Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. India and New Zealand did well; Hong Kong and Malaysia were weak. Many European markets are closed today. Greece, the Czech Republic, Hungary and Spain are doing well; Russia and Poland are weak. Futures in the States point towards an up open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil is up, copper down. Gold and silver are up. Bonds are down.

Oil is up almost 2 bucks this morning. I guess there’s a wild fire in the heart of Canada’s oil sands, and officials in Libya say fighting between rival factions could pull 120K barrels/day off the market. Many oil stocks have taken hits lately, so oil bulls will get some relief.

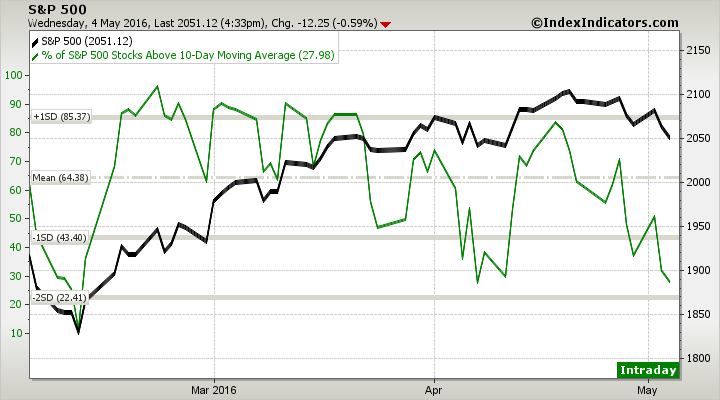

The selling that has taken place over the last 1-2 weeks has been the most sustained since the February bottom was established. Several short-term breadth indicators have cycled down to lows.

The percentage of SPX stocks trading above their 10-day moving averages has matched its early-April low.

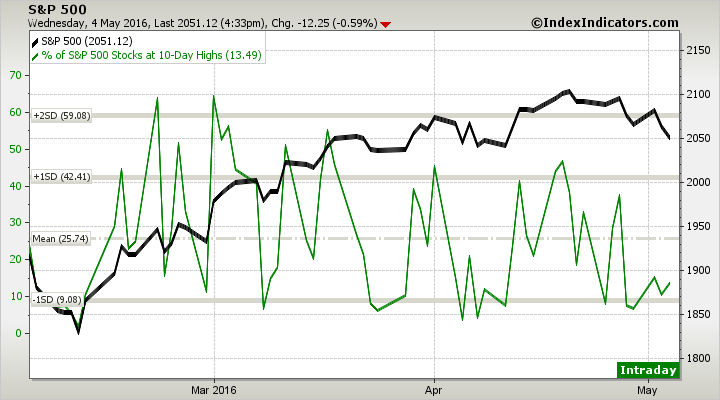

The percentage of SPX stocks trading at a 10-day high dropped to match previous lows from the last two months and is now moving up.

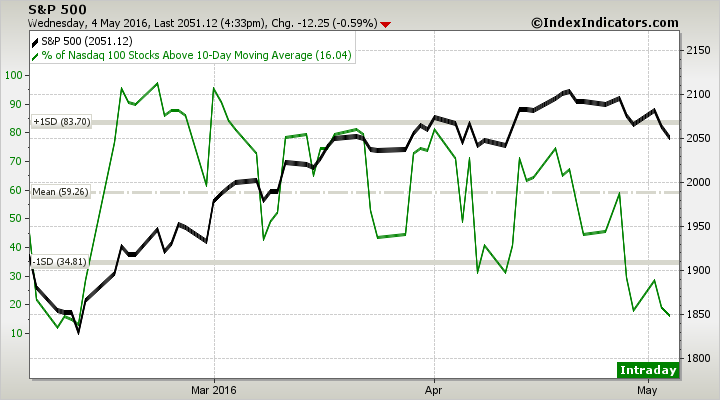

And the percentage of Nas 100 stocks above their 10-day MAs has almost matched its February low.

This would be a good place for a bounce, but with so much of Europe closed today, volume is likely to be light here in the States…so a bounce won’t have much meaning. And employment numbers get released tomorrow morning – another reason trading may be slow today.

Stock headlines from barchart.com…

Tesla (TSLA -4.20%) rose 5% in pre-market trading after it said it plans to deliver 80,000 to 90,000 new Model S and Model X vehicles this year and reach 500,000 vehicles by 2018, two years sooner than originally planned.

McKesson (MCK -1.87%) gained over 1% in after-hours trading after it reported Q4 adjusted EPS of $3.17, higher than consensus of $3.14.

Kraft Heinz (KHC +1.65%) jumped nearly 5% in after-hours trading after it reported Q1 adjusted EPS of 73 cents, well above consensus of 61 cents.

MetLife (MET -1.90%) fell nearly 3% in after-hours trading after it reported Q1 operating EPS of $1.20 with a 1 cent net tax benefit, weaker than consensus of $1.38.

Prudential Financial (PRU -1.55%) lost 3% in after-hours trading after it reported Q1 operating EPS of $2.18, below consensus of $2.37.

Whole Foods Market (WFM -0.83%) gained nearly 2% in after-hours trading after it reported Q2 EPS of 44 cents, better than consensus of 41 cents.

TripAdvisor (TRIP -4.10%) dropped over 3% in after-hours trading after it reported Q1 adjusted EPS of 32 cents, well below consensus of 46 cents.

Weight Watchers International (WTW -1.11%) surged 12% in after-hours trading after it raised guidance on full-year EPS to 80 cents-$1.05 from a February estimate of 70 cents-$1.00.

Relypsa (RLYP -19.17%) gained nearly 3% in after-hours trading after it reported a Q1 loss of -$1.26, a smaller loss than consensus of -$1.46.

CenturyLink (CTL +1.24%) slid nearly 4% in after-hours trading after it reported Q1 adjusted EPS of 46 cents, well below consensus of 68 cents.

TASER International (TASR -0.79%) rose over 4% in after-hours trading after it reported Q1 EPS of 6 cents, higher than consensus of 4 cents.

ARRIS International PLC (ARRS -0.13%) rallied over 8% in after-hours trading after it reported Q1 adjusted EPS of 47 cents, better than consensus of 40 cents and said it sees Q2 adjusted EPS of 65 cents-70 cents, well above consensus of 56 cents.

Qorvo (QRVO -1.18%) climbed 7% in after-hours trading after it said it sees Q1 adjusted EPS of $1.05, higher than consensus of 96 cents.

Fitbit (FIT -0.47%) tumbled over 10% in after-hours trading after it said its sees Q2 adjusted EPS of 8 cents – 11 cents, below consensus of 26 cents and below the lowest estimate of 12 cents.

EP Energy (EPE +0.23%) jumped nearly 20% in after-hours trading after it reported Q1 adjusted EPS of 19 cents, well above consensus of 1 cent.

Wednesday’s Key Earnings

AB Inbev (BUD) -1.6% on unfavorable currency, Brazil turmoil.

Annaly Capital (NYSE:NLY) flat AH following in-line results.

Delphi Automotive (NYSE:DLPH) -4.2% despite doubling its profits.

Energy Transfer Partners (NYSE:ETP) unmoved AH after beating estimates.

Fitbit (NYSE:FIT) -10.4% AH following heavy spending.

Priceline (NASDAQ:PCLN) -7.5% hammered by weak profit guidance.

Shell (NYSE:RDS.A) -2.5% as tumbling oil prices took their toll.

Tesla (TSLA) +3.8% AH after a beat and strong guidance.

Time Warner (NYSE:TWX) +1.6% driven by Turner and HBO.

Transocean (NYSE:RIG) +1.1% AH after topping expectations.

Twenty-First Century Fox (NASDAQ:FOXA) swung AH following a mixed quarter.

Whole Foods (NASDAQ:WFM) +1.1% AH battling a traffic dip in FQ2.

Zynga (NASDAQ:ZNGA) +14.8% AH boosted by big ad gains.

Today’s Economic Calendar

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Gallup Good Jobs Rate

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

11:50 Fed’s Bullard speech

4:30 Money Supply

4:30 Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 5)”

Leave a Reply

You must be logged in to post a comment.

initial jobs was clueless, but the decline in rail traffic is not.

Seeking Alpha carries a piece on Minsky which is worth looking at, it recognized that the sum total of the three major components of the national debt balance – private, government, and foreign – must be zero. Accordingly, Minsky predicted, just before he died in 1996, that the budget surpluses of the Clinton years would necessarily result in a counterbalancing increase in private indebtedness, which he thought would prove highly destabilizing. For better or worse, he did not live to see this prediction come spectacularly true. But he also believed that the unprecedented stability and growth of the immediate postwar period was due to a stabilizing massive federal debt, with correspondingly little private debt and large public holdings of ultra-safe assets.

Worth thinking about icreased debt is coming soon.

Hey Jason. Love your daily Before The Open. I like how you bold Asian/European/States in your first paragraph. Would you possibly consider bolding if those markets are mixed, up, or down too? It would make it easier to scan/read. Just a suggestion. Thanks for the continued good work!

I’ll mess around with changing the text color based on up/down/flat. How’s that?