Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Indonesia rallied more than 2%; Hong Kong also did well. Japan dropped more than 1%; Malaysia was also weak. Europe currently leans to the downside. Turkey is down 1%; Norway, Russia, Greece and Italy are also weak. The UK is doing well. Futures in the States point towards a moderate gap up open for the cash market.

—————

My podcast – with Chat With Traders

—————

The dollar is flat. Oil is up; copper is down. Gold is flat; silver is up a small amount. Bonds are down.

This is what I said in yesterday’s PM Obs…

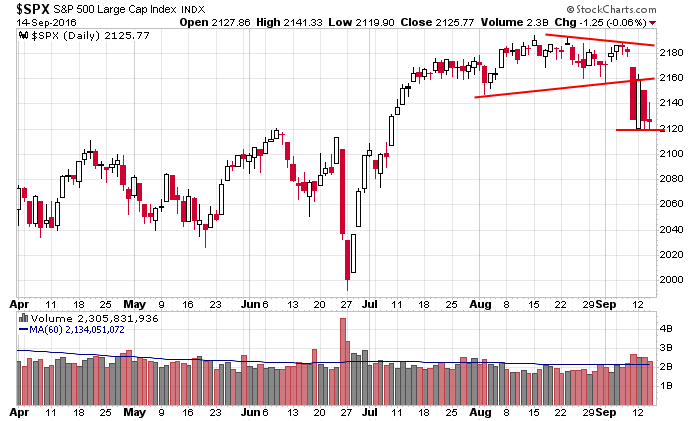

Here’s the S&P daily. Support has been established at 2120. My gut feel says up from here. Pin the market near the low and then surprise everyone with an up day tomorrow and follow through Friday. This is purely a gut feel and has no basis in statistics or any other analysis tool.

I still get the same feeling, so after today’s opening gap up, I think FH (first hour) weakness is likely to get bought.

Options expire tomorrow. And it’s not just regular stock options, it’s triple witching.

Don’t be a hero out there. Day traders can do their thing, but swing traders, those who depend on trends and steady, predictable movement, should take on much less risk right now. Just my opinion.

Stock headlines from barchart.com…

Transocean Ltd. (RIG -2.04%) was upgraded to ‘Hold’ from ‘Sell’ at Canaccord Genuity.

Autodesk (ADSK -0.41%) was rated a new ‘Buy’ at Evercore ISI with a 12-month target price of $80.

Symantec (SYMC -0.45%) was rated a new ‘Buy’ at Guggenheim Securities with a 12-month target price of $30.

PayPal Holdings (PYPL +0.25%) was rated a new ‘Buy’ at Craig-Hallum with a 12-month target price of $52.

Nabors Industries Ltd. (NBR -0.75%) was rated a new ‘Buy’ at DA Davidson with an 18-month target price of $16.

Gamco reported that it increased its stake in Herc Holdings (HRI +1.29%) to 10.3% from 9.0%.

Clarcor (CLC -0.50%) lowered guidance on fiscal 2016 adjusted EPS to $2.57-$2.63 from a prior view of $2.60-$2.80.

Apogee Enterprises (APOG +3.71%) gained over 6% in after-hours trading after it raised guidance on fiscal 2017 EPS to $2.80-$2.90 from a June 22 estimate of $2.70-$2.85.

Helmerich & Payne (HP +0.17%) was rated a new ‘Buy’ at DA Davidson with an 18-month price target of $72.

Star Bulk Carriers (SBLK unch) slid 4% in after-hours trading after it announced a $51.5 million public offering of common stock.

Acacia Research (ACTG -2.57%) rallied over 15% in after-hours trading after it won a $22 million judgement against Apple in a patent litigation case, according to Perdix Capital.

Lakeland Industries (LAKE -0.73%) climbed nearly 10% in after-hours trading after it authorized a $2.5 million stock repurchase program.

Student Transportation (STB +1.29%) climbed over 5% in after-hours trading after it reported Q4 EPS of 7 cents, above consensus of 6 cents.

Aerie Pharmaceuticals (AERI +7.53%) surged 60% in after-hours trading after it reported positive results in its “Mercury 1” clinical trial for its Roclatan drug for lowering fluid pressure inside the human eyeball.

Today’s Economic Calendar

8:30 Initial Jobless Claims

8:30 Producer Price Index

8:30 Retail Sales

8:30 Philly Fed Business Outlook

8:30 Empire State Mfg Survey

8:30 Current Account

9:15 Industrial Production

9:45 Bloomberg Consumer Comfort Index

10:00 Business Inventories

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

4 thoughts on “Before the Open (Sep 15)”

Leave a Reply

You must be logged in to post a comment.

Still in fertilizers Pot/Augr.

This year’s best-performing sectors in the S&P 500: SPY -0.06%…. are telecommunications, with a total return of 14.9%, and utilities, at 13%.. So stock picking matters. Why the up opening???

high-dividend, low-risk, low-growth value stocks like telecoms and utilities look like stocks, but they are talk and walk like bonds. we can see this by observing that TLT is also up by more than 10% this year, commensurate with utilities and telecoms. when yields go down, high-dividend stocks and bonds rally. period.

there was a little false break low at 2115 spx and a reversal in after hour futurs in asian trading

bears sell rallies