Good morning. Happy Tuesday.

The Asian/Pacific markets up across-the-board. Hong Kong, South Korea and Taiwan rallied more than 1%; Japan, Singapore, India, Indonesia and Malaysia also did well. Europe is currently posting across-the-board gains. Germany, France, Austria, the Netherlands, Norway, Russia, Greece, Poland, Italy, Belgium, Portugal and Sweden are up more than 1%. Futures here in the States point towards a positive open for the cash market.

—————

List of Indexes and ETFs – here

—————

The dollar is up a small amount. Oil is up; copper is down. Gold and silver are down. Bonds are up.

Yesterday the S&P closed at its highest level since November and within about 25 points of its all-time high. But of course the index is already at an all-time high if you include dividends.

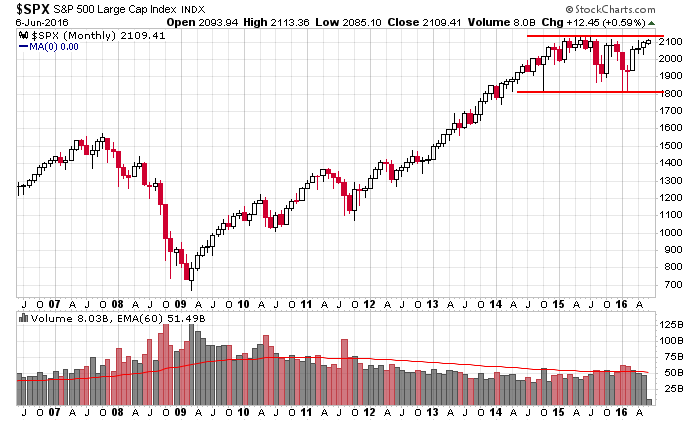

If the chart below was that of an individual stock, you’d be bullish and looking to buy dips within the pattern and a breakout. And you’d have a 300-point price target.

But it’s not a stock; it’s the S&P 500, and because of all the negative news, you don’t think it’s possible…you don’t think it makes sense…there’s a laundry list of reasons the market should go down, not up. And that’s exactly why it’s very possible.

In the near term – and the near term in this case is upwards of a year – anything goes. Think about how long the dot com bubble lasted beyond what made sense.

The odds the market legs up is high enough for you to have a plan in place to profit from it. More after the open.

Stock headlines from barchart.com…

Norwegian Cruise Line Holdings Ld. (NCLH -0.72%) was rated a new ‘Buy’ at Sterne Agee CRT with a price target of $80.

Jabil Circuit (JBL +0.93%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs with a price target of $17.

Marathon Oil (MRO +4.80%) was rated a new ‘Buy’ at KLR Group with a target price of $21.

Layne Christensen (LAYN -1.01%) reported a Q1 loss continuing operations of -45 cents a share, a wider loss than consensus of -32 cents.

Discovery Communications (DISCA +1.73%) was downgraded to ‘Underperform’ from ‘Market Perform’ at Bernstein.

Catalent (CTLT -0.49%) announced a secondary public offering of 10 million shares of common stock.

United Natural Foods (UNFI +0.57%) jumped over 10% in after-hours trading after it reported Q3 EPS of 76 cents, higher than consensus of 65 cents, and then raised guidance on full-year adjusted EPS to $2.47-$2.53 from a March 7 estimate of $2.34-$2.44.

Casey’s General Stores (CASY -0.98%) reported Q4 EPS of $1.19, below consensus of $1.22, although Q4 revenue of $1.58 billion was above consensus of $1.57 billion.

Thor Industries (THO +0.54%) gained over 1% in after-hours trading after it reported Q3 adjusted EPS from continuing operations of $1.51, better than consensus of $1.43.

Xactly (XTLY +1.25%) rose 4% in after-hours trading after it reported a Q1 adjusted EPS loss of -9 cents, narrower than consensus of -15 cents, and then raised guidance on full-year revenue to $95.5 million-$97.0 million from a March 3 estimate of $94 million-$95.5 million.

Sigma Designs (SIGM +2.62%) reported a Q1 adjusted EPS loss of -12 cents, wider than consensus of -5 cents.

WWD reported that Ralph Lauren (RL +0.54%) plans close some stores and cut up to 10% of its workforce.

DryShips (DRYS +10.80%) tumbled 12% in after-hours trading after three lenders said DryShips had elected to suspend principal repayments and interest payments and was in breach of certain covenants in loan agreements.

Today’s Economic Calendar

8:30 Productivity and Costs

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

1:00 PM Results of $24B, 3-Year Note Auction

3:00 PM Consumer Credit

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Jun 7)”

Leave a Reply

You must be logged in to post a comment.

This rally has about two weeks left.

I do not see a major pullback. For Mr buy and hold this summer will be gold.

a few mote points up and its a terminal browdening megaphone patter and eu fear causing money into usa

only chance of a break out up is london into europe on fear

lets have some fear ,other wise no one is going to buy this ponsi with a naked yellen