Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly up. China, Singapore, Hong Kong and South Korea did the best. Europe is currently doing very well. Austria, the Netherlands, Poland, Turkey, Spain and Italy are up more than 1%; Germany, France, Belgium, the Czech Republic and Portugal are also doing well. Futures in the States point towards a moderate gap up open for the cash market.

—————

LB Weekly – the indexes, the breadth indicators, a look at the big picture

—————

The dollar is down a small amount. Oil is down; copper is flat. Gold is down; silver is up. Bonds are up.

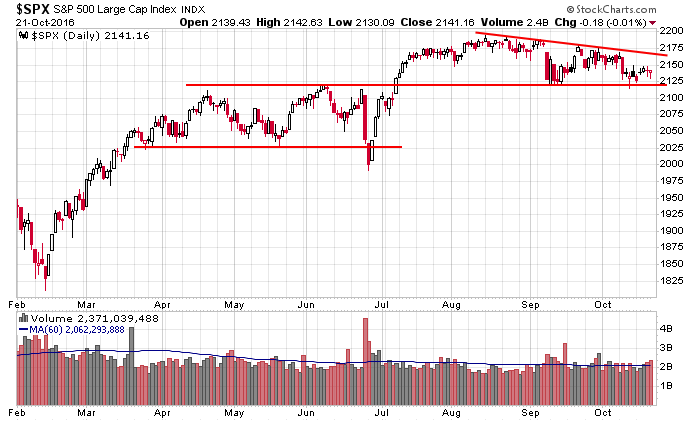

As is typically the case on a Monday morning, I don’t have much to add to the comments made over the weekend in LB Weekly. In it I concluded the indexes are flat and neutral, but beneath the surface, some deterioration was taking place. If left alone, the technicals should lead to the market pulling back, but we have an election in two weeks. The current administration is not going to let the market fall apart.

AT&T (T) is going to attempt to acquire Time Warner (TWX) for $85.4B.

Rockwell Collins (COL) is buying B/E Aerospace (BEAV).

And we already know TD Ameritrade (AMTD) is buying Scottrade.

M&A activity is bullish. If companies felt the market was going to drop much, they’d wait to do such deals.

Regarding the T/TWX merger…I keep hearing TV needs to be re-invented, that it’s the last major piece of technology that has undergone incremental improvements but no technology jumps. Now I’m wondering if this is all we’re going to get – just a bunch of mergers that combine content providers with content distributors. That would be kind of boring.

Here’s the daily S&P – not much to get excited about. Even though today’s open will be at 9-day high, the index is still stuck in a range. More after the open.

Stock headlines from barchart.com…

Time Warner (TWX +7.82%) rose 1% in pre-market trading after AT&T said it is close to an agreement to acquire the company for $85 billion.

B/E Aerospace (BEAV -0.08%) surged 19% in pre-market trading after Rockwell Collins said it would acquire the company for $6.4 billion.

Verizon Communications (VZ -1.91%) was upgraded to ‘Buy’ from ‘Hold’ at Drexel Hamilton LLC with a 12-month target price of $54.

VMware (VMW -0.48%) was upgraded to ‘Outperform’ from ‘Market Perform’ at William Blair.

Kinder Morgan (KMI -0.38%) was upgraded to ‘Strong Buy’ from ‘Outperform’ at Raymond James with a 12-month target price of $27.

MB Financial (MBFI -2.24%) was upgraded to ‘Buy’ from ‘Neutral’ at DA Davidson with an 18-month target price of $43.

Jack in the Box (JACK +2.10%) was initiated with a ‘Sell’ at Goldman Sachs with a price target of $88.

Hertz Global Holdings (HTZ +1.51%) was rated a new ‘Sell’ at Goldman Sachs with a price target of $29.

Pershing Square bought 2.33 million shares of Chipotle Mexican Grill (CMG +1.69%) and now has the second- biggest stake in the company.

Merit Medical Systems (MMSI -2.07%) said it received a subpoena from the U.S. DOJ requesting documents regarding its marketing and promotional practices.

Today’s Economic Calendar

8:30 Chicago Fed National Activity Index

9:00 Fed’s Dudley: “Evolving Structure of the U.S. Treasury Market”

9:05 Fed’s Bullard speech

9:45 PMI Manufacturing Index Flash

1:45 PM Fed’s Powell: “Future of the settlement process for Treasury market”

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

5 thoughts on “Before the Open (Oct 24)”

Leave a Reply

You must be logged in to post a comment.

Four fed speakers today. AT&T seeks to buy TW and trump has almost given up, so we can see lots 0f action this week. long options on rise in markets. By the way, hate windows 10, AApl has my money.

they do make an app that makes win10 look like win7…everyone wants me to help them with win10 and i dont want or have a clue…i will stick with win7 and do minimal updates..

good for you. How do get the conversion? jwwc99@yahoo.com

sent..

a nas 100 retest high unconfirmed by 3 lower highs in spx and divergence dow

german dax up unconfirmed by ftse

be carefull of a fast move down as central banks may not be able to hold it