Good morning. Happy Wednesday.

The Asian/Pacific closed mostly down. Hong Kong, Australia, New Zealand and South Korea dropped more than 1%. India and Singapore were also weak. Europe is currently mostly weak. The Netherlands and Norway are down more than 1%; the UK, Germany, Belgium, Sweden, Switzerland, and the Czech Republic are also weak. Futures in the States point towards a down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil is down; copper is flat. Gold and silver are down. Bonds are down.

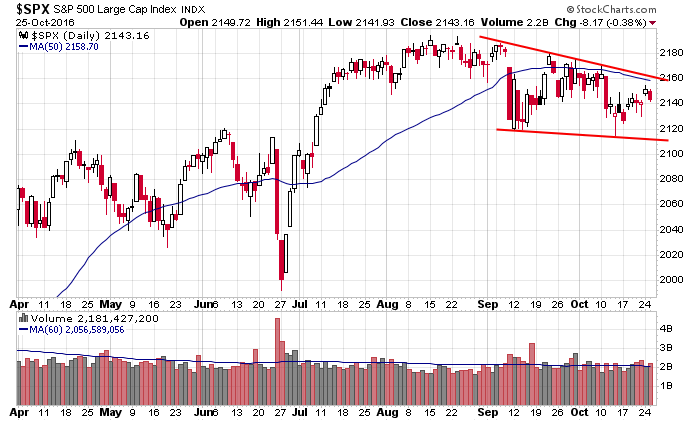

In the last two weeks the S&P moved 40 points off its low but got rejected by its declining 50-day MA.

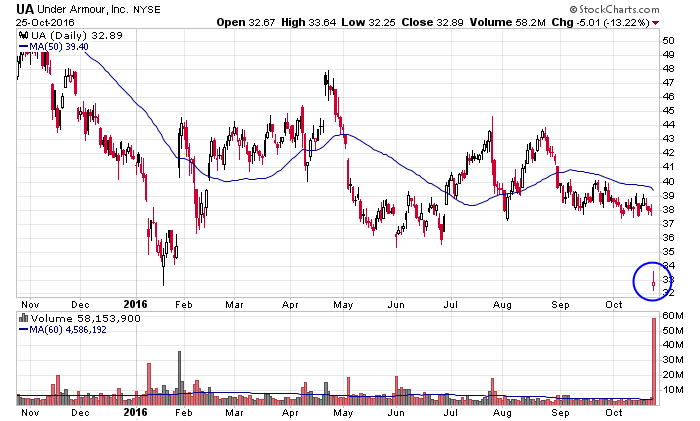

Under Armour got hit hard after releasing earnings. It’s near a 52-week low.

Apple had earnings yesterday. First the stock spiked; then it dropped and is currently 3+ dollar below yesterday’s close. Here’s the 5-min after-hours and premarket chart.

This comes just two days after Facebook, Google and Microsoft moved to all-time highs.

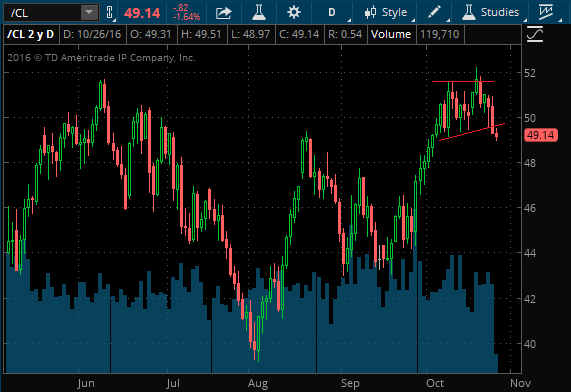

Oil moved to a new high…and is now at a 3-week low. False breakout?

No big bets right now. There aren’t many “easy and obvious” trades.

Stock headlines from barchart.com…

Apple (AAPL +0.51%) slid 3% in pre-market trading after it reported Q4 revenue of $46.9 billion, below consensus of $47 billion, and forecast Q1 gross margins of 38%-38.5%, weaker than consensus of 39%

Under Armour (UA -13.22%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Cowen with a 12-month target price of $35.

Twitter (TWTR -4.27%) rose 3% in after-hours trading after Betaville reported that Disney is still interested in acquiring the company.

Akamai Technologies (AKAM +0.39%) climbed over 6% in after-hours trading after it reported Q3 adjusted EPS of 68 cents, higher than consensus of 61 cents.

Juniper Networks (JNPR +0.25%) rose 4% in after-hours trading after it reported Q3 adjusted EPS of 58 cents, higher than consensus of 52 cents/

Edwards Lifesciences (EW -2.86%) slumped over 12% in after-hours trading after it reported Q3 revenue of $739.4 million, less than consensus of $749.1 million, and said it sees Q4 sales of $750 million-$790 million, below consensus of $801.6 million.

Panera Bread (PNRA -2.04%) rose 5% in after-hours trading after it reported Q3 adjusted EPS of $1.37, higher than consensus of $1.34, and then raised its full-year adjusted EPS view to $6.67-$6.72 from a July 26 estimate of $6.60-$6.70.

NuVasive (NUVA -2.74%) tumbled 12% in after-hours trading after it cut its full-year revenue forecast to $952 million from a prior estimate of $962 million.

Express Scripts Holding (ESRX +0.39%) gained over 1% in after-hours trading after it reported Q3 adjusted EPS of $1.74, above consensus of $1,73, and then raised the low end of its full-year adjusted EPS view to $6.36-$6.42 from a prior view of $6.33-$6.43.

CH Robinson Worldwide (CHRW +0.45%) declined over 3% in after-hours trading after it reported Q3 EPS of 90 cents, below consensus of 96 cents.

Owens-Illinois (OI -0.99%) rallied over 3% in after-hours trading after it raised the low end its full-year adjusted EPS view to $2.27-$2.32 from a July 27 view of $2.25-$2.35.

Pandora Media (P -4.84%) fell 5% in after-hours trading after it lowered guidance on full-year revenue to $1.354 billion-$1.366 billion from a prior view of $1.385 billion-$1.405 billion.

NCR Corp. (NCR -2.17%) rose over 3% in pre-market trading after it reported Q3 adjusted EPS of 87 cents, above consensus of 81 cents, and then raised its full-year adjusted EPS view to $2.97-$3.02 from a prior view of $2.90-$3.00.

Diplomat Pharmacy (DPLO -0.24%) dropped over 5% in after-hours trading after President Gary Kadlec and CFO Sean Whelan said they will both step down on Dec 31.

Gladstone Capital (GLAD -1.68%) slid over 3% in after-hours trading after it announced a common stock offering, although no size was given.

Tuesday’s Key Earnings

3M (NYSE:MMM) -3% cutting its guidance.

Apple (AAPL) -3.4% AH posting its first revenue decline in 15 years.

Baker Hughes (NYSE:BHI) +4.3% reporting a less-than-expected loss.

Caterpillar (NYSE:CAT) -1.8% after lowering its forecasts.

Chipotle (NYSE:CMG) -2.7% AH on slipping comparable store sales.

Corning (NYSE:GLW) -3.8% following soft revenues.

DuPont (NYSE:DD) -0.6% on a possible Dow merger delay.

Eli Lilly (NYSE:LLY) +0.4% following a soft quarter.

Freeport-McMoRan (NYSE:FCX) +3.5% swinging to a Q3 profit.

General Motors (GM) -4.2% on Brexit impact factors.

Lockheed Martin (LMT) +7.3% lifting its outlook.

Merck (NYSE:MRK) +2% after beating estimates.

Pandora (NYSE:P) -8.6% AH cutting its revenue forecast.

Panera Bread (NASDAQ:PNRA) -2% AH on strong comparable sales.

Procter & Gamble (NYSE:PG) +3.4% reporting underlying sales growth.

Sprint (NYSE:S) -6.1% despite better-than-expected earnings.

Under Armour (NYSE:UA) -13.2% warning of future growth.

United Tech (NYSE:UTX) +1.9% boosting its guidance.

Valero (NYSE:VLO) +4.8% after topping expectations.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:30 International trade in goods

9:45 PMI Services Index Flash

10:00 New Home Sales

10:30 EIA Petroleum Inventories

11:30 Results of $15B, 2-Year FRN Auction

1:00 PM Results of $34B, 5-Year Note Auction

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

3 thoughts on “Before the Open (Oct 26)”

Leave a Reply

You must be logged in to post a comment.

The RUT is near a 4 month low. The NASDAQ is near an all time high. The divergence makes me want to stay clear. October 2007 had such a divergence. Don’t expect to be that bad this time.

closed shorts and could be a reversal day if spx2130 holds

the marsians may be buying as if trump wins they may have a contract to establish a penial colony on mars for all the bankers politicans ,judges and corrupt officials of earth

another test of the down sloping 5o day ma may set up for a fast crash to sub zero

well we have sub zero interest rates –why not sub zero stocks

of course that may mean a bit of doom /gloom and trump will win