Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. India fell almost 2%; Indonesia, Australia and South Korea were also weak. Malaysia, New Zealand and Hong Kong did okay. Europe currently leans to the upside. The UK, Austria, the Netherlands, Norway, Stockholm, Turkey, Denmark and Portugal are doing well; Belgium and Italy are weak. Futures in the States point towards a positive open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is down. Oil is up; copper is down. Gold and silver are up. Bonds are up.

The market mostly moved up yesterday. The small caps and Dow pushed to new highs. Several indexes have started to rest. The Nas 100 remains weak. A lot of money has left big cap tech stocks. FB, AMZN, NFLX, GOOGL, MSFT, BABA and others have seen lots of selling pressure.

Oil broke a support level at $43 but closed above the level and is now up to $44.66 in premarket trading. Oil has been rolling in a range the last seven months. It’s not strong or weak – it’s neutral and not showing signs it wants to move forcefully in one direction or the other.

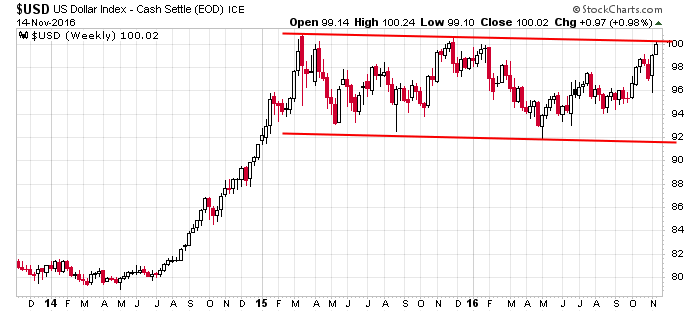

The dollar peaked its head above $100 yesterday and then closed right at the level. If the dollar runs, lots of adjustments will need to be made. Heck, if the dollar runs, will the Fed still raise rates in December?

Bank stocks have gone vertical. No way can we chase them.

Overall the market has gone from extreme fear to “OMG, I missed the bottom, please please please pull back and give me another chance.” Gotta love Wall Street. More after the open.

Stock headlines from barchart.com…

Home Depot (HD -1.68%) rose nearly 3% in pre-market trading after it reported Q3 EPS of $1.60, better than consensus of $1.58, and then raised guidance on full-year EPS to $6.33 from an August 16 estimate of $6.31.

Wells Fargo (WFC +2.88%) was downgraded to ‘Sell’ from ‘Neutral’ at Guggenheim with a price target of $47.

HCA Holdings (HCA +3.39%) climbed 2% in after-hours trading after its board authorized $2 billion in share repurchases.

Southwest Airlines (LUV +3.44%) and American Airlines Group (AAL +1.09%) both gained over 2% in after-hours trading after Berkshire Hathaway said it added both companies to its holdings.

Aimmune Therapeutics (AIMT +4.71%) slid 6% in after-hours trading after it said it sees 2016 GAAP R&D expenses of $50 million-$55 million, higher than an August 10 view of $40 million-$45 million.

Pier 1 Imports (PIR +0.76%) rose over 4% in after-hours trading after it said it sees Q3 adjusted EPS at the high end of view of 9 cents-15 cents, above consensus of 11 cents.

Tesaro (TSRO +2.95%) fell nearly 6% in after-hours trading after it proposed an offering of 1.75 million shares of common stock.

Advance Auto Parts (AAP -1.46%) rallied over 10% in after-hours trading after it reported Q3 adjusted EPS of $1.73, above consensus of $1.72, and said Q3 comparable sales fell -1%, less than consensus of -3.5%.

Zoe’s Kitchen (ZOES +0.76%) dropped almost 4% in after-hours trading after it reported Q3 restaurant comparable sales were up +2.4%, weaker than consensus of +2.8%, and said its sees full-year revenue of $276 million to $277 million, below consensus of $277.7 million.

Alarm.com Holdings (ALRM +5.37%) jumped nearly 6% in after-hours trading after it reported Q3 adjusted EPS of 19 cents, above consensus of 11 cents, and hen raised its 2016 revenue view to $254.0 million-$256.3 million from a prior view of $242.3 million-$245.8 million.

Globant SA (GLOB +2.20%) fell over 3% in after-hours trading after it reported Q3 non-IFRS EPS of 30 cents, below consensus of 31 cents, and said it sees Q4 non-IFRS EPX of so cents-33 cents, weaker than consensus of 3 cents.

AngioDynamics (ANGO +0.89%) slid 3% in after-hours trading after it announced a secondary offering of 2.5 million shares.

LifeLock (LOCK +3.03%) climbed over 4% in after-hours trading after Bloomberg reported that Symantec and Permira are among companies interested in acquiring LifeLock.

Amplify Sack Brands (BETR -3.79%) tumbled 9% in after-hours trading after it reported Q3 adjusted EPS of 12 cents, weaker than consensus of 15 cents, and then lowered guidance in 2016 adjusted EPS to 49 cents-51 cents from a May 2 view of 61 cents-64 cents.

Today’s Economic Calendar

7:30 Fed’s Rosengren: Economic Outlook

8:30 Empire State Mfg Survey

8:30 Import/Export Prices

8:30 Retail Sales

8:55 Redbook Chain Store Sales

9:05 Daniel Tarullo speech

10:00 Business Inventories

1:30 PM Stanley Fischer speech

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

2 thoughts on “Before the Open (Nov 15)”

Leave a Reply

You must be logged in to post a comment.

the soverign debt implosion is just starting –trillions $$$$ lost or vanished

been waiting for db to dumb…its the one holding all the bad debt…