Good morning. Happy Wednesday.

Parts of Asia remained closed. Japan dropped more than 2%; Singapore, Australia, India and Malaysia fell more than 1%. Europe is currently posting solid gains. Italy is up more than 4%, Denmark and Spain more than 3%, and Germany, France, Austria, Belgium, Sweden, Switzerland, the Czech Republic and Greece are up more than 2%. Futures here in the States point towards a big gap up open for the cash market.

—————

Top Shelf Trading – eMagazine – I was featured in here this month.

—————

The dollar is flat. Oil is up, copper is down. Gold and silver are down. Bonds are down.

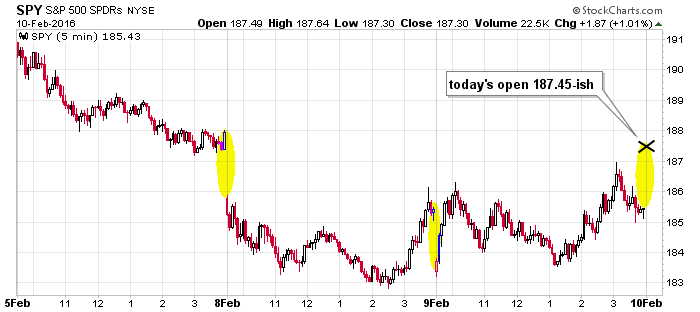

Having fun yet? Big gap down Monday. Big gap down Tuesday. And now a big gap up today. Lots of nice intraday swings for day traders to play, and now the market will open close to last week’s close. Essentially the market spent the last two days trying to pound out a bottom, and now it’ll attempt to rally. Here’s the 3-day SPY chart.

Solar City (SCTY) will gap down 30% today. Several other solars (SPWR, FSLR, CSIQ) are down in sympathy.

Janet Yellen speaks on Capitol Hill today. Her first such appearance since the Fed raised rates in December. Her “testimony” should shed light on the pace rates are to be raised going forward. Wall St. has already factored in no more rate hikes this year.

The Chinese market has been closed all week – it helps since they were a steady source of bad news.

That’s it for now. Not much else to say. My overall bias remains firmly to the downside. It would take a big and sustained rally for this to change. In the near term anything goes. There have been just as many up days as down days, and per my comment yesterday, there have been several moderate or big rallies in just the last six months. They’re playable. More after the open.

Stock headlines from barchart.com…

Time Warner (TWX -6.08%) reported Q4 EPS of $1.06, higher than consensus of $1.00.

Dean Foods (DF +0.26%) was upgraded to ‘Buy’ from ‘Hold’ at BB&T with a price target of $22.

Hess Corp. (HES -0.74%) was upgraded to ‘Conviction Buy’ from ‘Hold’ at Goldman Sachs.

Disney (DIS +0.22%) fell over 3% in pre-market trading after it reported Q1 adjusted EPS of $1.63, above consensus of $1.45, but reported a -6% decline in networks operating income for Q1, driven by a decline in subscribers from ESPN and lower advertising revenue from A&E.

Akamai (AKAM -3.44%) surged over 12% in after-hours trading after it reported Q4 adjusted EPS of 72 cents, higher than consensus of 62 cents, and then said its board authorized a new $1 billion share buyback plan.

Seattle Genetics (SGEN -1.06%) slid over 4% in after-hours trading after it lowered guidance on 2016 Adcetris sales to $255 million-$275 million, below consensus of $291.3 million.

Nuance Communications (NUAN -1.40%) rose nearly 7% in after-hours trading after it reported Q1 adjusted EPS of 36 cents, higher than consensus of 33 cents.

Paycom Software (PAYC -7.18%) jumped over 10% in after-hours trading after it reported Q4 adjusted EPS of 10 cents, higher than consensus of 8 cents, and then raised guidance on Q1 revenue to $82 million-$84 million, above consensus of $74.6 million.

Computer Sciences (CSC +0.33%) reported Q3 adjusted EPS continuing operations of 71 cents, better than consensus of 68 cents.

SolarCity (SCTY -5.69%) slumped 30% in after-hours trading after it lowered guidance on Q1 adjusted EPS to a loss of -$2.55 to -$2.65, a much wider loss than expectations of -$2.06.

Berkshire Partners reported a 10.4% stake in Mattress Firm (MFRM -4.08%) .

Empire District Electric (EDE +0.57%) jumped nearly 15% in after-hours trading after Algonquin Power & Utilities acquired the company for $2.4 billion.

Standard & Poor’s cut the credit rating of Chesapeake Energy (CHK -4.41%) by one level to ccc, saying its debt is “unsustainable.”

Earnings and Economic Numbers from seekingalpha.com…

Today’s Economic Calendar

7:00 MBA Mortgage Applications

10:00 Yellen delivers semi-annual monetary policy testimony

10:30 EIA Petroleum Inventories

1:00 PM Results of $23B, 10-Year Note Auction

2:00 PM Treasury Budget

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 10)”

Leave a Reply

You must be logged in to post a comment.

Yellen day!! she will do nothing but pontificate on what she thinks {she sees but she is delusional}, so plan for a rally then a reversal up for a while, careful getting involved. Notice, EU/Japanese banks are talking up further negative interest rates. Five years ago they would have thrown you out of school (or your bank) for such talk. CHK is just the first petroleum firm to walk the plank. Good-bye, oil banks and US oil production; the middle east loves this action is the US.

become a daytrader and have fun

with virtually no gaps on futures 24 hour charts

snippers and scalpers required for 30 minute trades or longer on large margins

yea man, it can be a few seconds/minutes using a 5 tick chart..