Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. New Zealand and Taiwan did well; Japan posted the biggest loss. No other market moved much from its unchanged level. Europe currently leans to the upside. Italy is up more than 1%; Austria, the Netherlands, Norway, Sweden, Russia, Poland, Finland and Spain are also doing well. Greece and Turkey are weak. Futures in the States are mixed (S&P up, Nas down).

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down a small amount. Oil is flat; copper is up. Gold and silver are down. Bonds are up.

After a weak opening 30 minutes yesterday the market did well. Most of the indexes closed near their highs and in positive territory. The S&P is once again not far from its all-time high. It wouldn’t take much to push through.

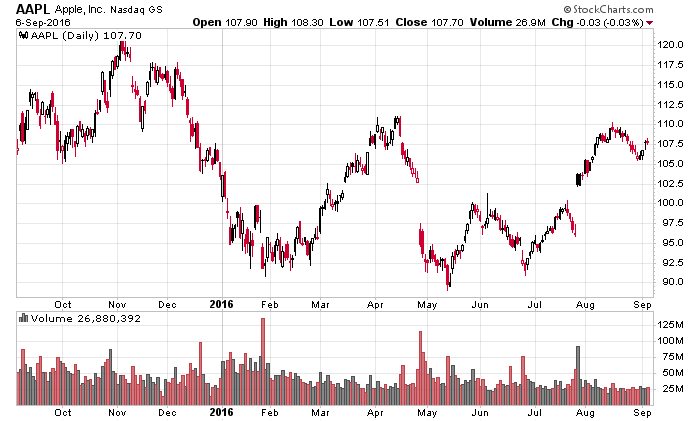

Big day for Apple today. It has an event in San Francisco where it’s expected to talk about the iPhone 7, among other things. Here’s AAPL. It’s flat and trendless over the last year.

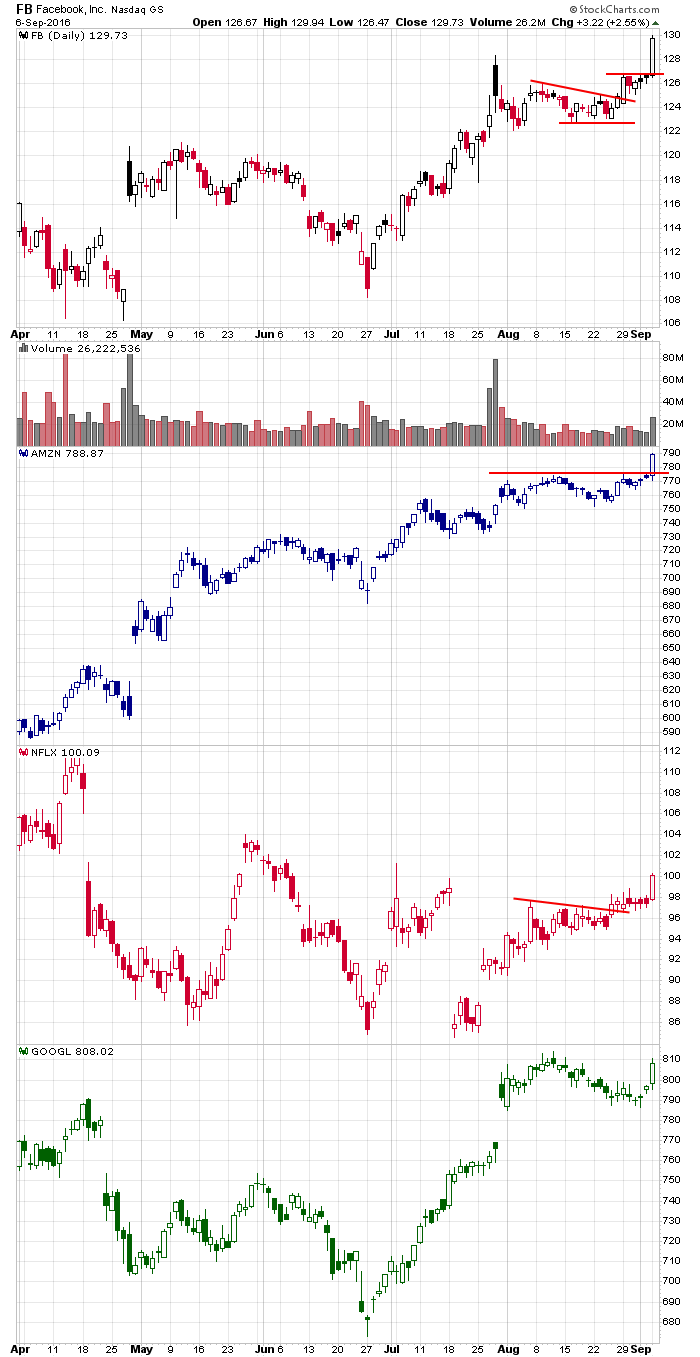

Other big cap tech stocks did great yesterday. Facebook, Amazon, Netflix and Google all enjoyed solid days. FB and AMZN are at all-time highs; GOOGL isn’t far behind. The leaders are leading. It bodes well going forward. Can AAPL play catch up?

The market can “wake up” at any time. Have a plan and be ready. More after the open.

Stock headlines from barchart.com…

Royal Caribbean Cruises Ltd. (RCL -1.33%) was downgraded to ‘Hold’ from ‘Buy’ at Argus

Casey’s General Stores (CASY +0.02%) dropped nearly 9% in after-hours trading after it reported Q1 EPS of $1.70, below consensus of $1.81.

Valeant Pharmaceuticals (VRX +2.47%) climbed 2% and Progenics (PGNX +3.36%) jumped nearly 4% in after-hours trading after the companies said the drug Relistor for treatment of opioid-induced constipation is now available for prescribing in the U.S.

Intersil (ISIL -2.23%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel with a 12-month price target of $21.

Catalent (CTLT +0.16%) lost over 7% in after-hours trading after it announced a 19-million share secondary offering.

Advanced Micro Devices (AMD -2.26%) dropped 4% in after-hours trading after it filed to sell $600 million in stock and $450 million of convertible notes to repay debt.

Sigma Designs (SIGM +8.07%) gained 3% in after-hours trading after it reported Q2 adjusted EPS of 7 cents, well above consensus of 2 cents.

Ollie’s Bargain Outlet Holdings (OLLI -0.98%) fell nearly 3% in after-hours trading after it started a secondary offering of 13.7 million shares.

HealthEquity (HQY +0.92%) rose nearly 3% in after-hours trading after it reported Q2 adjusted EPS of 16 cents, higher than consensus of 13 cents, and then raised its full-year revenue estimate to $174 million-$178 million from a prior view of $173 million-$177 million

Dave & Buster’s Entertainment (PLAY -0.71%) slid 7% in after-hours trading after it cut its full-year comparable sales estimate to 2.25%-3.25% from a June 7 estimate of 3.25%-4.25%.

Momenta Pharmaceuticals (MNTA -0.57%) ws downgraded to ‘Sell’ from ‘Hold’ at Maxim Group.

Applied Optoelectronics (AAOI -0.57%) surged 23% in after-hours trading after it raised its Q3 revenue forecast to $63 million-$65 million from an Aug 5 estimate of $56 million-$59 million,

Tuesday’s Key Earnings

Marvell Technology (NASDAQ:MRVL) -0.5% on disappointing guidance.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 Gallup U.S. Job Creation Index

8:55 Redbook Chain Store Sales

9:45 PMI Services Index

10:00 Fed’s Esther and Lacker testify before the House Committee

10:00 Job Openings and Labor Turnover Survey

2:00 PM Fed’s Beige Book

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Sep 7)”

Leave a Reply

You must be logged in to post a comment.

Looks like the markets are slipping, a slow slide as the economy enters recession this month as a trend change arrives. No rate increase and Congress is confused about fiscal actions & budget. 2186 may be the top in SP. Notes, Bonds will fail This month, Sept 2016.

hal a loo ya

just waiting for german dax to roll over

and perhaps ftse for the dow

even the aussie shares trade in usa –adr’s

then of course is the currencies

best potential short IMO

japan n225 niki

volitility to pick up