Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed with a lean to the upside. Japan rallied 2%; Australia and South Korea also did well. China dropped 1.8%, and Singapore fell 1%. Europe is currently mostly down. London, Germany, France, Austria, Norway, Russia, Finland, Italy and Sweden are down 1% or more. Futures in the States point towards a moderate gap down open for the cash market.

—————

Join Leavitt Brothers – Top Notch Analysis and Trading Ideas

—————

The dollar is down, Oil and copper are down. Gold and silver are up. Bonds are down.

January is in the books. The market sold off hard the first half of the month but then rallied the second half and recaptured a little more than half the loss. I consider the overall trend, or at least the overall sentiment, to be down. But we know that within downtrends, there are big up days and big rallies – big enough to lure sideline money into the market and cause shorts to cover. Hence, we shouldn’t just go short and walk away for 6 months.

There are many opportunities to play the swings. You only have to look back to the last big market meltdown (2007/08) to see the S&P was unchanged between Aug 2007 and Aug 2008. And that was the beginning stages of the Financial Crisis! What if we’re not in the beginning stages of a big meltdown. What if the market is just chopping around with a downward bias and is destined to undergo a normal correction? If the market can be flat a year into the Financial Crisis, it can certainly be flat today too. My point is we should expect some big swings in both directions. Buy and hold won’t work. Those who can navigate the ups and downs will do very well.

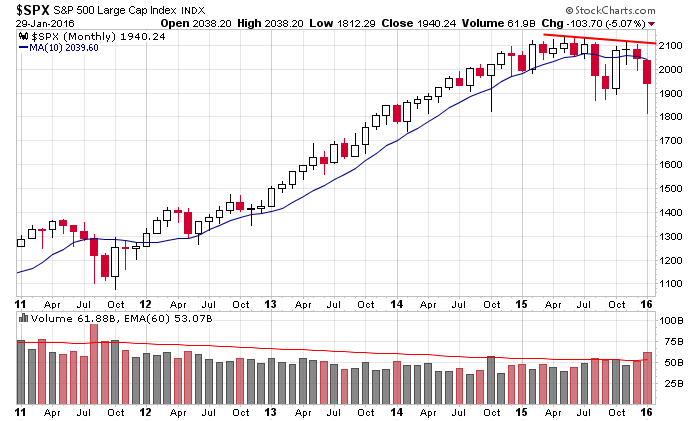

Here’s the S&P monthly. As long as the index is below its down-sloping 10-month moving average I’ll consider the overall bias to be down. But the bounces are playable. More after the open.

Stock headlines from barchart.com…

Roper Technologies (ROP +3.51%) reported Q4 EPS of $1.82, below consensus of $1.87.

Dominion Resources (D +1.73%) reported Q4 EPS of 70 cents, less than consensus of 88 cents.

Aetna ({=AET reported Q4 EPS of $1.37, better than consensus of $1.21.

Genuine Parts (GPC +3.38%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

Air Products & Chemicals (APD +6.47%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS with a price target of $151.

L-3 Communications (LLL +4.34%) was upgraded to ‘Buy’ from ‘Underperform’ at Bank of America.

Northrup Grumman (NOC +2.73%) was upgraded to ‘Buy’ from ‘Neutral’ at Bank of AMerica.

Chipolte Mexican Grill (CMG -0.02%) rose over 1% in pre-market trading on reports that the U.S. Centers for Disease COntrol and Prevention may declare an end to the E. Coli outbreak today that has plagued the restaurant chain over the past couple of months.

Resource America (REXI +1.63%) said it has hired Evercore for strategic, financial options that may include, but aren’t limited to, monetizing non-core assets, expanding the stock buyback program, and a partial of full sale of the company.

Apollo Global’s (APO +1.12%) co-founder Josh Harris said that Apollo’s LBO financing market has “dried up” amid a financing struggle.

Care Capital Properties (CCP +1.35%) filed to offer as much as $250 million in common stock.

According to Platts reports, ArcelorMittal (MT -4.74%) is in discussions on the sale of some of its U.S. long steel mills, including the one in Steelton, PA.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

8:30 Personal Income and Outlays

8:30 Gallup US Consumer Spending Measure

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 1)”

Leave a Reply

You must be logged in to post a comment.

The abc up goes on up for a while then the abc down comes again maybe 5k down?. WTI is down today so is the NYA. ONCE the PCE and GDP move down the correction damage is largely done so the time is near to look for an up move. Plan on now on stocks wanted when they hit the deck in the abc down. I suspect FED is done. best to all.

thats about the way i see it to

eventually the long only’s will get squeezed and panic sell or the shorts will have to cover

but not the short term trader

however their is a lot more going on in the world and my longer term bias is down

currency wars,debt implosion,soverign corporate and real estate busts world wide

even a usa debt explosion with the cashless fed wire and the death of cash

–viva volitility