Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mixed. China rallied 1.5% while South Korea fell 0.7%. Japan, Hong Kong and Taiwan were closed. Europe is currently up across-the-board. Greece is up more than 1%; Germany, France, the Netherlands, Norway, Poland and Italy are also doing well. Futures in the States point towards a moderate gap up open for the cash market.

—————

LB Weekly – the indexes, the breadth indicators, a look at the big picture

—————

The dollar is up. Oil and copper are up. Gold and silver are up. Bonds are down.

Here’s a link to the LB Weekly. My conclusion was that there’s nothing going on. The S&P is trading in a tiny 3-week range, inside a bigger range. In the near term the breadth indicators have weakened, but overall I’m still encouraged by what I see. Swing for singles and doubles until volatility comes back.

Federal Reserve Vice Chairman Stanley Fischer made some dovish comments over the weekend regarding rates. He said there’s little risk the Fed waits too long to raise rates. Besides S&P futures being up 10 points this morning, gold is up 10 bucks – a big relief move coming off a huge down week.

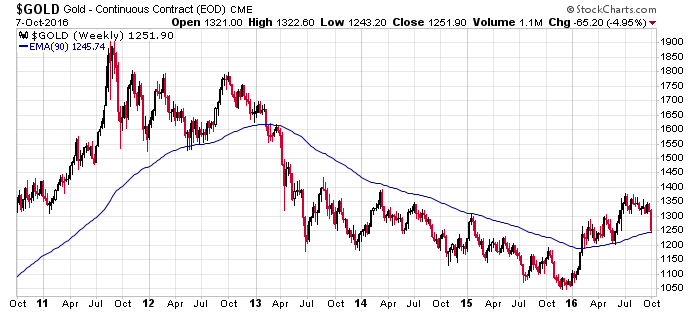

Here’s my weekly gold chart with the 90-week EMA. As you can see, with Friday’s close, within a few bucks, is important. A 10-dollar gap up today gives the bulls a little breathing room.

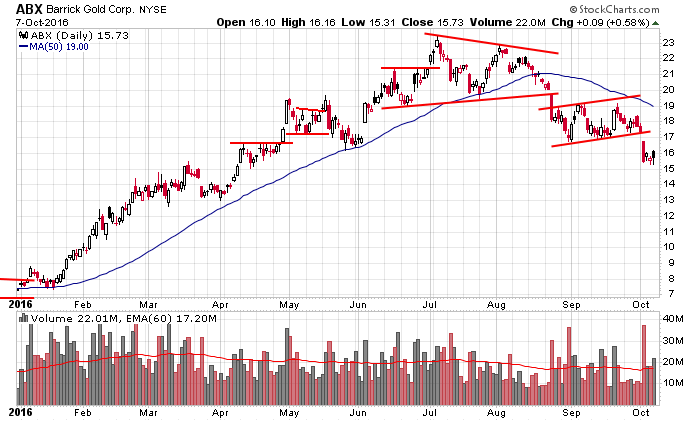

But many of the stocks look like this ABX chart. The stock rode its 50-day MA up…took out the moving average and support…consolidated and then broke down in a big way last week. This is bearish, and until ABX and other gold & silver stocks that are in the same boat can stabilize themselves above their 50’s, rallies should be used as selling opportunities.

Can the market wake up this week? We’ll see. More after the open.

Stock headlines from barchart.com…

Mylan (NV) jumped over 10% in pre-market trading after it agreed to a $465 million settlement with the U.S. Department of Justice and other government agencies to resolve questions about classification of EpiPen for the Medicaid Drug Rebate program.

Sherwin-Williams (SHW -1.94%) was upgraded to ‘Buy’ from ‘Hold’ at Argus Research.

Under Armour (UA -0.11%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo.

Mattel (MAT -1.44%) was upgraded to ‘Buy’ from ‘Neutral’ at MKM Partners with a 12-month target price of $36.

Twitter (TWTR -0.10%) dropped nearly 7% in pre-market trading after people familiar with the matter said top bidders have lost interest in bidding for Twitter.

American Eagle Outfitters (AEO +0.98%) was upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital Markets with a target price of $21.

CVR Energy (CVI -1.48%) was upgraded to ‘Neutral’ from ‘Underweight’ at Piper Jaffray.

Oil-Dri Corp of America (ODC -0.61%) reported Q4 EPS of 72 cents versus 71 cents y/y with Q4 revenue of $64.91 million, down -0.4% y/y.

The WSJ reports that Viacom (VIA -0.92%) and CBS (CBS -1.76%) boards retained advisors to explore a merger.

Duke Energy (DUK -0.67%) rose over 3% in after-hours trading after it said it had restored power for 38,000 out of 200,000 customers who were out of power in Florida as of late Friday afternoon.

Twilio (TWLO -0.18%) lost 3% in after-hours trading after it said it plans to offer $400 million in shares in a secondary offering.

Inotek Pharmaceuticals (ITEK -2.06%) slumped over 10% in after-hours trading after the company said it informed Chief Science Officer, William McVicar, that his employment will be ending.

Today’s Economic Calendar

12:30 PM TD Ameritrade IMX

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Oct 10)”

Leave a Reply

You must be logged in to post a comment.

slow-motion meltdown of the Eurozone’s banking system is the key to this weeks pains. Expect some Fed action in Dec to help the ECB keep the EU off the ropes. Still expecting weak ending to 2016. The US election may be the biggest threat to our solvency. Be nervous.

Correction to my post a week or so ago. I have seen this pattern before in the early 90’s.

I see a modest pull back then strong buying. I seldom put much faith in pre electronic data but at this time it is all I have.

The market is full of human emotion. Human emotions never change. Greed is always greed. Fear is always fear.