people familiar with the matter said that Johnson Controls is discussing a merger with TYco.

Amazon.com (AMZN +3.71%) was upgraded to ‘Buy’ from ‘Hold’ at Edward Jones.

Science Applications International Corp. (SAIC +0.77%) was downgraded to ‘Hold’ from ‘Buy at Jeffries.

Caterpillar (CAT +2.16%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

Thor Industries (THO +1.85%) was downgraded to ‘Hold’ from ‘Buy’ at Wellington Shields.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

10:30 Dallas Fed Manufacturing Survey

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 25)”

Leave a Reply

You must be logged in to post a comment.

lol–fed to ban cash payments and do QE INFINITY

if so say good bye to earth

ban cash payments? for what?

every thing–groceries ,food,petrol

the cashless society will run on credit cards or debit cards

and the fed will steal your credit

uncle sam will be in charge of your life and future

then the fed can print all the fantasy credit it wants

QE DOES NOT PRINT REAL MONEY ONLY CREDIT THAT IT TRANSFERS THROUGH OUT THE WORLD

the great debt bubble

its called the fed payment system and all banks through out the world have access to it

electronic money transfer system–not real money

their is less than 10 % real usd’s in circulation for all the credit/debt

its the same as 1929 –trade and currency wars

only this time their is a massive debt bubble that no one can pay back

everyone has convinced china to be a consumer society

only who is going to produce the goods–not decadent lazy immoral unethical usa

the rise of facisum will be next