Good morning. Happy Wednesday. Happy FOMC Day.

The Asian/Pacific markets closed with stiff, across-the-board losses. Japan, Hong Kong, Australia, India, New Zealand, South Korea and Taiwan each dropped more than 1%. Europe is currently mostly down. Austria, Norway, Poland, Denmark, Spain and Italy are down more than 1%; Germany, France, Belgium, the Netherlands, the Czech Republic, Finland and Portugal are also weak. Futures in the States point towards a flat open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil and copper are down. Gold and silver are up. Bonds are up.

Yesterday the S&P dropped to its lowest level since early July and then bounced 14 points into the close. The index has been bleeding down for two months and yesterday suffered its biggest intraday drop since the early-September ECB news. The 6-day losing streak is the longest in a while.

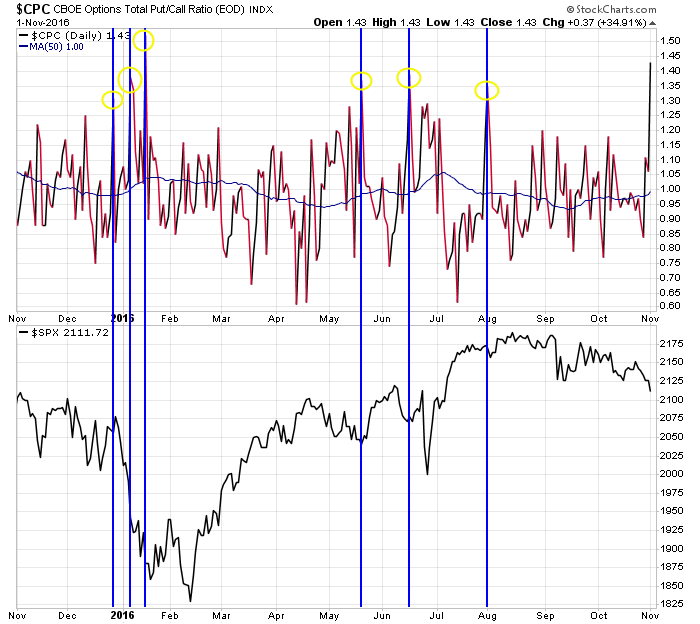

Per the put/call you could argue the market is due for a bounce very soon. Previous spikes to the current level either pinpointed local bottoms or were completely ignored. This puts us in a situation where the market should bounce or it will fall hard – no middle ground.

The Fed meets today and announces rates at 2:00 ET. There is no expectation rates will be raised right now, but Wall St. will be looking for hints that rates will or won’t likely be raised in December. It could be a nonevent or a market mover.

I’m still on conservative mode. No big bets right now.

Stock headlines from barchart.com…

Wynn Resorts Ltd. (WYNN +0.39%) climbed 2% in pre-market trading after it reported Macau’s gaming revenue rose +8.8% to $2.73 billion, the third straight monthly increase.

Luminex (LMNX +1.51%) rose 3% in after-hours trading after it reported Q3 adjusted EPS of 21 cents, above consensus of 20 cents, and then raised its 2016 revenue estimate to $267 million-$270 million from a July 28 estimate of $261 million-$269 million.

Twilio (TWLO -3.67%) rose nearly 2% in after-hours trading after it was rated a new ‘Outperform’ at Oppenheimer with an 18-month target price of $50.

Brocade Communications (BRCD +21.98%) was upgraded to ‘Outperform’ from ‘Sector Perform’ at RBC Capital Markets with a 12-month target price of $14.

Amkor Technology (AMKR +0.87%) climbed over 5% in after-hours trading after it reported Q3 EPS of 25 cents, higher than consensus of 21 cents, and said it sees full-year EPS of 55 cents, above consensus of 42 cents.

Lockheed Martin (LMT -0.65%) received a $536.4 million modification to an existing U.S. Air Force contract.

Tenet Healthcare (THC -2.67%) dropped over 3% in pre-market trading after it reported Q3 adjusted EPS continuing operations of 16 cents, weaker than consensus of 19 cents.

Raytheon (RTN -0.42%) was awarded a $174.7 million U.S. Defense Advanced Research Projects Agency contract that will run through Oct, 2017.

Tesoro (TSO +1.74%) lost 2% in after-hours trading after it cut its 2016 capex view to $900 million, below an earlier view of $1 billion.

Green Plains Partners LP (GPP -0.93%) reported Q3 adjusted EPS of 20 cents, weaker than consensus of 28 cents.

Aegion (AEGN -1.12%) reported Q3 adjusted EPS of 32 cents, below consensus of 35 cents.

FreightCar America (RAIL +0.54%) tumbled 10% in after-hours trading after it reported Q3 EPS of break-even, well below consensus of 12 cents.

Gasoline futures (RBZ16 +11.07%) surged over 10% in overnight Globex trading after Colonial Pipeline’s right of way, the biggest U.S. gasoline pipeline in the U.S., was shut down after an explosion and fire in Shelby County, Alabama.

Instructure (INST +1.64%) plunged 2% in after-hours trading after it reported Q3 adjusted revenue of $30.1 million, below consensus of $30.3 million, and said it sees Q4 revenue of $30.4 million-$31.0 million, below consensus of $32.2 million.

Tuesday’s Key Earnings

Electronic Arts (NASDAQ:EA) +5.9% AH boosting its outlook.

Emerson Electric (NYSE:EMR) +0.6% on mixed results.

Etsy (NASDAQ:ETSY) +1.4% AH lifting full-year guidance.

Gilead Sciences (NASDAQ:GILD) -1.1% AH following an earnings miss.

Herbalife (NYSE:HLF) -2% AH after naming a new CEO.

Kellogg (NYSE:K) +0.1% after a bottom line beat.

Occidental Petroleum (NYSE:OXY) -5.4% planning more spending.

Pfizer (PFE) -2% dropping its cholesterol drug trials.

Shire (NASDAQ:SHPG) -2.4% on falling hemophilia medicine sales.

Square (NYSE:SQ) +3.9% AH on higher transaction revenue.

U.S. Steel (NYSE:X) -8.7% AH missing estimates, soft guidance.

Zillow (NASDAQ:Z) -1.4% AH despite topping expectations.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

8:30 Treasury Refunding Quarterly Announcement

10:30 EIA Petroleum Inventories

2:00 PM FOMC Announcement

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers