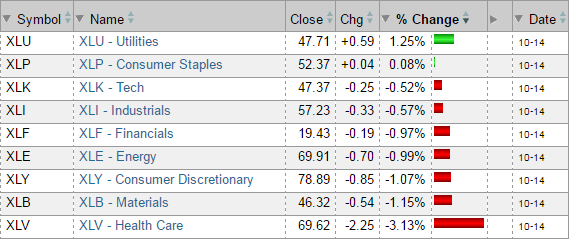

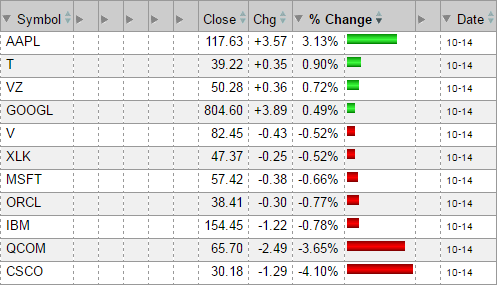

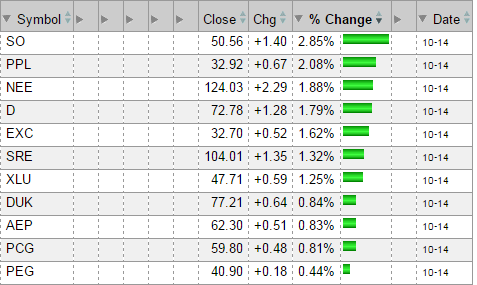

Per the nine S&P Select groups, this is how the market did last week.

S&P Select Groups

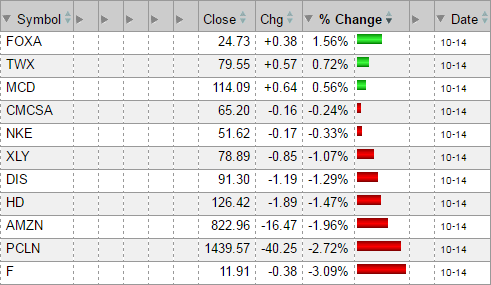

Consumer Discretionary

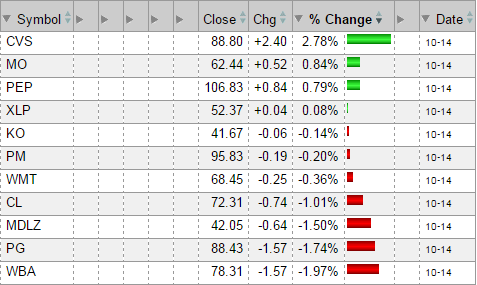

Consumer Staples

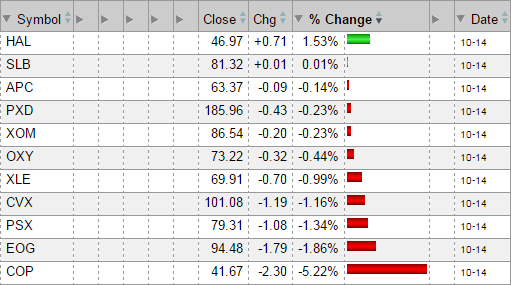

Energy

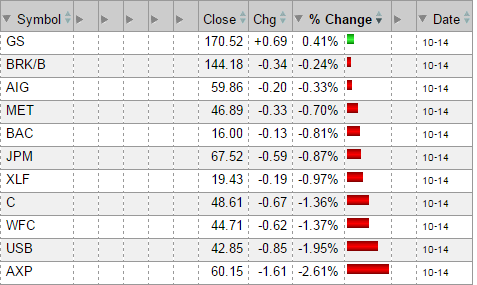

Financials

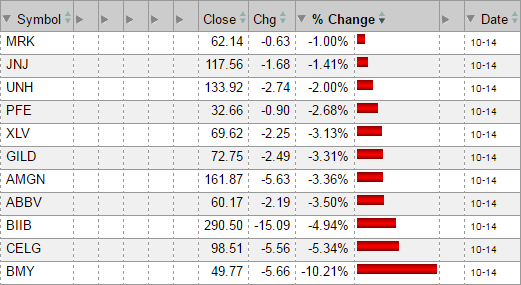

Health Care

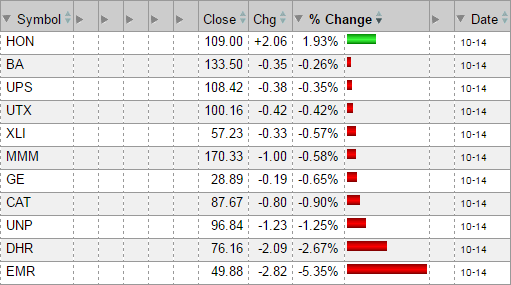

Industrials

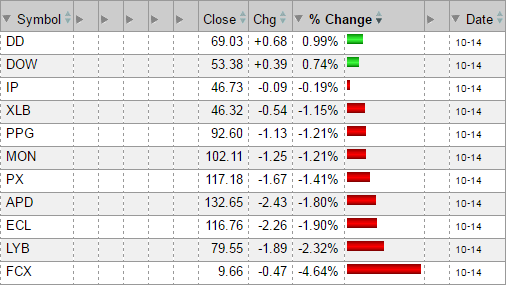

Materials

Technology

Utilities

2 thoughts on “S&P Select – Week in Review”

Leave a Reply

You must be logged in to post a comment.

THIS new game of Yellen’s may be a QE twist and some fiscal tampering to infuse capital into businesses; it is a desperate act, but Fed does not want to raise rates this year. So lower taxes or give tax holiday. This is a EU/BoJ stunt so play the utilities with a well managed etf, or watch a while in cash.

One sign that the economy is beginning to run hot is that the U.S. jobless rate has fallen to 5%, signaling diminished slack in the labor market (BS). Despite its descent in recent years, Fed officials have been prepared to keep interest rates low and encourage the jobless rate to fall further still”. (wages rise? my comment). WSJ comments 10/15/2016. This is playing with the Phillips curve and hoping nothing goes wrong( read inflation and added corp debt). T am Being very conservative.