Good morning. Happy Wednesday.

The Asian/Pacific markets mostly posted big, across-the-board gains. Hong Kong and India gained more than 2%; Japan, Australia, Indonesia, South Korea and Taiwan rallied more than 1%. Europe is currently up. France, Germany, the Netherlands, the Czech Republic, Russia, Poland, Denmark, Spain, Italy and Belgium are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down a small amount. Oil and copper are up. Gold is down, silver is up. Bonds are down.

Last week and over the weekend I said the failure of the bears to take control when they got the opportunity would likely lead to a bear trap – a push lower that causes longs to panic and sell and lures in shorts – that quickly reverses and surges higher. It happens with individual stocks; it happens with the overall market. It turns out this is exactly what has played out.

Lots of bearish headlines (George Soros and Stanley Drunkenmiller both issuing negative commentary) coupled with the prospects of higher rates (even though the FOMC minutes revealed nothing new) pushed the S&P down to a 2-month low. An innocent move up off the low exploded yesterday, and just like that the S&P is 50 points off its low. It’s still range bound. It’s still in consolidation mode, but now the bulls have some wiggle room. They no longer have their backs against the wall.

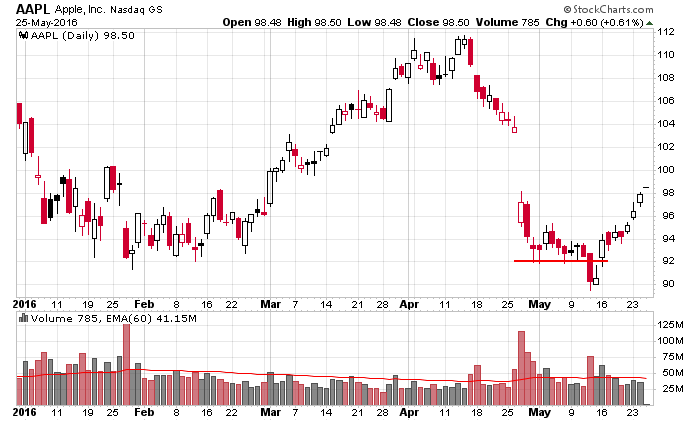

It happened with Apple.

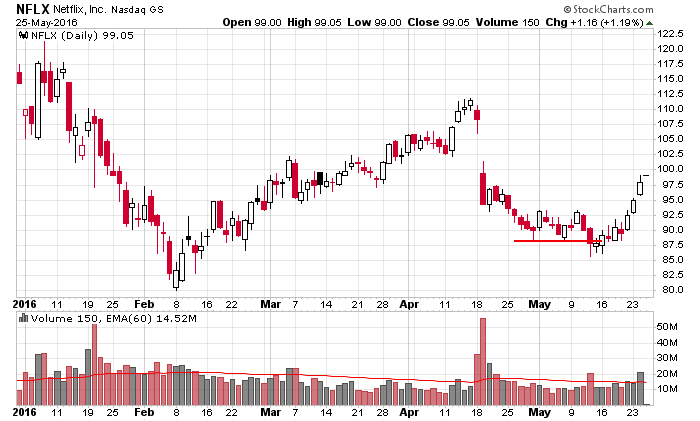

It happened with Netflix.

I love the yin and yang of the market. It moves in one direction to trap everyone…and then it quickly reverses.

Step #1 in trading patterns is recognizing them and playing them. Step #2 is quickly realizing a pattern isn’t working, so a quick exit is in order. Step #3 is to not only do #2, but to also reverse your position and go the other way.

Trading becomes easier when you stop fighting the market…when you stop negotiating and bargaining with it..when you simply read the action and position yourself. More after the open.

Stock headlines from barchart.com…

Intuit (INTU +2.57%) rose 1% in after-hours trading after it reported Q3 adjusted EPS of $3.43, better than consensus of $3.21, and then raised guidance on full-year adjusted EPS to $3.63-$3.65 from a February 25 estimate of $3.45-$3.50.

Arthur J Gallagher (AJG +1.11%) rose nearly 1% in after-hours trading after it announced that it will replace Coca-Cola Enterprises in the S&P 500 after the close of trading Friday, May 27.

Dycom Industries (DY +1.30%) jumped over 8% in pre-market trading after it reported Q3 adjusted EPS of $1.08, well above consensus of 74 cents, and then said it sees Q4 adjusted EPS of $1.45-$1.60, higher than consensus of $1.36.

Noble Energy (NBL -1.04%) was upgraded to ‘Buy’ from ‘Neutral’ at Sterne Agee CRT.

Best Buy (BBY -7.42%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Pilgrim’s Pride (PPC +0.20%) was downgraded to ‘Hold’ from ‘Buy’ at BB&T Capital Markets.

ON Semiconductor (ON +2.18%) gained 2% in after-hours trading after it was rated a new ‘Outperform’ at CLSA.

Axalta Coating Systems (AXTA +1.41%) fell nearly 1% in after-hours trading after it announced a sale of 25 million common shares by affiliates of the Carlyle Group.

Computer Sciences (CSC +1.86%) surged over 20% and Hewlett Packard Enterprises (HPE +1.12%) jumped 11% in pre-market trading after CSC announced that it will merge with HP Enterprise’s Services Unit.

Sportsman’s Warehouse Holdings (SPWH -2.10%) dropped 4% in after-hours trading after it said it sees fiscal-year 2017 adjusted EPS of 65 cents-73 cents, below consensus of 73 cents.

Chesapeake Energy (CHK +10.35%) rose over 2% in after-hours trading after it announced, for the second time in a month, a debt for equity swap as it attempts to strategically reduce its debt load.

American Axle & Manufacturing Holdings (AXL +2.68%) gained over 4% in after-hours trading after it announced that it will replace Education Realty in the Smallcap 600 after the close of trading Friday, May 27.

Nimble Storage (NMBL +2.08%) jumped over 10% in after-hours trading after it reported a Q1 adjusted EPS loss of -24 cents, a smaller loss than consensus of -26 cents, and then said it sees Q2 revenue of $93 million-$96 million, above consensus of $92.7 million.

Tuesday’s Key Earnings

AutoZone (NYSE:AZO) +3% on rising same-store sales.

Best Buy (NYSE:BBY) -7.5% after disappointing guidance.

HP Enterprise (NYSE:HPE) +10.9%; Computer Sciences (NYSE:CSC) +27.7% AH on their spinoff/merger plans.

Intuit (NASDAQ:INTU) -2.2% AH despite a strong tax season.

Toll Brothers (NYSE:TOL) +8.7% as home prices increased.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 International trade in goods

9:00 FHFA House Price Index

9:45 PMI Services Index Flash

10:30 EIA Petroleum Inventories

1:00 PM Results of $13B, 2-Year FRN Auction

1:00 PM Results of $34B, 5-Year Note Auction

1:00 PM Fed’s Kaplan: Monetary Policy

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (May 25)”

Leave a Reply

You must be logged in to post a comment.

“Delinquency rates on commercial and industrial loans spiked higher in the first quarter of 2016 and, based on forward-looking data, are poised to increase well into next year.” BLS May extract.

This is a holiday week, but window dressing on IRA money follows into the first of June , so about the first week things get real again. The summer correction into October ’16 follows. I am preparing for a broad short for summer. Yellen?? Who knows but I say no increase, but the opening paragraph should warn you its a long ways down if she does raise rates. Smile, it is summer….. almost.