Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Australia fell more than 1%; Taiwan and Hong Kong were also weak. New Zealand and South Korea did well. Europe is currently mixed and little changed. Norway is up more than 1%; the Czech Republic, Poland, Denmark, Italy and Russia are also doing well. Austria, Finland, Turkey and Greece are weak. Futures in the States point towards a positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is flat. Oil and copper are up. Gold and silver are up. Bonds are down.

Here’s the S&P over the last 12 days. Lots of gaps and no move last longer than a day plus the next day’s open. Lots of spit swapping. Brokers are happy. Day traders can do their thing. But anyone who likes smooth and predictable action has been frustrated.

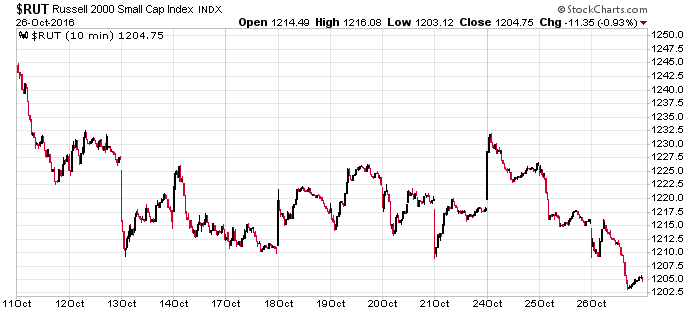

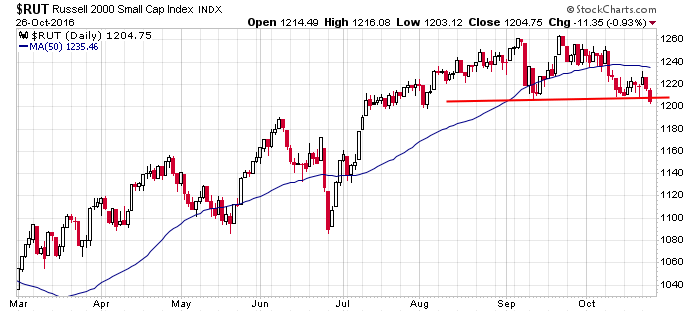

While the large caps are neutral over the last two weeks, the small caps point down. They moved in mid October, traded sideways in a range for two weeks and then broke down yesterday. Here’s the Russell 2000.

In fact the Russell daily is in the process of taking out a support level and is now near a 3-month low.

It’s something to keep an eye on – the Nas 100 put in a new high just a couple days ago and the large cap indexes are pretty neutral, but the small caps are moving down. The market won’t move up without the small caps participating. More after the open.

Stock headlines from barchart.com…

NXP Semiconductors (NXPI -1.97%) rose over 2% in pre-market trading after Qualcomm agreed to buy the company for $110 a share or $47 billion, an 11% premium to Wednesday’s closing price.

Tesla Motors (TSLA -0.05%) gained over 4% in after-hours trading after it reported an unexpected Q3 adjusted EPS profit of 71 cents, better than consensus of a -54 cent loss.

Cheesecake Factory (CAKE -0.47%) jumped 7% in after-hours trading after it reported Q3 adjusted EPS of 70 cents, above consensus of 61 cents.

F5 Networks (FFIV +1.98%) climbed 5% in after-hours trading after it reported Q4 adjusted EPS of $2.11, higher than consensus of $1.94, and said it sees Q1 adjusted EPS of $1.92-$1.95, higher than consensus of $1.87.

O’Reilly Automotive (ORLY -1.11%) slid 3% in after-hours trading after it lowered guidance on 2016 adjusted EPS to $10.58-$10.68, below consensus of $10.73.

Trinity Industries (TRN -0.62%) dropped 6% in after-hours trading after it said it sees Q4 EPS of 30-cents-40 cents, less than consensus of 43 cents, and said it sees first-half 2017 EPS 45 cents-60 cents versus $1.25 y/y.

Shutterfly (SFLY -0.90%) rallied 8% in after-hours trading after it reported a Q3 loss of -86 cents per share, a narrower loss than consensus of -95 cents.

Rent-A-Center (RCII +1.17%) dropped over 8% in after-hours trading after it cut guidance on full-year adjusted EPS to $1.05-$1.15 from a prior view of $1.65-$1.85.

Pilgrim’s Pride (PPC -1.15%) fell nearly 6% in after-hours trading after it reported Q3 adjusted EPS of 40 cents, weaker than consensus of 47 cents.

Ultra Clean Holdings (UCTT +2.17%) jumped nearly 9% in after-hours trading after it reported Q3 adjusted EPS of 17 cents, above consensus of 13 cents, and said it sees Q4 adjusted EPS of 17 cents-20 cents, higher than consensus of 11 cents.

Interface (TILE -0.32%) slid nearly 5% in after-hours trading after it reported Q3 EPS of 25 cents, below consensus of 32 cents.

Cimpress NV (CMPR +1.64%) dropped over 9% in after-hours trading after it reported Q1 gross margin of 51.8%, less than consensus of 54.4%.

Planet Fitness (PLNT +3.78%) rose 4% in after-hours trading after it reported Q3 adjusted EPS of 16 cents, higher than consensus of 14 cents, and then raised guidance on 2016 adjusted EPS to 66 cents-67 cents from an August 11 view of 63 cents-66 cents.

Essendant (ESND -0.21%) tumbled 12% in after-hours trading after it reported Q3 adjusted EPS of 57 cents, weaker than consensus of 68 cents, and then cut guidance on 2016 adjusted EPS to $1.75-$1.90 from a prior view of $2.15-$2.30.

Wednesday’s Key Earnings

Barrick Gold (NYSE:ABX) +1.4% AH keeping a lid on costs.

Biogen (NASDAQ:BIIB) +3.7% after topping expectations.

Boeing (NYSE:BA) +4.7% posting a big beat, raising guidance.

Coca-Cola (NYSE:KO) -0.2% following a narrow Q3 beat.

Comcast (NASDAQ:CMCSA) -3% despite robust rollouts.

Groupon (NASDAQ:GRPN) -11% AH on many international exits.

Western Digital (NYSE:WDC) +5.3% AH following strong Q3 results.

Tesla (TSLA) +4.3% AH after generating a profit.

Texas Instruments (NYSE:TXN) volatile AH on mixed results.

VMware (NYSE:VMW) +2.4% AH after beating estimates.

Today’s Economic Calendar

8:30 Durable Goods

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

1:00 PM Results of $28B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Oct 27)”

Leave a Reply

You must be logged in to post a comment.

Jason ……………………………….for some reason… no email to me before open

Hmmm…no reason for this…probably lost in cyberspace.

advancers look very weak today..Rut doing nada…looks like bears are helping out the bulls