Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Singapore, Hong Kong, New Zealand and Australia closed down; Japan did well. Europe currently leans to the downside. Austria and Denmark are doing well; London, Finland, Norway, Sweden, Poland and Hungary are down. Futures here in the States point towards a flat open for the cash market.

The dollar is up. Oil and copper are up. Gold is down, silver is up. Bonds are down.

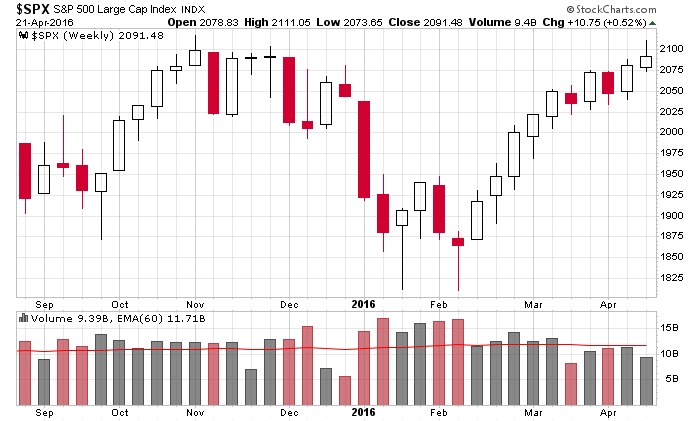

Here’s the weekly S&P chart. So far we have a moderate gain, but the current price level is in the middle of its weekly range. In fact barring a mini rally today, this week’s close will be the furthest off its high compared to all other candles since the February low was established.

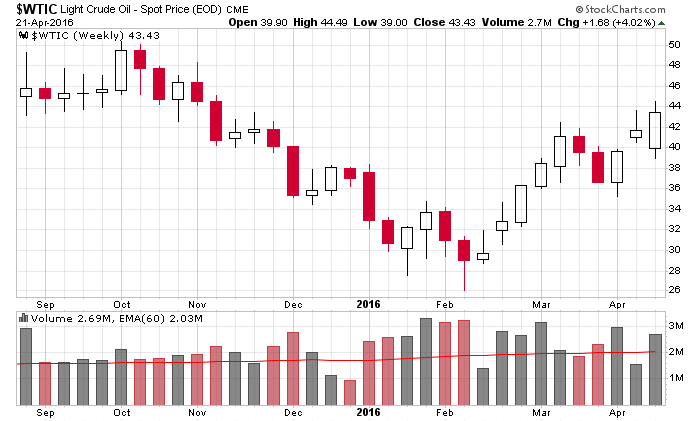

Oil started the week on a big down note thanks to the lack of agreement in Doha, but it’s back, pushed to a higher high and currently is at its highest closing level since November. Successfully absorbing the Doha news and the end of the Kuwait strike is a positive sign for the commodity.

The big news out this morning is the weakness among many big cap tech names.

MSFT, GOOG, V and MA are down this morning. SBUX and SAM are down too. S&P futures are flat, and Nas 100 futures are down 7.5 – not bad.

I like the market overall and believe the highs will be taken out, and once short covering really kicks in, the indexes will travel well into new high territory. But in the near term I’m not overly excited about having huge exposure. The market has come a long way in a short period of time, and earnings season so far has been more negative than positive. I’ve been in more of a “preserve capital” mode instead of a “be aggressive” mode. You do your thing. I’m being patient. More after the open.

Stock headlines from barchart.com…

General Electric (GE -0.55%) reported Q1 industrial operations and verticals EPS of 21 cents, higher than consensus of 19 cents.

Alphabet Inc. (GOOG +0.86%) dropped over 5% in pre-market trading after it reported Q1 adjusted EPS of $7.50, below consensus of $7.96.

Sears Holdings (SHLD -3.43%) rose over 5% in after-hours trading after it said it will close 68 Kmart stores and 10 Sears stores in an attempt to return to profitability.

Swift Transportation (SWFT -4.48%) climbed over 1% in after-hour trading after it reported Q1 adjusted EPS of 25 cents, above consensus of 21 cents.

Microsoft (MSFT +0.34%) fell over 4% in pre-market trading after it reported Q3 adjusted EPS of 62 cents, below consensus of 64 cents.

Skechers U.S. A. (SKX +2.53%) climbed over 5% in after-hours trading after it reported Q1 EPS of 63 cents, above even the highest estimate of 56 cents.

Norfolk Southern (NSC -0.64%) gained over 4% in after-hours trading after it reported Q1 adjusted EPS of $1.29, well above consensus of 97 cents

Starbucks (SBUX -0.43%) dropped nearly 5% in after-hours trading after it reported Q2 adjusted EPS of 39 cents, right on consensus, but reported Q2 revenue of $4.99 billion, below consensus of $5.03 billion.

Hanesbrands (HBI unch) rallied over 6% in after-hours trading after it reported Q1 adjusted EPS of 26 cents, better than consensus of 22 cents.

Southwestern Energy (SWN -1.20%) climbed over 4% in after-hours trading after it reported a Q1 adjusted EPS loss of -8 cents, narrower than consensus of -21 cents.

Advanced Micro Devices (AMD -2.96%) surged over 17% in pre-market trading after it reported a Q1 adjusted EPS loss of -12 cents, a smaller loss than consensus of -13 cents, and said it will license server chip technology to a Chinese state-backed venture that will produce server processors for the Chinese market.

Trinity Industries (TRN -3.08%) slid 2% in after-hours trading after it reported Q1 EPS of 64 cents, weaker than consensus of 69 cents.

Concordia Healthcare (CXRX +25.05%) jumped 12% in after-hours trading after it confirmed that it has had talks about strategic alternatives and formed a special committee to review its options.

Pacific Biosciencies of California (PACB -0.88%) rose 5% in after-hours trading after it reported a Q1 loss of -23 cents, a smaller loss than consensus of -25 cents.

Thursday’s Key Earnings

Alphabet (NASDAQ:GOOG) -5% after a big Q1 miss, ad price declines.

AMD (NASDAQ:AMD) +21.4% AH on a Chinese licensing deal/JV.

Blackstone (NYSE:BX) -4.1% following a tough quarter.

General Motors (NYSE:GM) +1.4% doubling its profits in Q1.

Microsoft (NASDAQ:MSFT) -4.7% AH weighed down by a weak PC market.

Schlumberger (NYSE:SLB) -4.5% AH warning of a worsening industry.

Southwest Airlines (NYSE:LUV) +1.5% on double-digit profit growth.

Starbucks (NASDAQ:SBUX) -2.7% AH on falling comparable store sales.

Under Armour (NYSE:UA) +6.8% expecting $5B in revenue this year.

Verizon (NYSE:VZ) -3.3% as seasonal weakness weighed on results.

Visa (NYSE:V) -3.8% AH after lowering its revenue forecast.

Today’s Economic Calendar

9:45 PMI Manufacturing Index Flash

1:00 PM Baker-Hughes Rig Count

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 22)”

Leave a Reply

You must be logged in to post a comment.

from Bloomberg:The Shanghai Composite Index has fallen 3.9 percent this week, the worst performance among 93 global benchmark gauges tracked by Bloomberg and the steepest decline since January 2016. It’s not just the stock market. The yuan is trading around its lowest level against a basket of currencies since November 2014, while yields on corporate debt have risen for 10 of the past 12 days.

Short today, building positions: it is close to downward correction. Leading china, then EU. I lost about 5k Thursday by being a wise A. Heads up.