Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed mixed; gains and losses were small to moderate. Japan, Singapore and Australia moved up; Indonesia and Taiwan moved down. Europe is currently mostly down. Italy is down more than 2%; Spain and France are down more than 1%; Germany, Austria, Belgium, the Netherlands, Switzerland, Greece, Poland, Finland and Sweden are down moderately. Futures in the States point towards a moderate gap down open for the cash market.

—————

List of Indexes and ETFs – here

—————

The dollar is up. Oil and copper are down. Gold and silver are down. Bonds are down.

Despite 3 of 4 up days this week, the S&P is only up 3 points since last Friday’s close, and after today’s open the index will be posting a loss on the week.

Whether the market closes up or down today or for the week doesn’t matter. A 5% correction wouldn’t end the overall uptrend.

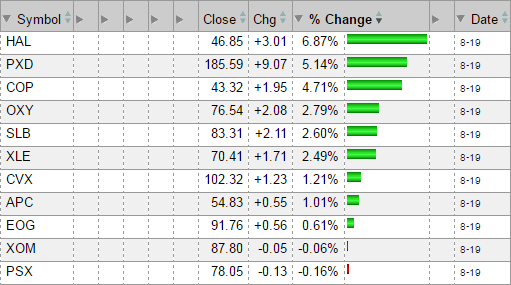

Here’s the monthly XLE chart I’ve been posting. It’s being scooped up by its 10-month MA and just traded through resistance. Even if the stock continues to make higher highs and high lows instead of surging upward, I’ll consider the newly formed trend to be up as long as the moving average continues to act as support.

We’ve had a handful of good plays from the oil group lately. Too bad crude rallied virtually uninterruptedly the last couple weeks; we would have had more.

It’s Friday. Other than a little extra chatter about rates, there isn’t much going on. Only trade the good ones. Don’t force things. More after the open.

Stock headlines from barchart.com…

U.S. Steel (X +1.49%) was downgraded to ‘Underweight’ from ‘Sector Weight’ at Keyblanc Capital Markets.

Thor Industries (THO +2.40%) was downgraded to ‘Hold’ from ‘Buy’ at Wunderlich Securities.

Allergan Plc (AGN -0.15%) was upgraded to ‘Buy’ from ‘Neutral’ at Mizuho Securities with a 12-month target price of $318.

Hormel Foods (HRL +1.90%) was upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital Markets.

Applied Materials (AMAT +1.43%) jumped over 5% in pre-market trading after it reported Q3 adjusted EPS of 50 cents, better than consensus of 48 cents, and said it sees Q4 adjusted EPS of 61 cents-69 cents, well above consensus of 48 cents.

Ross Stores (ROST +0.93%) climbed 3% in after-hours trading after it reported Q2 EPS of 71 cents, above consensus of 67 cents, and then raised guidance on full-year EPS to $2.69-$2.75 from a prior view of $2.63-$2.72.

Square (SQ +3.07%) rose over 3% in pre-market trading after Point72 Asset Management disclosed a new 5.4% passive stake in the company, making it the third largest shareholder.

The GAP (GPS +1.65%) lost almost 1% in after-hours trading after it said it sees 2016 EPS of $1.87-$1.92, below consensus of $1.94.

Pentair PLC (PNR -0.09%) gained over 1% in after-hours trading after it said its sold its valves & controls business to Emerson for $3.15 billion.

Mentor Graphics (MENT +1.65%) surged 13% in after-hours trading after it reported Q2 adjusted EPS of 15 cents, higher than consensus of 9 cents.

Forex Capital Markets LLC (FXCM +2.61%) tumbled nearly 10% in after-hours trading after the CFTC charged the company with undercapitalization and failure to timely report its undercapitalization violation.

Corrections Corp of America (CXW -35.45%) jumped over 6% in after-hours trading after it said the inspector general’s report on private prisons contains “significant flaws” and that the findings don’t match up with “numerous independent studies.” GEO Group (GEO -39.58%) also rallied 5% on the news.

New York & Co. (NWY +3.54%) surged over 20% in after-hours trading after it reported Q2 net sales of $232.8 million, better than consensus of $227.0 million.

Wednesday’s Key Earnings

Canadian Solar (NASDAQ:CSIQ) +17.5% blowing through estimates.

Gap (NYSE:GPS) -1.9% AH giving a weak full-year outlook.

Wal-Mart (NYSE:WMT) +1.9% boosting operating income.

Today’s Economic Calendar

1:00 PM Baker-Hughes Rig Count

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Aug 19)”

Leave a Reply

You must be logged in to post a comment.

After an historic “debt binge,” leverage among US corporations has reached “record highs,” S&P warns, and now they may be even more vulnerable to defaults than before the Great Recession. S&P Comments AUG2016 Go slow, the termites have been at work this year

be a thrill seeker,—become a daytrader

good clear moves lately even with small range