Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Japan, Australia, New Zealand and Taiwan did well; India, Indonesia and South Korea were weak. Europe is currently mostly up, but gains are small. Russia is up 1%; the UK, Germany, Austria, the Netherlands and Poland are also doing well. Spain, Greece, Portugal and Romania are weak. Futures in the States point towards a slight up open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is flat. Oil and copper are up. Gold and silver are up. Bonds are down.

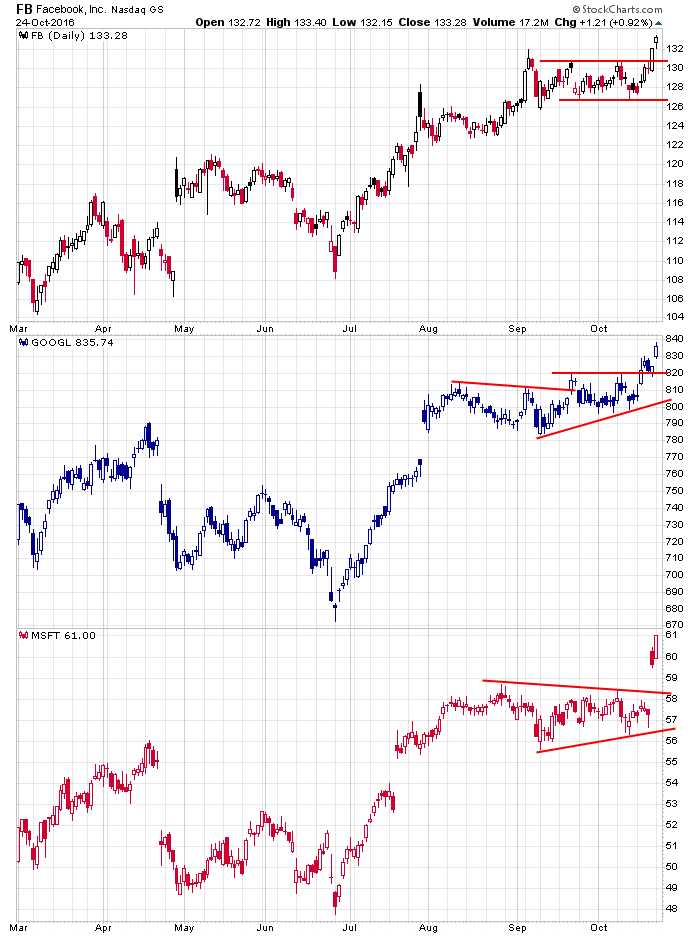

Yesterday most of the indexes remained in range, but the Nas 100 moved to a new all-time high thanks to some big moves from several big cap tech stocks. Facebook, Google and Microsoft jumped to new all-time highs.

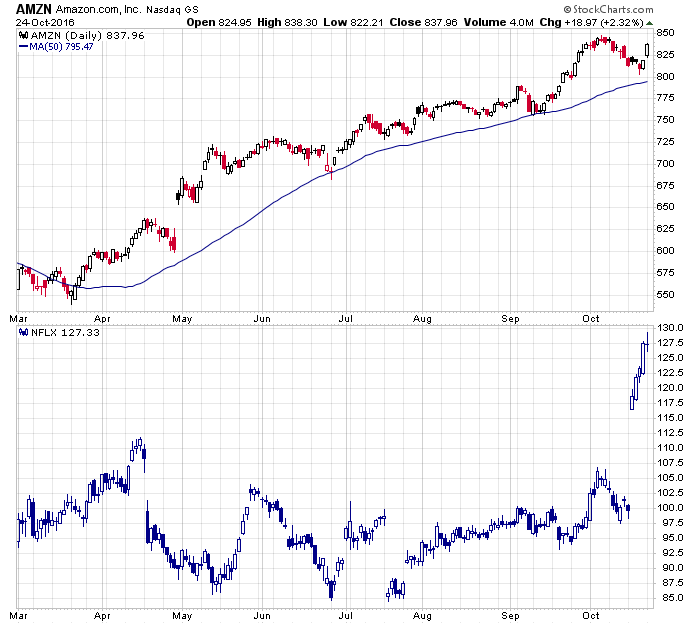

Amazon and Netflix are close to their own new highs.

These are all great companies. For the most part they deserve the gains, but I’m wondering how much is performance chasing. Fund managers who’ve under-performed or who’ve just had so-so years will chase the best-performers in a desperate attempt to post a decent gain for the year. If this is true, all these stocks could run up 10% the next two months.

Otherwise the market is stuck in a range. The first hurdle to climb is the election. If the market doesn’t wake up after that, then maybe we’ll have to wait until the December Fed meeting. I doubt it, but it’s possible. More after the open.

Stock headlines from barchart.com…

Swift Transportations (SWFT +2.22%) gained 2% in after-hours trading after it reported Q3 adjusted EPS of 34 cents, higher than consensus of 32 cents.

Rambus (RMBS +3.18%) climbed 5% in after-hours trading after it reported Q3 adjusted EPS of 16 cents, above consensus of 13 cents, and said it sees Q4 revenue of $94 million-$98 million, higher than consensus of $894.4 million.

Eli Lilly (LLY -0.87%) dropped nearly 3% in pre-market trading after it reported Q3 adjusted EPS of 88 cents, weaker than consensus of 96 cents.

Visa (V +1.00%) lost nearly 1% in after-hours trading after it said it sees 2017 adjusted EPS growth of mid-teens on a nominal dollar basis, below estimates of 20% growth.

Sonic (SONC +1.85%) sank 10% in after-hours trading after it reported Q4 revenue of $162.1 million, below consensus of $167.2 million.

CoreLogic (CLGX +2.18%) rose nearly 3% in after-hours trading after it reported Q3 adjusted EPS of 73 cents, higher than consensus of 66 cents and boosted its stock buyback plan by 1 million shares.

Wabash National (WNC +0.83%) lost 6% in after-hours trading after it reported Q3 revenue of $464.3 million, weaker than consensus of $480.6 million.

Greenhill & Co. (GHL +1.51%) slipped over 1% in after-hours trading after it reported Q3 EPS of 41 cents, weaker than consensus of 42 cents.

Fiesta Restaurant Group (FRGI -0.55%) gained over 1% in after-hours trading after it said it will close 10 Pollo Tropical Locales and re-brand up to three locations as Taco Cabana.

ProAssurance (PRA +0.52%) slid 5% in after-hours trading after it said preliminary Q3 operating EPS will be between 43 cents-47 cents, weaker than consensus of 60 cents.

Allison Transmission Holdings (ALSN +0.40%) rose over 2% in after-hours trading after it reported Q3 EPS of 27 cents, higher than consensus of 24 cents.

Park National (PRK +0.75%) climbed nearly 3% in after-hours trading after it reported Q3 EPS of $1.78, well above consensus of $1.40.

New Mountain Finance (NMFC +1.02%) fell 3% in after-hours trading after it began an offering of 5 million shares of common stock.

SAExploration Holdings (SAEX -3.11%) catapulted over 40% in after-hours trading after it received $24.4 million of tax credit certificates from Alaska’s Department of Revenue and was granted access to the remaining $15 million of funding available under its senior loan facility.

Monday’s Key Earnings

B/E Aerospace (NASDAQ:BEAV) +16.4% after a buyout from Rockwell Collins (NYSE:COL).

Kimberly Clark (NYSE:KMB) -4.7% on lower selling prices.

T-Mobile (NASDAQ:TMUS) +9.5% increasing subscriber numbers.

Visa (NYSE:V) -1% AH issuing a light outlook.

Today’s Economic Calendar

8:55 Redbook Chain Store Sales

9:00 FHFA House Price Index

9:00 S&P Case-Shiller Home Price Index

10:00 Consumer Confidence

10:00 Richmond Fed Mfg.

10:00 State Street Investor Confidence Index

1:00 PM Results of $26B, 2-Year Note Auction

1:20 PM Fed’s Lockhart speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Oct 25)”

Leave a Reply

You must be logged in to post a comment.

The fed says Dec 2016 will be the date up .25 bp. in the meanwhile, the debt rises mighty. own some gold and EM etfs??

true false breaks have fast moves in the the opposite direction

nas 100 may qualify –at its high after hours it hit 4923 and low today at 4887

ive closed my short incase its just a pull back for another 5th wave push higher

im waiting to see which direction