Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mostly down. Indonesia fell more than 2%; Hong Kong, Singapore and Malaysia dropped more than 1%. Japan rallied 1.7%. Europe is currently mixed and little changed. The UK, Germany, France, the Netherlands are up; Poland is down more than 1%; Norway, Sweden, Switzerland, Russia, Turkey, Finland, Italy and Greece are down. Futures in the States point towards a flat open for the cash market.

—————

LB Weekly – the indexes, the breadth indicators, a look at the big picture

—————

The dollar is up. Oil is down; copper is up. Gold and silver are down. Bonds are down.

As is typically the case on a Monday morning, I don’t have anything to add to the comments made in LB Weekly, published Sunday morning.

In it concluded the market’s long term trend remains in place and is trying to re-assert itself.

The market rallied last Monday and Tuesday on news the FBI would not seek criminal charges against Hillary Clinton. Then the market rallied Wednesday-Friday on news Donald Trump won the election. So ultimately the market didn’t care who won, it just cared that there was indeed a winner. Now the market, which has been somewhat held hostage the most of this year, can resume it’s long term uptrend.

Last week was a big one. The Dow and Russell 2000 moved to new highs. The S&P posted its biggest weekly gain of the year, and the Russell posted its biggest weekly gain in five years. Numerous other groups also posted gains not seen in several years. Biotechs, regional banks, building & construction, industrials – all their biggest or second biggest gains since the 2009 bottom. Gold & silver posted their biggest loss since 2008, and the long bonds fell the most it’s ever fallen in a week.

On the surface the market is free to resume its long term trend, but beneath the surface, money is definitely rotating around.

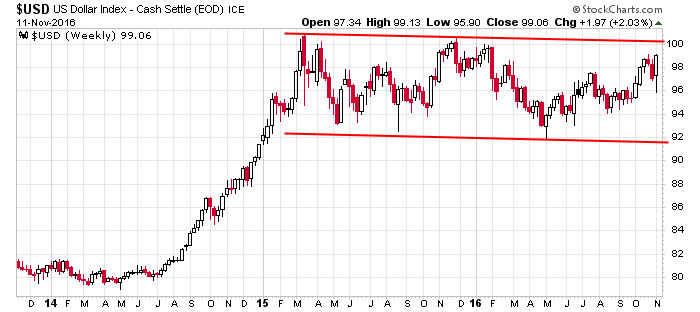

Keep an eye on the dollar. As of this writing, it’s trading at $99.63. If it breaks out at $100, there will be titanic shifts within the market.

Stock headlines from barchart.com…

CME Group (CME -2.28%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase with a 12-month target price of $116.

Lockheed Martin (LMT +0.74%) was upgraded to “Buy’ from ‘Hold’ at Stifel with a price target of $290.

Children’s Place (PLCE +3.70%) was upgraded to ‘Buy’ from ‘Underperform’ at Bank of America/Merrill Lynch with a price target of $92.

Aetna (AET -0.52%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Bernstein.

Capital One Financial (COF +2.22%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Callaway Golf (ELY +1.68%) was downgraded to ‘Neutral’ from ‘Buy’ at Compass Point Research & Trading LLC with a 12-month target price of $11.50.

GrubHub (GRUB -4.82%) was upgraded to ‘Buy’ from ‘Hold’ by Stifel with a price target of $46.

iRobot (IRBT +2.26%) was downgraded to ‘Hold’ from ‘Buy’ at Needham & Co.

Mentor Graphics (MENT +1.79%) surged 21% in pre-market trading after Siemens AG agreed to buy the company for $4.5 billion.

U.S. Steel (X +4.26%) and AK Steel Holding Corp. (AKS +2.74%) are both up 3% in pre-market trading an President-elect Trump’s promise to boost infrastructure spending.

EPR Properties (EPR +0.80%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Kansas City Capital Associates.

Digi International (DGII +5.43%) surged 20% in after-hours trading after Belden submitted an all-cash bid to buy the company for $380 million.

Atwood Oceanics (ATW +2.01%) slid 6% in after-hours trading after it reported Q4 revenue of $188.7 million, weaker than consensus of $194.1 million.

Today’s Economic Calendar

1:20 PM Fed’s Kaplan: Monetary Policy

4:30 PM Fed’s Lacker speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Nov 14)”

Leave a Reply

You must be logged in to post a comment.

don’t look now, but dollar (DX) is testing resistance (100). a confirmed break from this 2-year consolidation pattern will push the dollar to levels that we thought impossible until very recently. momentum indicators are a little tired on the daily chart, and very flat on the weekly chart. so immediate break and/or sharp follow-thru may not be in the cards just yet. still worth keeping an eye on, as the consequences of DX at 120 may be far-reaching.