Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Japan dropped almost 5%. Hong Kong, Australia, Indonesia and South Korea fell more than 1%. China remained closed. Europe is currently mostly up. Austria and Italy are up more than 2%; London, France, Germany, the Netherlands, Sweden, Switzerland, Greece, Denmark and Belgium are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

—————

Top Shelf Trading – eMagazine – I was featured in here this month.

—————

The dollar is up. Oil and copper are up. Gold and silver are down. Bonds are down.

Each day this week has rolled up and down, and each day closed with a loss. The small caps and Nas have fallen to lower lows. The other indexes have so far held their mid-January lows.

Janet Yellen finished testifying on Capitol Hill yesterday. She didn’t bow to Wall St’s implied demands to take lower rates off the table, and she didn’t say anything about QE4. I say it’s good. She’s under-promising and not backing herself into a corner with promises she may not keep.

China has been closed all week. Expect a big move on Monday when their market catches up to what has been a pretty weak week for the rest of the world.

But the market is the US won’t be able to react to China on Monday because it’s closed. We have a 3-day weekend ahead of us. Which makes me wonder who will flinch first. Who wants to hold long/short over the weekend?

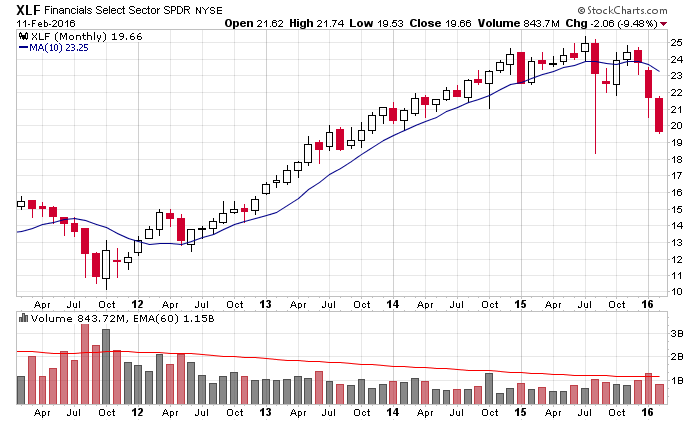

Financials have been weak and are clearly in a downtrend. Here’s XLF. But Jamie Dimon of JPM took his entire salary and bought 500K shares of the company’s stock. In my eyes a healthy bounce would only set up the next leg down.

The long term trend remains solidly down. There will be bounces along the way, but I suspect I’ll have a bearish bias all or most of the year. More after the open.

Stock headlines from barchart.com…

JPMorgan Chase (JPM -4.41%) climbed over 3% in after-hours trading after CNBC reported that CEO Jamie Dimon purchased 500,000 shares of JPM for $26.5 million.

ConocoPhillips (COP -1.42%) rose nearly 3% in pre-market trading as the the price of crude oil climbed %.

Square (SQ -2.93%) jumped over 6% in pre-market trading after Visa reported a 9.99% stake in the company.

Groupon (GRPN -0.44%) surged 16% in after-hours trading after it reported Q4 adjusted EPS of 4 cents, better than consensus of break-even.

Wynn Resorts (WYNN +2.67%) gained over 2% in after-hours trading after it reported Q4 adjusted EPS of $1.03, well above consensus of 76 cents.

Activision (ATVI +1.23%) plunged 14% in after-hours trading after it reported Q4 adjusted EPS of 83 cents, below consensus of 86 cents, and said it sees Q1 adjusted EPS of 11 cents, weaker than consensus of 18 cents.

Columbia Sportswear (COLM +0.71%) climbed 8% in after-hours trading after it reported Q4 adjusted EPS of 90 cents, higher than consensus of 75 cents, and then raised guidance on fiscal 2016 EPS to $2.55-$2.65, above consensus of $2.54.

Pandora Media (P +8.21%) dropped 6% in after-hours trading after it reported Q4 non-GAAP EPS of 4 cents, below consensus of 6 cents, and said it sees Q1 revenue of $280 million-$290 million, below consensus of $294.2 million.

CyberArk Software (CYBR +2.14%) slumped 8% in after-hours trading after it lowered guidance on fiscal 2016 adjusted EPS to 83 cents-86 cents, below consensus of 94 cents.

DaVita (DVA -1.71%) slid almost 2% in after-hours trading after the company said the government is conducting a False Claims Act investigation on allegations that DaVita Rx represented false claims for payment to government for prescription medications.

Rovi (ROVI -0.17%) climbed over 6% in after-hours trading after it reported Q4 adjusted EPS of 65 cents, well above consensus of 37 cents.

Select Comfort (SCSS +0.94%) sank 14% in after-hours trading after it lowered guidance on fiscal 2016 EPS to $1.25-$1.45, below consensus of $1.55.

Qlik Technologies (QLIK +2.86%) tumbled nearly 8% in after-hours trading after it reported Q4 adjusted EPS of 31 cents, below consensus of 38 cents, and said it sees a Q1 adjusted EPS loss of -12 cents to -14 cents, a wider loss than consensus of -9 cents.

Nu Skin Enterprises (NUS -4.96%) plunged over 15% in after-hours trading after it lowered guidance on fiscal 2016 revenue to $2.10 billion-$2.15 billion from a prior estimate of $2.29 billion-$2.33 billion, below consensus of $2.32 billion.

Earnings and Economic Numbers from seekingalpha.com…

Thursday’s Key Earnings

Activision Blizzard (NASDAQ:ATVI) -14% AH on lackluster holiday results.

AIG (NYSE:AIG) +1.8% AH on deal with Icahn, buyback, dividend boost.

Alcatel-Lucent (NYSE:ALU) +2.8% after beating estimates.

CBS (NYSE:CBS) -1.5% AH hurt by a writedown on radio licenses.

FireEye (NASDAQ:FEYE) see-sawed AH following mixed forecasts.

Groupon (NASDAQ:GRPN) +18.3% AH on beat, buyback, guidance hike.

Nokia (NYSE:NOK) +1% after topping expectations.

Pandora (P) -6% AH following a cautious 2016 outlook.

Peabody Energy (NYSE:BTU) -30.1% on a big Q4 miss, more pain ahead.

PepsiCo (NYSE:PEP) -0.7% following in-line earnings.

TransCanada (NYSE:TRP) flat after writedown, dividend increase, upcoming layoffs.

Teva Pharmaceutical (NYSE:TEVA) -5% as results failed to impress.

Today’s Economic Calendar

8:30 Retail Sales

8:30 Import/Export Prices

10:00 Business Inventories

10:00 Reuters/UofM Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 12)”

Leave a Reply

You must be logged in to post a comment.

Jason has the market pattern down tight, up today (on falling oil);then we see another ride down. But Imarket Signals.com show the earnings are below the S&P price which suggests the index will decline until earnings equal or exceed the price level in the index (S&P.) I know another mental case – but I like their equations on historic data back to 1999. Best to all.

trade the futures and dont have a holiday

yesterday during europe spx cash futures got down to spx 1807 for the cash market before open

but no big bounce so no false break

in march cash in usa will be banned and usa will become the cashless society

this will allow the fed to transfer usd through out the world electronicly and start of QE infinity

it will also be the end of the usa petro dollar as oil payments will be in chinees yaun

and the currency wars go on

as does the war between rushia middle east opec and china against usa

god save the queen and the bears

Aussie, do u trade any currencies…im looking to diversify and open up an everbank world currency fund…

i used to ,as they used to be the most un manipulated charts

but now the central banks have got to them as well and they are no longer to big to manipulate

you need a good daily list of world anowncements ,but longer time frames are ok

but with my impatient mind set ,then i am only any good as a day trader

so your money in your daytrade account is based on the aussie or usd?

trying hedge when and if the usd rolls over…i want to find something that will be valuable

vintage wine, sports cars, classical and modern art.

longer term every country wants a lower currency which is causing a depression same as 1929,but worse

follow the charts of usd and its inverse relationships of euro/yen /aussie/nz etc

and take a currency hedge–but i still think usd will be a safe haven or best of worse for a while

lol the jap yen is the carry trade currency and in fear and risk of is going up in face of their neg interest rate stupid central bank

gold can also be a fear hedge and has a usd relationship—ITS JUST STARTING ITS MASSIVE UPTURN

to fix deflation raise interest rates to 10% and bankrupt everyone

and that will be the end of deflation