Good morning. Happy Thursday.

The Asian/Pacific markets closed up across-the-board, but gains were on the small side. Japan rallied more than 1%; Malaysia, Indonesia and Hong Kong also did well. Europe is currently up across-the-board. The UK, Germany, Austria, Belgium, the Netherlands, Norway, Russia, Greece, Poland, Turkey, Spain and Italy are up more than 1%. Futures in the States point towards a positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil is flat; copper is up. Gold is up; silver is down. Bonds are up.

For one day the market’s range expanded, and the S&P dropped below a short term support level. But it recaptured support yesterday, and at today’s open will follow through a little.

I’m seeing some improvement in individual charts. It’s one of the few things that has been missing. Despite the market’s overall trend, there haven’t been many good set ups to play. In the same way the S&P has mostly traded in ranges while spending very little time trending, individual stocks have been a sloppy mess. Perhaps this is changing. Let’s hope so.

Oil posted its biggest up day in almost four weeks yesterday. By itself it doesn’t mean much, but because it took place at a couple key levels, it’s at least notable.

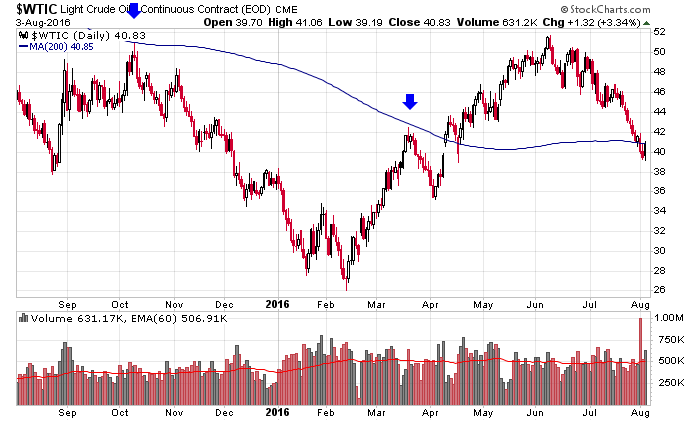

Oil is trying to recapture its 200-day moving average.

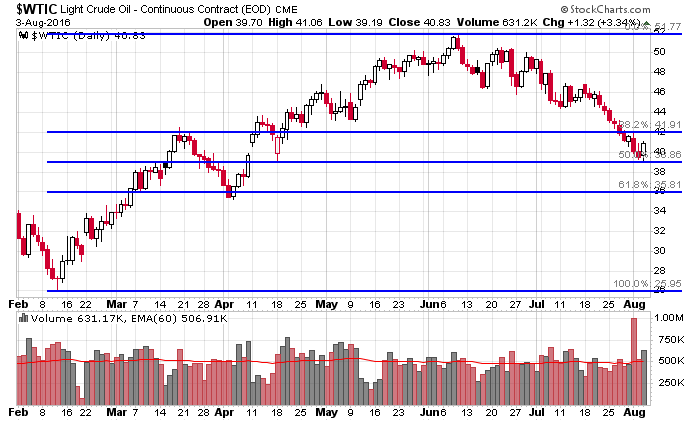

Which happens to also be the 50% pullback of the rally off its February bottom.

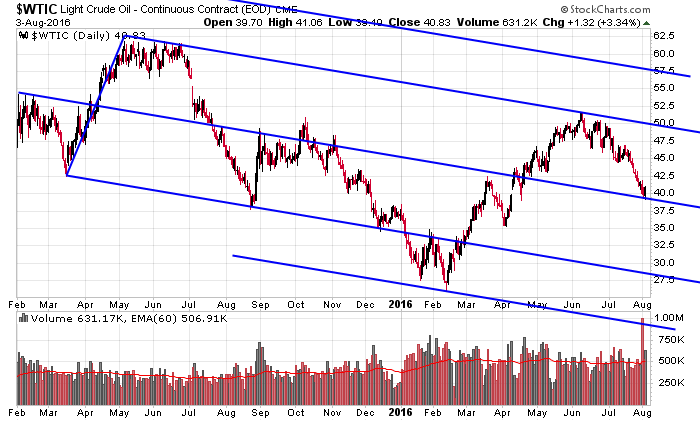

Which happens to also be at the median line of this pitch fork set which has done a good job describing the action the last 18 months.

It would be a great boost to the market if oil could leg up at the same time the S&P decided to attempt a breakout…but there are no guarantees. More after the open.

Stock headlines from barchart.com…

Transocean Ltd. (RIG +3.98%) gained nearly 2% in after-hours trading after it reported an unexpected Q2 adjusted EPS profit of 17 cents, higher than consensus of a -2 cent loss.

Prudential Financial (PRU +2.95%) dropped over 2% in after-hours trading after it reported Q2 operating EPS of $1.84, well below consensus of $2.50,

XPO Logistics (XPO +0.87%) jumped over 10% in after-hours trading after it reported Q2 adjusted EPS of 42 cents, well above consensus of 22 cents, and then raised its full-year adjusted Ebitda view to at least $1.265 billion from a July 18 view of $1.25 billion.

CF Industries Holdings (CF +0.12%) fell over 4% in after-hours trading after it reported Q2 net sales of $1.134 billion, below consensus of $1.139 billion.

Jack in the Box (JACK -0.89%) rallied almost 6% in pre-market trading after it raised guidance on full-year adjusted EPS to $3.65-$3.75 from a May 11 view of $3.50-$3.63.

Albemarle (ALB -0.45%) slid nearly 4% in after-hours trading after it reported Q2 adjusted Ebitda of $190.5 million, weaker than consensus of $237.5 million.

Square (SQ +3.88%) jumped over 15% in pre-market trading after it raised its 2016 adjusted Ebitda estimate to $18 million-$24 million from a prior view of $8 million-$14 million.

TripAdvisor (TRIP +0.12%) lost nearly 8% in after-hours trading after it reported Q2 adjusted EPS of 38 cents, below consensus of 42 cents,

GoDaddy (GDDY -3.51%) rose nearly 8% in after-hours trading after it hiked its 2016 revenue estimate to $1.84 billion-$1.847 billion from a May 4 view of $1.83 billion-$1.845 billion.

Avid Technology (AVID +1.21%) climbed 8% in after-hours trading after it raised guidance on non-GAAP year revenue to $535 million-$565 million from a prior view of $500 million-$525 million.

Genpact Ltd. (G +0.15%) lost 2% in after-hours trading after it lowered its 2016 revenue estimate to $2.59 billion-$2.62 billion from a May 5 estimate of $2.62 billion-$2.66 billion.

AxoGen (AXGN +7.32%) rallied 10% in after-hours trading after it reported a Q2 loss of -9 cents, a smaller loss than consensus of -12 cents.

Insulet (PODD +0.42%) jumped 8% in after-hours trading after it boosted its full-year revenue estimate to $345 million-$355 million from a May 3 view of $330 million-$350 million.

Teladoc (TDOC -1.17%) plunged over 25% in after-hours trading after it said it sees a full-year loss per share between $1.47-$1.52, a wider loss than consensus of -$1.25.

Tuesday’s Key Earnings

Annaly Capital (NYSE:NLY) -1.1% AH reporting in-line earnings.

Herbalife (NYSE:HLF) +1.7% AH raising full-year guidance.

Square (NYSE:SQ) +14% AH on a narrower-than-expected loss.

Tesla (TSLA) -1% AH following its 13th straight quarterly loss.

Time Warner (NYSE:TWX) +2.7% on Q2 beat, Hulu stake.

Transocean (NYSE:RIG) +1.4% AH after cutting operating costs.

Twenty-First Century Fox (NASDAQ:FOX) -3.3% AH as revenue fell short.

Today’s Economic Calendar

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Gallup Good Jobs Rate

9:45 Bloomberg Consumer Comfort Index

10:00 Factory Orders

10:30 EIA Natural Gas Inventory

4:30 Money Supply

4:30 Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers