Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Japan and New Zealand dropped more than 1%; China and Taiwan were also weak. Indonesia and Malaysia did well. Europe is currently mostly down. There were no big losers, but Germany, France, Belgium, the Netherlands, Sweden, Switzerland, Denmark, Finland, Spain, Italy and Portugal were all weak. Futures in the States point towards a down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down a full 1%. Oil and copper are up. Gold and silver are up. Bonds are up.

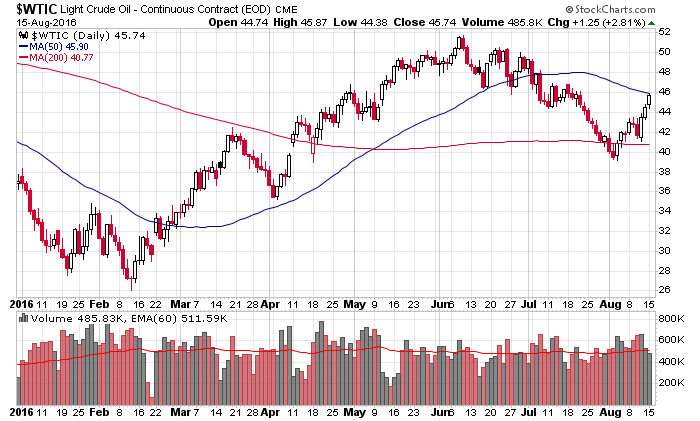

Two weeks ago I talked about oil being in a zone that could attract buyers. Crude was in the process of reclaiming its 200-day MA and was bouncing off its 50% retracement level and was bouncing off a median line set that had been describing the action. Here’s a link to that.

Now oil is bumping up against its 50-day MA – a moving average which has both supported and rejected price many times. It’s worth paying attention to if your long.

I’m mentioned some big names who are bearish the market. This is from Seeking Alpha: George Soros has become more bearish on equity markets, nearly doubling his short bet against the S&P 500, following similar moves by Jeffrey Gundlach, Carl Icahn and David Tepper. According to his 13F filing, Soros now holds put options on roughly 4M shares in SPY. He also lowered his gold holdings in Q2, slashing his stake in GLD by a quarter and almost liquidating his position in Barrick Gold (NYSE:ABX).

Every index put in a higher high yesterday. You can’t argue with the price movement, and even if we get an early-fall correction. I believe the weakness will get bought and new highs made again. And even if a top was being put in place, it’ll take time. There will be several up and down moves (while the internals deteriorate) that will allow us to get out of longs. Don’t fight the trend. More after the close.

Stock headlines from barchart.com…

JPMorgan Chase (JPM +0.61%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Bernstein.

PG&E (PCG -1.04%) slid 1% in after-hours trading after it started a 4.9 million-share offering.

Vipshop Holdings Ltd (VIPS +3.16%) gained 3% in after-hours trading after it reported Q2 net revenue of $2.02 billion, higher than consensus of $1.9 billion.

Praxair PX jumped nearly 7% in European trading after people familiar with the matter said the company has held talks on a possible merger with Linde AG.

Concho Resources (CXO +2.03%) fell nearly 2% in after-hours trading after it began an offering of 9.0 million shares to finance part of its purchase of land acquired in the Midland Basin from Reliance Energy.

Fabrinet (FN +4.21%) rallied over 4% in after-hours trading after it reported Q4 revenue of $276.4 million, above consensus of $262.8 million, and said it sees Q1 adjusted EPS of 70 cents-72 cents, higher than consensus of 60 cents.

Aratana Therapeutics (PETX -0.84%) rose 4% in after-hours trading after it said the U.S. FDA approved its Nocita as a local post-operative analgesia for cranial cruciate ligament surgery in dogs.

Shopify (SHOP -0.76%) lost 3% in after-hours trading after it said it will offer 7.5 million Class A subordinate voting shares.

Imprimis Pharmaceuticals (IMMY +0.78%) climbed over 2% in after-hours trading after it reported Q2 revenue of $4.91 million, above $4.38 million from Q1 and $1.97 million y/y.

Golub Capital BDC (GBDC +0.97%) fell nearly 3% in after-hours trading after it set a 1.75 million share secondary offering via Wells Fargo.

Hain Celestial Group (HAIN -3.52%) plunged 24% in pre-market trading after it said it will delay its Q4 and fiscal 2016 financial results as it evaluates whether revenue tied to concessions granted to certain U.S. distributors was accounted for in the correct period.

Asterias Biotherapeutics (AST +3.00%) jumped 9% in after-hours trading after it said it will expand the “SCiSTAR” study with two additional cohorts of 5-8 patients each with sensory incomplete injuries.

Monday’s Key Earnings

Sysco (NYSE:SYY) unchanged after mixed results.

Today’s Economic Calendar

8:30 Consumer Price Index

8:30 Housing Starts

8:55 Redbook Chain Store Sales

9:15 Industrial Production

10:00 E-Commerce Retail Sales

12:30 PM Fed’s Lockhart speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

6 thoughts on “Before the Open (Aug 16)”

Leave a Reply

You must be logged in to post a comment.

PSI and housing suggest nothing is happening and the Fed does not care… yet. They have a difference in opinion about what is needed. Today little to do, except to try to push the indices up again on no volume. The Hang Sang is looking bearish today as the Chicoms ponder IPOs . Nothing to it today, take a sun bath and make a few plans. Frankly I am concerned that no one is driving the economy. I am not.

i just paid for a trip to Italy, does that count?

expect a pull back of at least 10%

But after Labor Day.

how has Neal been

for once i agree with you

but labour day ,trump to short the markets with his billions $

but their is still a chance of a smaller pull back and a pop higher

support spx 2170 and 2140

but all i want is volitility

still holding yesterdays world shorts,but momentum is still to the down today

one gap is filled…the others are at 2175,2165,2140,2130,2098,2035 and 2004

Soros, Druckenmiller and Icahn are the new NY cab drivers handing out stock market tips.