Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Australia rallied 2%; China, Hong Kong, Indonesia, Malaysia and South Korea gained more than 1%. Europe is currently mixed. Greece is down more than 4%, and Switzerland is down more than 1%. Norway, Russia, Poland, Turkey and Hungary are up more than 1%; the Netherlands and the Czech Republic are also doing well. Futures here in the States point towards a gap down open for the cash market.

—————

Join Leavitt Brothers – Top Notch Analysis and Trading Ideas

—————

The dollar is down. Oil is down, copper is up. Gold and silver are up. Bonds are up.

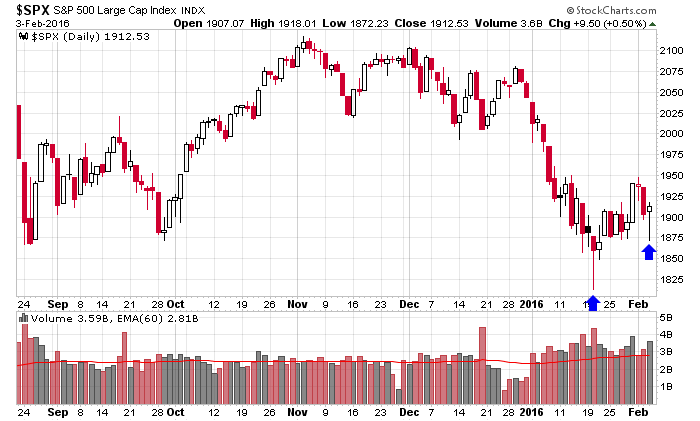

Here we go again. For the second time in three weeks the market opened, sold off hard and then rallied hard and closed well off the lows and near the intraday highs. A long lower tail formed on the daily charts. Here’s the S&P.

Three weeks ago the move off the low was very tepid. The market dropped just as often as it rallied, and although the net change was up, the market spent much more time churning in place. I’ve commented the action more closely resembled the August low, which eventually got sold into, than the September low, which led to a 200+ SPX rally. We’ll see what happens this time. There are no slam dunks here.

Tomorrow morning before the open we’ll get the latest employment figures from the Labor Dept. In my opinion, in the past, bad news was good news because it meant rates would be held low. But now, I think bad news is bad news. Wall St. is not obsessed with rates any more. It wants to see actual evidence the economy is firming, not contracting. Under this scenario, poor numbers tomorrow will tank the market. Good news could start a squeeze that lasts a few weeks.

No big bets right now. More after the open.

Stock headlines from barchart.com…

Viacom (VIAB +2.10%) surged over 7% in pre-market trading after a person familiar witt the matter said the board will meet today to name a successor to Chairma Summer Restone.

CBS Corp. (CBS +3.50%) rose 4% in pre-market trading after Summer Redstone resigned as chairman of CBS and will be replaced by CEO Les Moonves.

Yum! Brands (YUM +0.18%) fell over 1% in after-hours trading after it reported Q4 revenue of $3.95 billion, less than consensus of $4.03 billion.

Cisco (CSCO +1.18%) slid nearly 1% in after-hours trading after it said it will acquire Jasper Technologies for $1.4 billion in cash and assumed equity awards.

Allstate (ALL -0.55%) gained nearly 1% in after-hours trading after it reported Q4 adjusted EPS of $1.60, higher than consensus of $1.35.

MetLife (MET -1.89%) fell over 2% in after-hours trading after it reported Q4 operating EPS of $1.23, below consensus of $1.36.

Noble Corp. Plc (NE +4.13%) dropped 7% in after-hours trading after it reported Q4 adjusted EPS of 52 cents, weaker than consensus of 55 cents, and said it faces a “challenging outlook” in 2016.

Take-Two Interactive Software (TTWO -1.82%) climbed 8% in after-hours trading after it reported Q3 adjusted EPS of 89 cents, well above consensus of 50 cents, and raised guidance on fiscal 2016 adjusted EPS to $1.65-$1.75 from a prior view of $1.00-$1.15, better than consensus of $1.15.

GoPro (GPRO +4.59%) slumped over 8% in pre-market trading after it lowered guidance on fiscal 2016 revenue to $1.35 billion-$1.50 billion, below consensus of $1.59 billion, and said Brian McGee will succeed Jack Lazar as CFO effective March 11.

VirnetX Holding (VHC +29.81%) soared over 80% in after-hours trading after a jury in Texas awarded the company $625.6 million in a patent trial against Apple.

Cadence Design Systems (CDNS unch) climbed 4% in after-hours trading after it reported Q4 non-gaap EPS of 31 cents, higher than consensus of 29 cents.

DHT Holdings (DHT +3.86%) slid over 10% in after-hours trading after it reported Q4 EPS of 31 cents, below consensus of 33 cents.

Glu Mobile (GLUU -2.90%) surged over 20% in after-hours trading after it reported an unexpected Q4 EPS profit of 2 cents, better than consensus of a -3 cent loss.

SolarEdge Technologies (SEDG +2.73%) jumped over 11% in after-hours trading after it reported Q2 adjusted EPS of 44 cents, better than consensus of 35 cents.

Imperva (IMPV -0.76%) tumbled over 10% in after-hours trading after it said it sees a Q1 adjusted EPS loss of -26 cents to -32 cents, weaker than consensus of an -11 cent loss.

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Productivity and Costs

8:30 Gallup Good Jobs Rate

9:45 Bloomberg Consumer Comfort Index

10:00 Factory Orders

10:30 EIA Natural Gas Inventory

4:30 Money Supply

4:30 Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 4)”

Leave a Reply

You must be logged in to post a comment.

Todays weak productivity reflects a sharp slowdown in gross domestic product growth during the last quarter 2015 and an acceleration in the pace of hiring. Economic growth slowed to a 0.7 percent rate in the final three months of 2015, while nonfarm payrolls rose by an average 284,000 jobs per month. It is not good news but with plans one survives. Still my cycles say up for another week or so then an ABC down into May 2016. Planning some shorts on indices and a few more bonds. Best to all.

this is definitly a intraday snippers market and its fun

their are a few shorter term option,but 7-12 day moves are rear

Small caps seem to have more traction this time down.

I think we are in for a nice rally. I think we had a capitulation.

DX is selling off sharply after trying to test the breakout level (100). it is clearly not ready to bust through. perhaps it won’t break out at all. gold is already reacting to it, making multi-month highs every day. oil is also trying to get out of the big pit it was pushed into. if continued, weaker dollar will eventually change the dynamic in many markets including equities, commodities and bonds.

why now is oil a trigger for the market?

because its a currency /trade war that the world is in like 1929

usd/yen,yaun,euro

aussie dollar to be new world reserve currency –lol

we also have oil,gold,uranium and politicans