Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China dropped 2%; India was also weak. Japan moved up 1.3%; New Zealand and South Korea also did well. Europe is currently mostly up. France, Spain and Italy are up more than 3%, and Germany, the Netherlands and Portugal are up more than 2%. Futures here in the States point towards a big gap up open for the cash market.

The dollar is up 1%. Oil is up, copper is down. Gold and silver are down. Bonds are up.

Yesterday was a slow, range-bound day. There was little energy or enthusiasm.

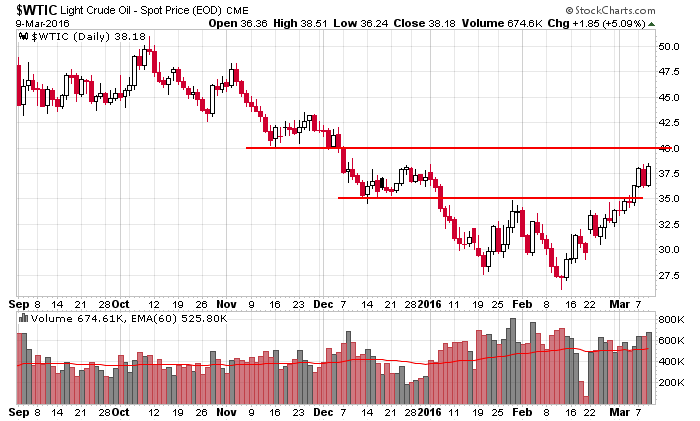

Oil’s movement was notable. It completely recovered the previous day’s gains in route to hitting a 2-month high.

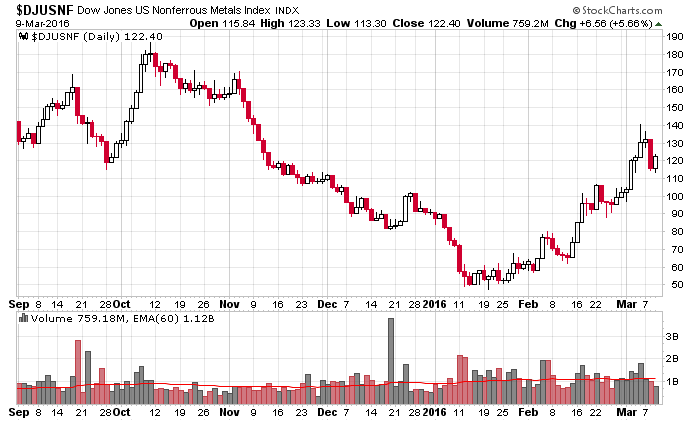

Along with oil, nonferrous metals have been leading the market the last month. They too posted a decent gain – albeit on declining volume.

I highlight these because the dollar is up a buck before regular trading hours trading begins. New Zealand cuts its interest rate, and there’s lots of speculation the ECB will do anything needed to improve the economic landscape in Europe. A strong dollar in the US won’t be well-received by commodities…and it also cuts into the profit margins of multi-nationals.

I’m being a little more cautious here. We had a great run for about three weeks. I’ve toned things down and am waiting for the charts to reset. More after the open.

Stock headlines from barchart.com…

Expedia (EXPE +0.79%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray with a 12-month price target of $140.

Sally Beauty Holdings (SBH +0.03%) was downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray with a 12-month price target of $31.

Royal Bank of Scotland Group PLC (RBS +0.46%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Bernstein.

Ryerson Holding (RYI +0.22%) reported Q4 sales of $668.8 million, below consensus of $711.4 million.

American Eagle Outfitters (AEO +1.13%) lost nearly 2% in after-hours trading after it announced that CFO Mary Boland plans to retire April 1 and Chief Accounting Officer Scott Hurd will be interim CFO.

B&G Foods (BGS -0.54%) fell over 2% in after-hours trading after it announced a public offering of 4 million shares of its common stock.

Square (SQ +4.79%) rose nearly 2% in after-hours trading after it reported Q4 revenue of $374.4 million, higher than consensus of $344.7 million.

Box Inc. (BOX +3.73%) jumped over 10% in after-hours trading after it said it sees Q1 revenue of $88 million-$89 million, above consensus of $86.4 million, and then said it sees a fiscal 2017 adjusted loss of -83 cents to -85 cents, narrower than consensus of a loss of -90 cents.

Gulfport Energy (GPOR +4.01%) slid over 2% in after-hours trading after it announced a public offering of 14 million shares of its common stock.

Spectrum Pharmaceuticals (SPPI -1.18%) gained nearly 3% in after-hours trading after it reported a Q4 loss of -6 cents a share, a smaller loss than consensus of -18 cents.

Nasdaq (NDAQ +0.77%) agreed to buy International Securities Exchange from Deutsche Borse for $1.1 billion.

Sunrun (RUN -0.45%) climbed 3% in after-hours trading after it was rated a new ‘Buy’ at Deutsche Bank with a price target of $15.

Omega Protein (OME +6.46%) slumped over 20% in after-hours trading after it reported Q4 adjusted EPS of 29 cents, well below consensus of 53 cents.

Energy XXI Ltd. (EXXI +12.50%) plunged over 30% in after-hours trading when it said it may seek Chapter 11 bankruptcy protection as soon as next week.

Earnings and Economic Numbers from seekingalpha.com…

Wednesday’s Key Earnings

Box (NYSE:BOX) +10.5% AH after beating expectations, healthy outlook.

Square (NYSE:SQ) +1.7% AH on strong volume growth, positive guidance.

Today’s Economic Calendar

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Quarterly Services Report

10:30 EIA Natural Gas Inventory

1:00 PM Results of $12B, 30-Year Note Auction

2:00 PM Treasury Budget

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 10)”

Leave a Reply

You must be logged in to post a comment.

today i am mr false break high premarket futures and europe

will the cash market catch up for another chance to short

They fired the bazooka in the ECB, but the PBOC beat them by buying their creditors. Hope Congress is napping, but mrs Yellen must be thrilled: Queen of the world moves. She must be thrilled. Buy SDY, and wait awhile to own gold. I’ll have a beer and go back to sleep.

500 german dax down points –false break

is that what spupid marrio dopy wanted–ecb will bankrupt germany and its banks

buy the rumour sell the fact

no one beleives central banks any more

viva volitility

long live the bears

central banks have to consider their effect on chineese yaun now

no one wins a currency war

only real true world prosperity can save the world bull

down with the 7 year fantasy bull

deflation is to little real money chasing to much goods/supply

bankrupt the world that will cut supply and create true prosperity

will the fed ban usd cash so as it can easily transfer credit usd through out the world

their is a liquidity crysis

so far i would call this a key outside reversal

support spx 1950-70

still holding –thats a long time for me

we need to build better space ships [jobs]

to trade with the marsians–[supply]

to fix deflation