Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Singapore and India gained more than 1%; Taiwan, Indonesia, New Zealand, South Korea and Hong Kong also did well. Europe is currently mixed and little changed. There are no big movers. Switzerland, Hungary and Spain are up; Norway and Portugal are down. Futures here in the States point towards a slight up open for the cash market.

The dollar is up. Oil is down; copper is up. Gold and silver are down small amounts. Bonds are down.

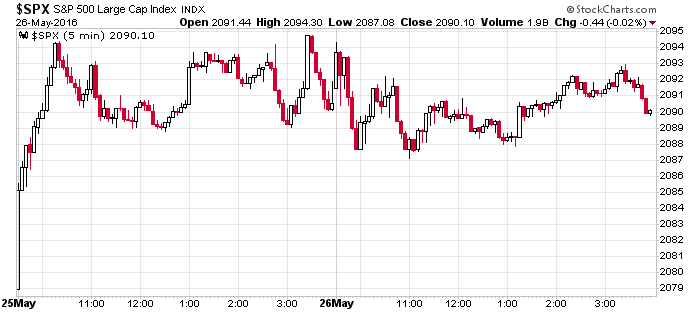

This is what the S&P has done the last two days. Other than Wednesday’s open, it’s moved in an 8-point range and has made no attempts to move up or down. I expect the same today ahead of the 3-day holiday weekend.

Overall we have a lot of mixed signals…

The indexes are range bound, and beneath the surface, the breadth indicators are mixed and mostly neutral. These don’t tell us a breakout (in either direction) is imminent.

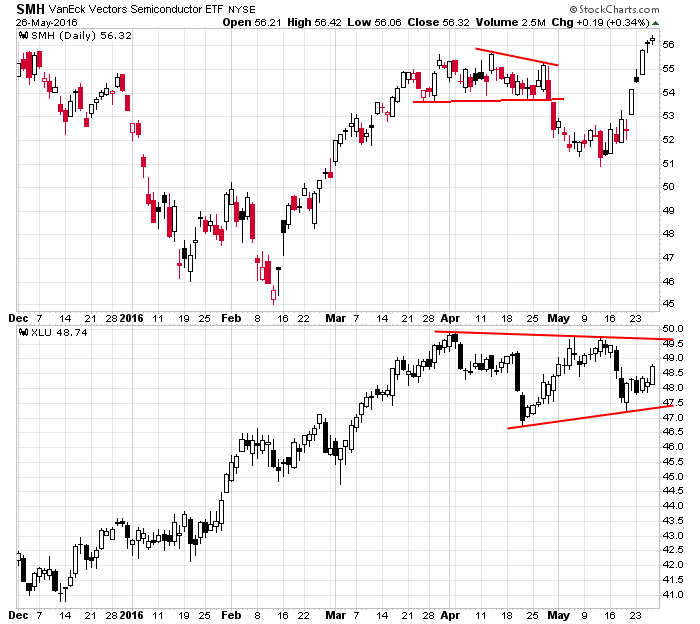

Groups are also mixed. Semiconductors (risk on) have done well lately; utilities (risk off) are nicely poised to breakout and run.

Call them mixed signals or cross-currents. The only movement that is supported right now is a continuation of the range.

Have a great day. Enjoy the extra day off. If you’re not around today, we’ll see you Tuesday.

Stock headlines from barchart.com…

Ulta Salon Cosmetics & Fragrance (ULTA +1.05%) rallied nearly 8% in pre-market trading after it reported Q1 EPS of $1.45, higher than consensus of $1.29, and said it sees full-year EPS growth in the low twenties percentage range versus a prior view of up 18%-20%.

Monsanto (MON -1.84%) was downgraded to ‘Neutral’ from ‘Overweight’ at Atlantic Equities with a 12-month price target of $105.

GameStop (GME +0.84%) dropped over 8% in after-hours trading after it said it sees Q2 adjusted EPS of 23 cents-30 cents, below consensus of 33 cents.

Duluth Holdings (DLTH -0.96%) was rated a new ‘Buy’ at Stifel with a 12-month price target of $28.

Terex (TEX -3.45%) was downgraded to ‘Hold’ from ‘Buy’ at Evercore ISI with a 12-month price target of $21.

Caleres (CAL +1.16%) lost 1% in after-hours trading after it reported Q1 EPS of 41 cents, below consensus of 43 cents, and then lowered guidance on full-year revenue to $2.60 billion-$2.63 billion from a March 15 view of $2.65 billion-$2.68 billion, below consensus of $2.66 billion.

Veeva Systems (VEEV -0.43%) jumped 10% in after-hours trading after it reported Q1 adjusted EPS of 15 cents, higher than consensus of 11 cents, and then raised its full-year revenue estimate to $516 million-$520 million from a prior view of $508 million-$513 million, above consensus of $512.1 million.

Palo Alto Networks (PANW +1.71%) sank 11% in pre-market trading after it reported Q3 adjusted EPS of 42 cents, right on consensus, but said it sees Q4 adjusted EPS of 48 cents-50 cents, below consensus of 50 cents.

Deckers Outdoor (DECK +0.61%) fell over 2% in after-hours trading after it said it sees full-year net sales of unchanged to down -3%, weaker than estimates of up +2%, and then lowered guidance on full-year adjusted EPS to $4.05-$4.40, below consensus of $4.61.

First Data Corp. (FDC +1.39%) gained 1% in after-hours trading after Vice Chairman Plumeri disclosed a purchase of 250,000 shares of the company’s stock on Wednesday.

BG Staffing (BGSF -0.24%) slumped over 14% in after-hours trading after it announced a public offering of stock, although no terms were available at the time of this writing.

21Vianet Group (VNET +6.09%) slid 4% in after-hours trading after it reported a Q1 adjusted loss/Ads of 13 cents and Q1 gross margins of 19.6% versus 26.8% y/y.

Splunk (SPLK +1.05%) dropped over 7% in after-hours trading despite reporting a -2 cent Q1 adjusted EPS loss, right on consensus.

Titan Pharmaceuticals (TTNP +1.29%) surged 23% in after-hours trading after it said it will receive a $15 million payment from partner Braeburn Pharma, double-digit royalties and up to $165 million is sales milestones following FDA approval of its Probuphine implant.

Tuesday’s Key Earnings

AutoZone (NYSE:AZO) +3% on rising same-store sales.

Best Buy (NYSE:BBY) -7.5% after disappointing guidance.

HP Enterprise (NYSE:HPE) +10.9%; Computer Sciences (NYSE:CSC) +27.7% AH on their spinoff/merger plans.

Intuit (NASDAQ:INTU) -2.2% AH despite a strong tax season.

Toll Brothers (NYSE:TOL) +8.7% as home prices increased.

Today’s Economic Calendar

8:30 GDP Q1

8:30 Corporate Profits

10:00 Reuters/UofM Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

11:30 Janet Yellen

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (May 27)”

Leave a Reply

You must be logged in to post a comment.

Dr. Yellen we presume today is a nonevent: Grundlach bond brain says she does nothing and I vote she adds to confusion on policy but nothing else.

I am Still short into the fall. Risky yes, but less so than cash or long stocks (oh a few dividends). WITC down this AM but behaving oddly. The PBC seen to want the yuan down, but needs crude. Dilemma??