Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Japan, Hong Kong and Singapore gained more than 1%; Australia, Malaysia, New Zealand and Taiwan also did well. Europe is currently split and little changed. Greece is up more than 1%; London, Belgium and Spain are also doing well. Russia is down more than 1%; the Czech Republic, Norway and Italy are also weak. Futures in the States point towards a flat open for the cash market.

—————

I wrote an article for Top Shelf Traders emagazine. You can check it out here. I consider it very important. It’s at the heart of what I do.

—————

The dollar is flat. Oil is up, copper is flat. Gold and silver are up. Bonds are down.

Yesterday was a solid up day on weak-ish volume. I’m hoping the the move continues – not because I’m super bullish, but because the progress or lack of progress of the internals will likley tell us what’s on the horizon.

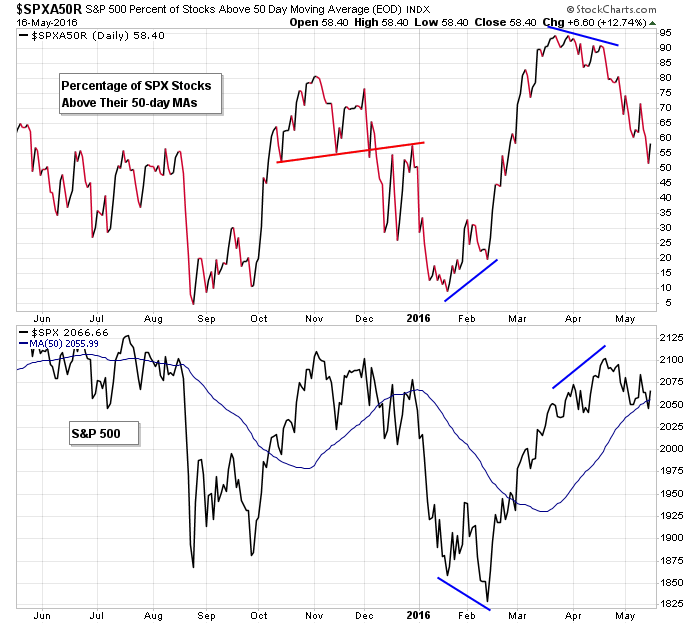

I’m talking about the percentage of stocks above their 20- and 50-day moving averages, the percentage of stocks at 10- and 20-day highs, the advance/decline lines, the advance/decline volume lines, the bullish percent charts…and more. All have cycled down to some degree – some to low levels, others off their highs. If the market moves up here, these indicators will either support the move by also moving up, or they’ll hint at weakness beneath-the-surface by putting in lower highs.

Here’s an example…the percentage of SPX stocks above their 50-day moving averages. If the market moves up, but this indicators doesn’t make much upside progress, then the market is very likely to reverse and head south again.

Right now things are in limbo, but we’ll be getting some valuable information soon. Meanwhile, I’m still long oil and gold & silver. More after the open.

Stock headlines from barchart.com…

Hartford Financial Services Group (HIG -0.32%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Wells Fargo Securities.

Home Depot (HD +1.66%) climbed over 1% in pre-market trading after it reported Q1 EPS of $1.44, higher than consensus of $1.35, and then raised guidance on full-year EPS to $6.27 from a previous view of $6.12-$6.18.

Freeport-McMoRan (FCX +6.05%) is up over 3% in pre-market trading after Jeffries Group upgraded the stock to ‘Buy’ from ‘Hold.’

Bob Evans Farms (BOBE +0.43%) was rated a new ‘Buy’ at Maxim Group with a 12-month price target of $59.

Agilent Technologies (A +0.75%) climbed nearly 4% in after-hours trading after it raised guidance on fiscal 2016 adjusted EPS to $1.88-$1.92 from a March 7 estimate of $1.81-$1.87, above consensus of $1.86.

Office Depot (ODP -5.16%) gained over 2% in after-hours trading after the company hired Bain for a strategic review of its business.

Relypsa (RLYP +4.07%) dropped over 7% in after-hours trading after it reported no increase in April in the weekly average of new patients who began taking Veltassa with a free starter supply.

Amplify Snack Brands (BETR +0.39%) slid over 4% in after-hours trading after it started a 10-million share secondary offering of common stock.

Community Health Systems (CYH +2.00%) climbed nearly 4% in after-hours trading after Greenlight Capital Holdings reported a new stake in the company in Q1.

Akorn (AKRX +4.94%) rose over 1% in after-hours trading after it reported Q1 revenue of $268.3 million, better than consensus of $267.1 million.

Meritage Homes (MTH +0.77%) gained over 2% in after-hours trading after it said it sees Q2 EPS of 78 cents-85 cents, higher than consensus of 78 cents.

Globalstar (GSAT +12.24%) rose over 5% in after-hours trading after Greenlight Capital Holdings reported a new stake in the company in Q1.

Aegerion Pharmaceuticals (AEGR +33.53%) dropped over 13% in after-hours trading after it lowered guidance on full-year sales to $130 million-$150 million from a prior view of $160 million-$190 million, below consensus of $174.8 million.

Today’s Economic Calendar

8:30 Consumer Price Index

8:30 Housing Starts

8:55 Redbook Chain Store Sales

9:15 Industrial Production

10:00 E-Commerce Retail Sales

12:00 PM Fed’s Lockhart speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 17)”

Leave a Reply

You must be logged in to post a comment.

High jinx volatility

A blunderer a BRK?- AAPL real lead or bust??? Time to suspect boom or bust is coming. Stops are the price to play. Nervous as hell. Best

Also, NYSE Composite vs SPX show their negative divergence at 20ma/50ma,even at 100ma level charts.

Thank you for your professional analysis.