Good morning. Happy Wednesday. Happy FOMC Day.

The Asian/Pacific markets closed mostly down. Singapore, Japan and New Zealand dropped 0.6 – 0.7%. Indonesia gained 0.7%. Europe is currently mixed. Greece is down 3.7%; Poland and the Netherlands are also weak. Norway is up more than 1%; Germany, Austria, Denmark and Portugal are also up. Futures here in the States point towards a down open for the cash market.

The dollar is down a small amount. Oil is up a buck; copper is down. Gold and silver are up. Bonds are up.

Today is Fed day. They’ve said numerous times they want to raise rates, so in my opinion, they should do it now. The S&P is up almost 300 points the last 11 weeks, so there’s a big cushion to work with. The market can easily absorb a rate hike and not do too much damage to the charts. But they probably won’t…or at least Wall St. doesn’t think they will.

If they don’t want to raise, they’ll desperately grasp for anything that allows them to hold off. Despite the overall market strength, big cap tech stocks have taken hits lately.

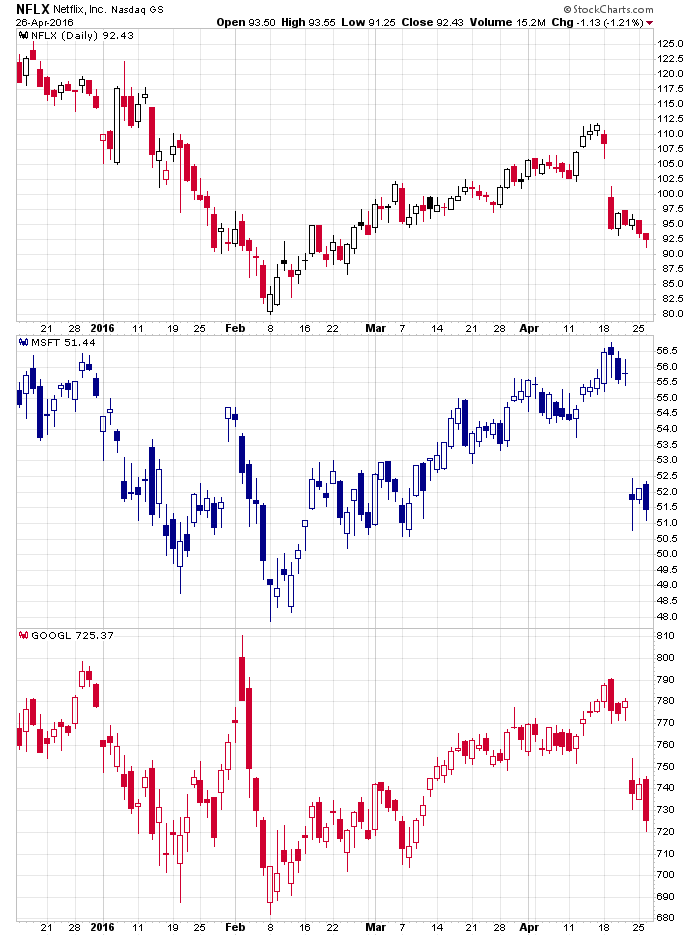

Last week Netflix, Microsoft and Google and took big hits.

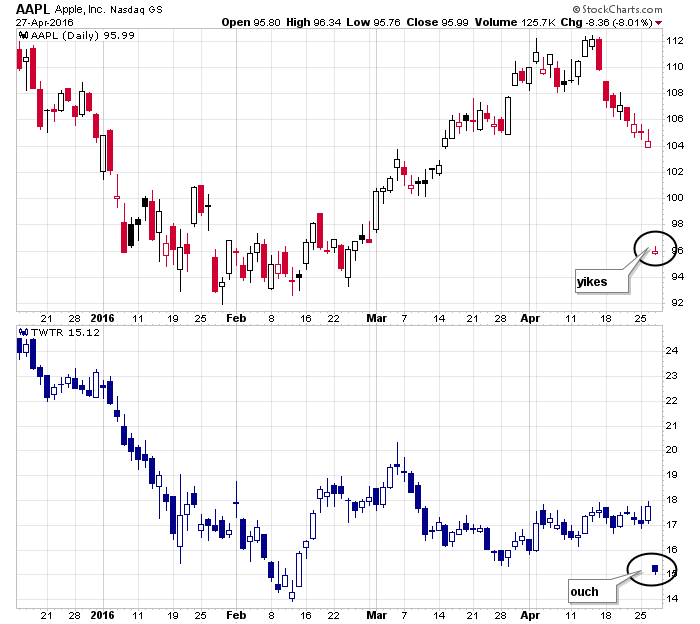

Today Apple and Twitter will do the same.

Apple’s earnings were below expectations. Revenue fell. Profits declined. Sales dropped for the first time in a decade.

Perhaps the Fed looks at the odds of a tech recession and continues to hold off raising rates. They’ll do what they want. They’ll spin whatever info and data is available and justify whatever they want to do.

Personally I haven’t bought a tech stock in a while. All my focus has been in the commodity space. More after the open.

Stock headlines from barchart.com…

Apple (AAPL -0.69%) dropped more than 7% in pre-market trading after it forecast Q3 revenue of $41 billion-$43 billion, weaker than consensus of $47.35 billion and below the lowest estimate of $43.95 billion.

Capital One Financial (COF +1.29%) dropped nearly 2% in after-hours trading after it reported Q1 adjusted EPS continuing operations of $1.85, weaker than consensus of $1.92.

Twitter (TWTR +3.86%) slid 14% in pre-market trading after it said it sees Q2 revenue of $590 million-$610 million, well below consensus of $677.1 million.

Panera Bread (PNRA -1.50%) climbed 2% in after-hours trading after it reported Q1 adjusted EPS of $1.56, better than consensus of $1.50,

Total System Services (TSS +0.82%) gained over 4% in after-hours trading after it raised guidance on fiscal 2016 adjusted EPS to $2.78-$2.85 from a January 26 estimate of $2.56-$2.62.

Cree (CREE +1.65%) climbed 2% in after-hours trading after it reported Q3 adjusted EPS of 17 cents, higher than consensus of 14 cents.

Buffalo Wild Wings (BWLD +0.13%) slumped over 10% in after-hours trading after it lowered guidance on fiscal 2016 EPS to $5.65-$5.85 from a February 3 estimate of $5.95-$6.20, below consensus of $6.10.

Hub Group (HUBG +2.93%) rallied 5% in after-hours trading after it reported Q1 adjusted EPS of 58 cents, well above consensus of 40 cents.

ViaSat (VSAT +1.30%) gained over 1% in after-hours trading after it was announced that it will replace Acuity Brands in the S&P MidCap 400 after the close of trading on Monday, May 2.

AT&T (T -0.31%) slid over 1% in after-hours trading after it reported Q1 adjusted EPS of 72 cents, better than consensus of 69 cents, but said it added a total 129,000 monthly subscribers, fewer than consensus of 283,000.

Acuity Brands (AYI +1.42%) rose over 1% in after-hours trading after it was announced that Acuity will replace ADT Corp. in the S&P 500 after the close of trading on Monday, May 2.

H&R Block (HRB -0.92%) tumbled over 6% in after-hours trading after it said it sees fiscal 3016 revenue falling year-on-year after total U.S. assisted tax returns prepared through April 19 fell 5.8%

Collegium Pharmaceuticals (COLL -2.18%) rallied over 12% in after-hours trading after it received FDA approval for its Xtampza ER drug extended-release capsules.

Barracuda Networks (CUDA -2.14%) rose over 9% in after-hours trading after it reported Q4 adjusted EPS of 15 cents, well above consensus of 9 cents.

Wabash National (WNC +4.98%) jumped nearly 13% in after-hours trading after it raised guidance on fiscal 2016 adjusted EPS to $1.65-$1.75 from a February 3 estimate of $1.50-$1.60, higher than consensus of $1.52.

Tuesday’s Key Earnings

Buffalo Wild Wings (NASDAQ:BWLD) -12.2%, punished after earnings miss.

AT&T (NYSE:T) -0.7%, tops estimates with help from DirecTV.

Nabors (NYSE:NBR) sinks 9.9% after weak Q1, warns of reduced rig counts.

Fortinet (NASDAQ:FTNT) soars 9.9% following solid earnings beat, strong billings.

Chipotle (NYSE:CMG) -4.5% as margins disappear.

Capital One (NYSE:COF) -1.6%, misses as charge-offs, provisions rise.

eBay (NASDAQ:EBAY) +1.6% after topping consensus.

U.S. Steel (NYSE:X) flat after missing on EPS and revenue.

Edwards Lifesciences (NYSE:EW) +1.3% following solid growth, raised guidance.

Panera Bread (NASDAQ:PNRA) +2.1% after blazing past peers with comparable-store sales.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 International trade in goods

10:00 Pending Home Sales

10:30 EIA Petroleum Inventories

2:00 PM FOMC Announcement

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 27)”

Leave a Reply

You must be logged in to post a comment.

No rate change is merited…but.

In truth it’s difficult to find just who is buying stocks right now.

1.Corporate buybacks are in a blackout period,(earnings) so it’s not that.

2.Corporate insiders are selling the farm (down turn is near).

3.Individual investors are pulling money out of stock funds (they know too).

4.And institutional investors have been net sellers of stocks for weeks now.(raise rates- why?)

This leaves Central Banks.

What used to be conspiracy theory is now a fact: the futures exchanges permit Central Banks to buy stock futures to provide “liquidity.” It is not coincidence that this policy occurred around the time the markets began to feel increasingly manipulated with stocks ramping higher for absolutely no reason at various points during the day. Never trust the Fed we are not smart enuf….

fed says soon, rhymes with June. lol. they will keep saying we may hike the rate next month, but they will not. what they will do (again) is say we may raise it next time. of course they won’t do it that time either. the world is cutting rates, it is unrealistic for the fed to run uphill. message is clear, go buy some assets, we will keep the money loose. markets understand the message and will act on it. when the congress grills yellen, she will say they managed inflation expectations that way. i am not smart money, but i am not that dumb either. i am just a kid with a ruler, and i at least know how to use the ruler.