Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Japan, India, South Korea and Taiwan did the best. Europe is currently mostly up. London, Norway, Sweden, Turkey, Denmark, Finland, Spain and Portugal are up more than 1%. Futures here in the States point towards a flat open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil and copper are down. Gold and silver are up. Bonds are up.

The movement this week has triggered some stats that have either never happened or rarely happens.

The VIX has dropped 39.3% the last four days. Since 1990, this is the largest 4-day drop. The VIX is now well-below where it was just prior to the Brexit vote.

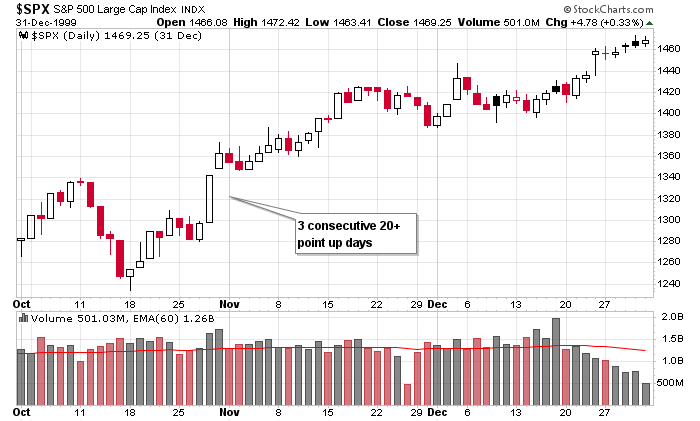

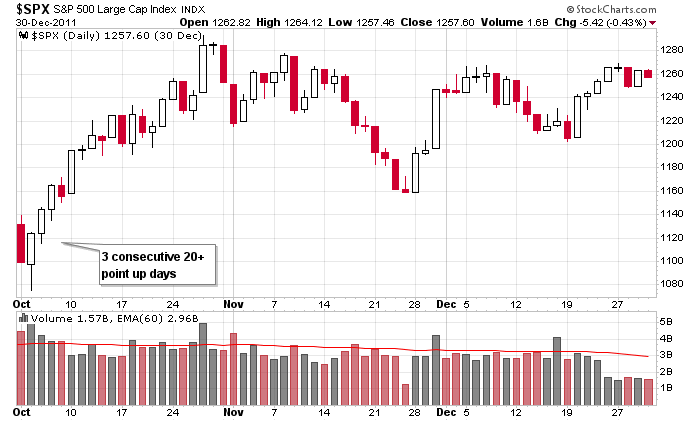

According to Victor Neiderhoffer, the S&P has posted 3 straight 20+ point up days for only third time. The first two were October 1999 and October 2011. Here are charts of those instances, so you can see what happened in the weeks and months after.

The big move down changed the structure of the charts, but the quick snap-back has put the market right back where it was. The internals still need to improve, and charts of key stocks also have some work to do. But for the bears who were salivating at the market finally falling…well, sorry, you’re probably going to lose again. Absent additional countries leaving the EU, the market is going up to new highs and beyond. It’s not necessarily going to happen right now, but it’s going to happen.

On another note, I remain long gold and silver. They’ve been my favorite groups for a while. This is why half the Long List is gold and silver stocks and why I’ve posted so many on the Message Board. The trend of these groups is super strong. Dips continue to be buyable.

The market is closed Monday. Enjoy your 3-day weekend.

Stock headlines from barchart.com…

Micron Technology (MU +4.32%) slumped over 9% in pre-market trading after it reported Q3 net sales of $2.90 billion, below consensus of $2.96 billion, and forecast Q4 revenue of $2.9 billion-$3.2 billion, less than consensus of $3.21 billion.

SolarCity (SCTY -1.48%) was downgraded to ‘Neutral’ from ‘Ourperform’ at Credit Suisse with a target price of $27.

Concern Pharmaceuticals (CNCE -0.53%) was rated a new ‘Buy’ at Stifel with a 12-month price target of $23.

Preferred Bank/Los Angeles (PFBC +0.49%) was rated a new ‘Outperform’ at FBR Capital Markets with a 12-month price target of $37.

Skyworks Solutions (SWKS +2.51%) was downgraded to ‘Neutral’ rom ‘Buy’ at Mizuho Securities with a 12-month price target of $68.

Huntington Ingalls Industries (HII +2.18%) won a $272.5 million contract from the U.S. Navy to build the LHA 8, a large-deck amphibious assault warship.

Netflix (NFLX +0.46%) rose over 3% in after-hours trading after 7Park had positive comments on Netflix Q2 international subscribers.

Tesla (TSLA +0.99%) fell over 2% in after-hours trading after the U.S. National Highway Safety Administration (NHTSA) said it opened an investigation into a fatal crash involving a Tesla Model S sedan when the ‘Autopilot’ feature was engaged.

Mobileye (MBLY +9.96%) dropped over 4% in after-hours trading after the NHTSA said it opened a preliminary investigation into a fatal crash involving a Tesla car using Mobileye’s ‘Autopilot’ feature.

Wingstop (WING -0.18%) gained over 3% in after-hours trading after it set a $2.90 special dividend and closed on a new $180 million senior secured debt facility.

Franklin Covey (FC +5.87%) tumbled 12% in after-hours trading after it reported an unexpected -7 cent Q3 EPS loss, much weaker than consensus for a 7 cent gain.

Array BioPharma (ARRY +2.01%) climbed over 5% in after-hours trading after it submitted an application to the FDA for approval for its bibimetinib in patients with advanced NRAS-mutant melanoma.

Thursday’s Key Earnings

ConAgra Foods (NYSE:CAG) +0.4% following in-line earnings.

Micron (NASDAQ:MU) -8.9% AH on another sales decline.

Today’s Economic Calendar

Auto Sales

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

11:00 Fed’s Mester: Economic Outlook and Monetary Policy

1:00 PM Baker-Hughes Rig Count

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Jul 1)”

Leave a Reply

You must be logged in to post a comment.

Nice work