Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Japan and Singapore dropped more than 1%; Australia and South Korea were also weak. China did well. Europe is currently mostly down. Greece and Spain are down more than 2%; Germany, France, Belgium, the Netherlands, Sweden, Russia, Denmark and Italy are down more than 1%. Poland is doing well. Futures in the States point towards a moderate gap down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are down.

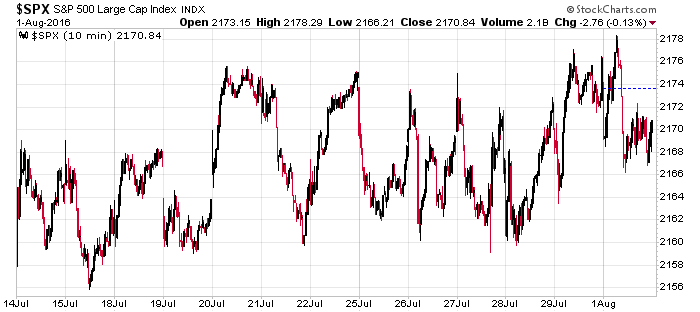

Here are the last 13 S&P days. The range expanded slightly up on Friday and then again today, but neither move motivated new buying.

This is an historically small period. The market trades range bound more often than it trends, but ranges tend to be much fatter and typically have several mini trends within the range. Not right now. Very little has gone on with the overall market lately – just mostly alternating up and down days and absolutely no follow through. Pretty amazing considering both major political parties had their conventions, and we’re in the heart of earnings season. Beneath the surface stuff is going on (there are always leading and lagging groups – it’s my job to find those – but on the surface it’s been pretty quiet. I highly doubt it stays like this much longer.

Stock headlines from barchart.com…

Buffalo Wild Wings (BWLD +1.21%) was downgraded to ‘Hold’ from ‘Buy’ at Maxim Group.

Frontier Communications (FTR -2.31%) slid over 3% in pre-market trading after it reported Q2 adjusted Ebitda of $1.03 billion, less than consensus of $1.05 billion.

Charter Communications (CHTR +0.48%) was rated a new ‘Buy’ at Bank of America/Merrill Lynch with a price target of $300.

Williams Cos. (WMB -6.01%) rallied over 4% in after-hours trading after the company cut its dividend to 20 cents a share from 64 cents and said it will reinvest $1.7 billion into Williams Partners through 2017 with the cash saved from the lower dividends.

Texas Roadhouse (TXRH +1.02%) dropped over 5% in after-hours trading after it reported Q2 franchise comps of +2.6%, below consensus of +3.7%.

FormFactor (FORM +0.53%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel with a 12-month target price of $13.

Tenet Healthcare (THC -5.55%) lost over 2% in after-hours trading after it reported Q2 adjusted EPS of 38 cents, weaker than consensus of 51 cents.

Chegg (CHGG +2.78%) climbed nearly 4% in after-hours trading after it reported Q2 adjusted EPS of 5 cents, better than consensus of 3 cents.

Trex Co. (TREX +0.82%) gained nearly 3% in after-hours trading after it reported Q2 EPS of 79 cents, higher than consensus of 71 cents.

Atwood Oceanics (ATW -3.65%) rose 3% in after-hours trading after it reported Q3 revenue of $227.8 million, above consensus of $225.2 million.

T2 Biosystems (TTOO +24.38%) slumped 9% in after-hours trading after it reported an Q2 EPS loss of -58 cents, wider than consensus of -56 cents

Amkor Technology (AMKR +2.54%) jumped 11% in after-hours trading after it reported an unexpected Q2 EPS profit of 2 cents, better than consensus for an -8 cent loss, and said it sees Q3 sales of $1.01 billion-$1.09 billion, higher than consensus of $936 million.

Cognex (CGNX +0.33%) surged 15% in after-hours trading after it reported Q2 EPS continuing operations of 50 cents, higher than consensus of 44 cents, and then said it sees Q3 revenue of $142 million-$147 million, above consensus of $127.6 million.

Monday’s Key Earnings

Williams Cos. (NYSE:WMB) +4.1% AH with plans to invest $1.7B into Williams Partners (NYSE:WPZ).

Today’s Economic Calendar

Auto Sales

6:15 PM Fed’s Kaplan: Monetary Policy

8:30 Personal Income and Outlays

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Aug 2)”

Leave a Reply

You must be logged in to post a comment.

Japan cabinet has approved a ¥28T ($274B) stimulus package amid a growing consensus that monetary policy alone won’t be able to revive the economy. Sounds familiar? Window dressing then a correction this month. Stops seem wise.