Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the upside. Indonesia rallied 1.4%; Singapore and Hong Kong also did well. Japan and China lost ground. Europe is currently mostly up. Germany is up more than 1%; France, Austria, the Czech Republic, Greece, Denmark, Finland and Switzerland are doing well too. Russia is down. Futures in the States point towards a positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is flat. Oil is flat; copper is down. Gold and silver are down. Bonds are down.

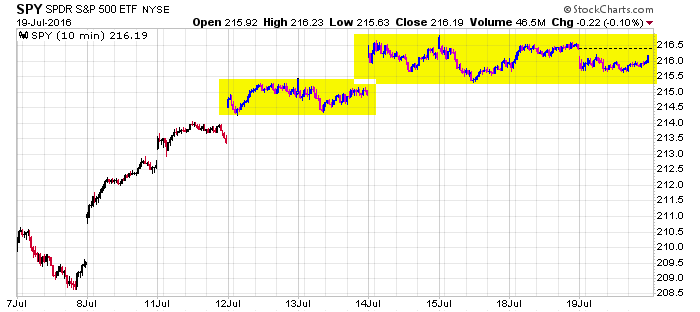

Here’s a 5-min SPY chart that shows what’s taken place the last nine days. Other than the trend day on July 8, the market has spent most of its time trading in tight ranges, and most of the gains have taken place in the form of gap ups. If you’ve been long the whole time, you’re up nicely. But there have been few opportunities to buy an index ETF intraday.

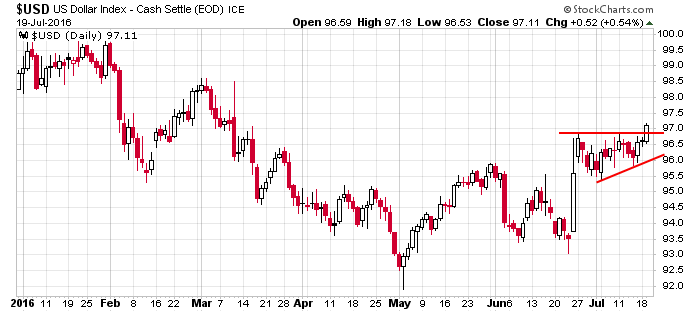

Yesterday the dollar broke out from a little ascending triangle pattern. A stronger dollar effectively acts as a rate increase, so the higher the dollar goes, the lower the odds the Fed raises rates this year.

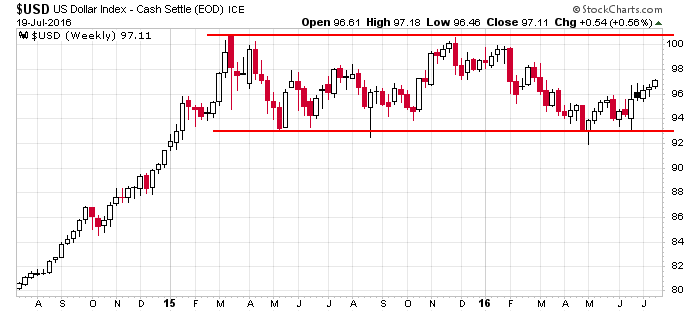

Backing up the dollar chart…the currency has spent all of 2015 and 2016 in an 8-dollar range, and right now it sits smack in the middle of the range. Despite what’s taking place in the near term, the big picture remains neutral. If we get a big breakout and rally, everything changes.

Earnings season is front and center. Netflix got hit hard yesterday. Microsoft is up nicely this morning. You know the risks. More after the open.

Stock headlines from barchart.com…

Microsoft (MSFT -1.61%) rallied over 4% in pre-market trading after it reported Q4 adjusted EPS of 69 cents, higher than consensus of 58 cents.

Morgan Stanley (MS -0.07%) is up over 3% in pre-market trading after it reported Q2 EPS of 75 cnts, above consensus of 60 cents.

Verizon Communucations (VZ -0.41%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Oppenheimer.

Hyatt Hotels (H -1.29%) was downgraded to ‘Sell’ from ‘Hold’ at Evercore ISI with a 12-month target price of $44.

Intuitive Surgical (ISRG +0.20%) jumped over 6% in after-hours trading after it reported Q2 adjusted EPS of $5.62, well above consensus of $4.98.

Ebay (EBAY +0.04%) gained +0.3% in after-hours trading after it reported June sale up +3.8% y/y, above the +2.8% /y increase in May.

Cintas (CTAS -0.24%) climbed over 3% in after-hours trading after it reported Q4 adjusted EPC continuing operations of $1.08, above consensus of $1.01, and said it sees full-year EPS continuing operations of $4.35-$4.45 higher than consensus of $4.28.

Discover Financial Services (DFS -0.19%) dropped over 2% in after-hours trading after it reported Q2 net revenue of $2.22 billion, below consensus of $2.23 billion.

Ryerson Holding (RYI -16.19%) lost over 1% in after-hours trading after it priced a secondary offering of 5 million shares.

Manhattan Associated (MANH -1.75%) rose over 2% in after-hours trading after it reported Q2 adjusted EPS of 49 cents, above consensus of 44 cents, and then raised guidance on full-year adjusted EPS to $1.78-$1.81 from a prior view of $1.73-$1.76.

Sarepta Therapeutics (SRPT +0.91%) fell 2% in after-hours trading after it reported a Q2 EPS loss of -$1.35, a bigger loss than consensus of -$1.23.

Marvell Technology Group (MRVL -2.28%) gained over 1% in after-hours trading after it reported Q4 adjusted EPS of 11 cents, better than consensus of 10 cents.

Interactive Brokers Group (IBKR +1.03%) slid nearly 3% in after-hours trading after it reported Q2 net revenue of $369 million, below consensus of $377.3 million.

Blackhawk Network Holdings (HAWK +1.82%) climbed over 5% in after-hours trading after it reported Q2 adjusted EPS of 37 cents, better than consensus of 26 cents, and then raised guidance on full-year adjusted EPS to $2.47-$2.66, higher than a prior view of $2.44-$2.63.

Zafgen (ZFGN +1.05%) plunged -39% in after-hours trading after it said it will stop all development on its lead obesity drug, beloranib, after two patients died in a clinical trial.

Tuesday’s Key Earnings

Johnson & Johnson (NYSE:JNJ) +1.7% lifting its profit forecast.

Goldman Sachs (NYSE:GS) -1.2% as conditions “remained challenging.”

Lockheed Martin (NYSE:LMT) +1% raising its guidance for 2016.

Microsoft (NASDAQ:MSFT) +4.1% AH after cloud sales doubled.

Philip Morris (NYSE:PM) -3% on lower shipment volumes.

UnitedHealth (NYSE:UNH) +1.3% following health-services growth.

United Continental (NYSE:UAL) +1.2% AH after topping expectations.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

10:30 EIA Petroleum Inventories

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

5 thoughts on “Before the Open (Jul 20)”

Leave a Reply

You must be logged in to post a comment.

IMF Scraps Forecast for Global-Growth Pickup on Brexit Fallout. If Bloomberg admits a hit of 2.4% globally, it is probable that it can much worse/better. The US markets could stay up, but

could also slide down. Trust is not merited given history. Earnings this week make things look better. BUT I use still use STOPs ISRG did well Tuesday, and I sold out.

indesision –the bears are ready

how about we say a target of zero–no one will beleive that

i would like to see the bears show up for a change..not these small down days..something with teeth..

helicopter money coming in. There will be no downfall.

volume is pathetic…