Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Japan, Singapore, India and Indonesia were weak. Europe is down across-the-board. Germany, the Netherlands, Norway, Poland and Hungary are down more than 1%; London, France, Sweden, Switzerland, the Czech Republic, Russia, Denmark and Finland are also weak. Futures here in the States point towards a moderate gap down open for the cash market.

—————

My podcast – with Trading Story

—————

The dollar is up. Oil and copper are down. Gold and silver are mixed and flat. Bonds are up.

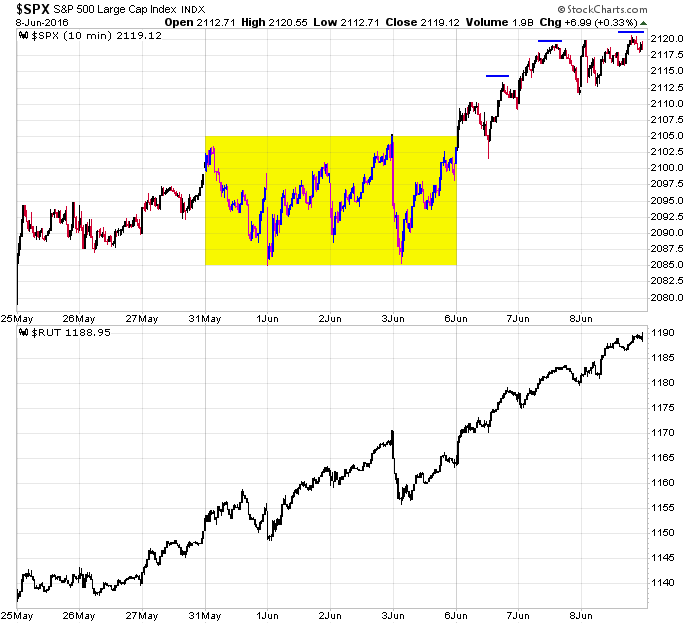

The market has been grinding up lately. No energy. Very little volume. Small ranges. Yet day after day the indexes continue posting higher high after higher high. As of yesterday’s close, the S&P was within 15 points of its all-time high (it’s already there if you include dividends).

Here are the intraday SPX and RUT charts. A range last week for the S&P has been followed by higher highs every day this week so far. The Russell, on the other hand, has simply trended up – almost uninterruptedly.

The market will let out a little air at today’s open. The bulls have a huge buffer to work with, so a weak open or even a weak couple days on the heels of solid gains over the last month month are nothing to be worried about. But we still have to manage positions wisely.

If today is a ho-hum down day, my guess is the market does very little until the Fed meeting next week. Odds did not favor the market breaking out ahead of the FOME anyways. More after the open.

Stock headlines from barchart.com…

Comtech Telecommunications (CMTL -1.36%) lowered guidance on fiscal 2016 revenue to $425 million-$435 million from a March 10 estimate of $435 million-$445 million.

US Concrete (USCR +2.47%) was rated a new ‘Buy’ at DA Davidson with an 18-month target price of $80.

SolarCity (SCTY -0.94%) rose over 3% in pre-market trading after it was upgraded to ‘Outperform’ from ‘Neutral’ at Baird.

Boston Scientific (BSX +0.75%) was rated a new ‘Buy’ at Guggenheim Securities with a 12-month price target of $26.

Chesapeake Energy (CHK +6.42%) tumbled over 4% in pre-market trading after it was downgraded to ‘Underperform’ from ‘Sector Perform’ at RBC Capital Markets.

Fitbit (FIT -1.47%) was rated a new ‘Outperform’ at Wedbush with a 12-month price target of $18.

Stryker (SYK +1.51%) was rated a new ‘Buy’ at Guggenheim Securities with a 12-month price target of $134.

LinkedIn (LNKD +0.11%) climbed nearly 2% in pre-market trading after it was upgraded to ‘Outperform’ from ‘Sector Perform’ at RBC Capital Markets with a target price of $160.

Restoration Hardware Holdings (RH +1.95%) plunged over 20% in pre-market trading after it reported an unexpected Q1 adjusted EPS loss of -5 cents, weaker than consensus of a 5 cent gain, and then cut its full-year adjusted EPS forecast to $1.60-$1.80, well below consensus of $2.66,

ABM Industries (ABM +1.52%) gained over 3% in after-hours trading after it reported Q2 adjusted EPS continuing operations of 31 cents, higher than consensus of 27 cents.

Tesco (TESO +2.33%) slid over 3% in after-hours trading after it announced a public offering of 7 million shares of common stock.

Envision Healthcare (EVHC +1.66%) rose over 3% in after-hours trading after Dow Jones reported that the company was in merger talks with Amsung.

Team Health Holdings (TMH -0.10%) tumbled over 9% in after-hours trading after Dow Jones reported that a deal between AmSung, who was rumored to merge with Team Health, was said to be close to a deal to merge with Envision Healthcare.

Brinker International (EAT +1.58%) jumped 6% in after-hours trading after it said it sees fiscal 2017 comparable sales up +0.5% to +2.0%.

Wednesday’s Key Earnings

Lululemon (NASDAQ:LULU) +4.9% increasing comparable-store sales.

Today’s Economic Calendar

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Wholesale Trade

10:30 EIA Natural Gas Inventory

1:00 PM Results of $12B, 30-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Jun 9)”

Leave a Reply

You must be logged in to post a comment.

Europe is a mess of bad policy and sick banks. Caution says a serious standoff between DRAGHI and the EU governments could blow into a storm which unhorses the Fed and the US markets {oh yes, EU too}. Now 89% cash and bonds. stops for etfs and shares. Shorts for ETFs and stocks if you must. Shortly shorts!!!