Good morning. Happy Friday.

The Asian/Pacific markets closed with a lean to the downside. Hong Kong and Taiwan dropped more than 1%; Singapore was also weak. Australia and New Zealand did okay. Europe is currently mostly down. Germany, France, Sweden, Switzerland, the Netherlands and Spain are down more than 1%. Futures here in the States point towards a slight down open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are down.

The market posted a solid loss yesterday on its biggest volume day of the month. Lots of people are coming out of the woodwork predicting a correction. Is it possible? Yeah I guess, but let’s remember the market hasn’t even put in back-to-back down days in almost four weeks. Tops take time to form, so even if the FOMC did act as an inflection point and a pullback is in the beginning stages, there’ll be some back and forth movement first. The market isn’t going to just drop unless there’s a major news event which changes Wall St’s psychology.

Many tech stocks have suffered big drops after releasing earnings. Today we’ll get a break from that. AMZN, EXPE, P and LNKD are set to gap up big.

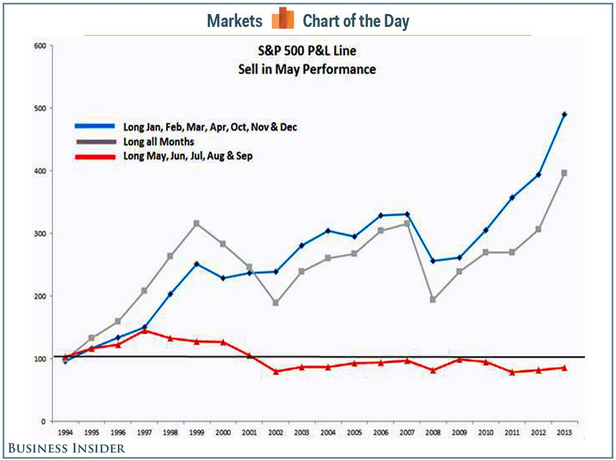

Today is the last trading day of April. Then starts the “sell in May and go away” period. It’s a real phenomenon. The market really does do significantly worse May-September than the other months of the year. It’s not a reason to just to abandon all longs, and it’s definitely not a reason to go short. But it’s something to keep in mid. Here’s a chart with some old data.

I’ve had a defensive posture for a couple weeks, and as of yesterday’s close, the S&P was flat over the previous month. Most of my activity has been in oil…and then I’ve had a few gold/silver and steel plays. But my focus and energy have been in oil, and it’s treated me well. More after the open.

Stock headlines from barchart.com…

Gilead (GILD -3.69%) dropped over 4% in pre-market trading after it reported Q1 adjusted EPS of $3.03, below consensus of $3.15, as sales of Harvoni were only $3.02 billion, below estimates of $3.17 billion.

Amazon.com (AMZN -0.75%) rallied 13% in pre-market trading after it reported Q1 revenue of $29.1 billion, higher than consensus of $27.97 billion, and said it sees Q2 revenue of $28 billion-$30.5 billion, above consensus of $28.3 billion.

Expedia (EXPE -0.72%) rallied over 10% in after-hours trading after it reported an unexpected Q1 adjusted EPS profit of 6 cents, better than consensus of a 6 cent loss.

LinkedIn (LNKD +3.50%) gained almost 7% in after-hours trading after it reported Q1 adjusted EPS of 74 cents, well above consensus of 60 cents.

Skyworks Solutions (SWKS -0.75%) slipped over 3% in after-hours trading after it reported Q2 adjusted EPS of $1.25, below consensus of $1.32, and said it sees Q3 adjusted EPS of $1.21, weaker than consensus of $1.32.

Outerwall (OUTR -5.02%) jumped over 8% in after-hours trading after it reported Q1 core EPS from continuing operations of $2.44, well above consensus of $1.33.

Pandora Media (P -0.11%) rose over 6% in after-hours trading after it reported a Q1 adjusted EPS loss of 20 cents, narrower than consensus of 32 cents

Molina Healthcare (MOH -1.53%) slumped over 11% in after-hours trading after it reported Q1 adjusted EPS of 51 cents, well below consensus of 81 cents, and then lowered guidance on 2016 adjusted EPS to $2.50-$2.95 from a previous forecast of $3.86.

B&G Foods (BGS -0.45%) rose 6% in after-hours trading after it reported Q1 adjusted EPS of 65 cents, higher than consensus of 51 cents, and then raised guidance on 2016 adjusted EPS to $2.05-$2.15 from a March 15 forecast of $1.90-$2.00.

Synaptics (SYNA -5.62%) tumbled over 12% in after-hours trading after it reported Q3 adjusted EPS of $1.21, well below consensus of $1.51, and said it sees Q4 revenue of $300 million-$340 million, well below consensus of $478.9 million.

Regal Entertainment Group (RGC +1.12%) gained nearly 4% in after-hours trading after it reported Q1 adjusted EPS of 27 cents, better than consensus of 25 cents.

Qlik Technologies (QLIK +3.25%) rose over 3% in after-hours trading after it raised guidance on fiscal year adjusted EPS to 42 cents-45 cents from a February 11 estimate of 41 cents-44 cents.

NeoPhotonics (NPTN -3.75%) sank over 12% in after-hours trading after it reported Q1 adjusted EPS of 15 cents, higher than consensus of 14 cents, but said it sees Q2 adjusted EPS of 8 cents-15 cents, weaker than consensus of 17 cents.

Gigamon (GIMO -3.52%) jumped over 10% in after-hours trading after it reported Q1 adjusted EPS of 22 cents, higher than consensus of 18 cents.

NeuStar (NSR -1.67%) slumped over 10% in after-hours trading after it said it sees fiscal year revenue of $1.22 billion-$1.24 billion, below the midpoint estimate of $1.24 billion.

Friday’s Key Earnings

Outerwall (NASDAQ:OUTR) +8% with the bottom line improved.

Western Digital (NASDAQ:WDC) -4% after missing on both lines of its report.

Baidu (NASDAQ:BIDU) +6% after revenue popped 31%.

SkyWest (NASDAQ:SKYW) +9% with profit soaring.

Groupon (NASDAQ:GRPN) +4% after boosting EBITDA guidance.

LinkedIn (NYSE:LNKD) +12% after a stronger-than-expected report.

Pandora (NYSE:P) +6% with listening hours on the rise.

Today’s Economic Calendar

6:30 Fed’s Kaplan: Monetary Policy

8:30 Personal Income and Outlays

8:30 Employment Cost Index

9:45 Chicago PMI

10:00 Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

3:00 Farm Prices

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 29)”

Leave a Reply

You must be logged in to post a comment.

Sell in May? Why? Avoid losses! Actually we USers are saving too much this morning. No one trusts the market, so bank your bucks. Mexico, where we anchored, is having economic problems with oil sales, Drug exports, jobs: you know why the locals love Obama. Careful yesterday was ugly due to someone in Japan being stingy with stimulants. Janet is rattled,so am I. Underway north @ 0700hrs Pacific DLT. Best.

oil gold silver all at multi-month highs, all seem to be breaking out and just beginning to accelerate. given the dollar is testing the bottom of its consolidation range and threatening to break down, the moves in commodities have longer term implications. we can put really high targets on both oil and metals.

all markets are being rigged controled by central banks

but technically spx should have small bounce

all central banks are now totally bankrupt and have been reported to marsian control for running ponsis