Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Indonesia rallied more than 2%, and Japan did better than 1%. New Zealand and South Korea also did well. Several indexes closed with losses, but the losses were small. Europe is currently mostly down. Greece is up more than 2%, and Russia is up more than 1%. The Czech Republic is down 1.6%; the UK, Germany, France, Belgium, Finland, Hungary, Spain, Portugal and Italy are also weak. Futures in the States point towards a down open for the cash market.

—————

Join our email list – get technical research reports sent directly to you.

—————

The dollar is up. Oil and copper are down. Gold is flat; silver is down. Bonds are down.

Yesterday was opposite day. The small caps, which had been leading, lagged, and the Nas 100, which hadn’t kept up since the election, posted a solid gain.

Big cap tech, which had been weak, did great. Financials, which had gone vertical, rested.

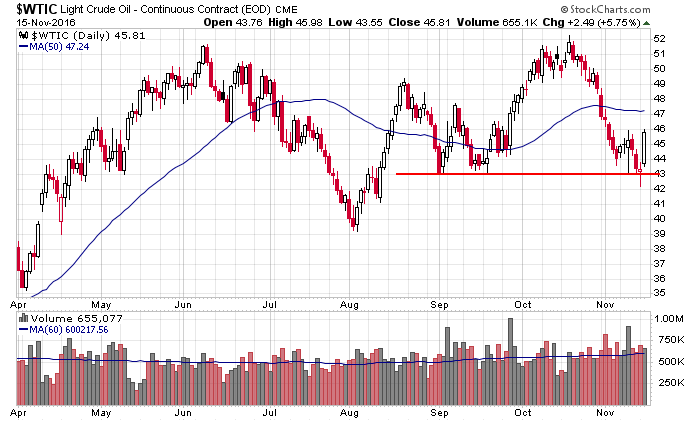

The big and most notable move came from oil. On Monday crude took out a support level but recaptured the level by the close. Then, yesterday, oil gapped up and rallied and posted its biggest single-day gain in a long time.

Many oil stocks are neutral. They’ve been trading in a range for a few months and aren’t necessarily ready to bust out.

Overall I see the group staying in a range. Unless OPEC cuts production, I don’t see crude breaking out to new highs and running…but I also don’t see much downside. I see the range continuing, which will give us a chance to buy dips and sell rallies.

The market is in pretty good shape. I have no interest being anything but long. More after the open.

Stock headlines from barchart.com…

Lowe’s (LOW -1.37%) fell over 5% in pre-market trading after it reported Q3 adjusted EPS of 88 cents, weaker than consensus of 96 cents, and then cut its full-year EPS view to $3.52 from an August 17 view of $4.06.

Sysco (SYY +0.02%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

Target (TGT -1.01%) jumped nearly 6% in pre-market trading after it reported Q3 adjusted EPS of $1.04, well above consensus of 83 cents, and then raised guidance on fiscal 2017 adjusted EPS to $5.10-$5.30 from an August 17 view of $4.80-$5.20.

Lululemon Athletica (LULU -1.76%) lost over 1% in pre-market trading after it was downgraded to ‘Neutral’ from ‘Buy’ at Credit Suisse Group AG.

OSI Systems (OSIS -1.88%) was rated a new ‘Buy’ at Drexel Hamilton LLC with a 12-month target price of $90.

ViaSat (VSAT +0.25%) slid over 2% in after-hours trading after it proposed a 6.5 million offering of common stock.

Agilient Technologies (A +0.15%) gained almost 2% in after-hours trading after it reported Q4 adjusted continuing operations EPS of 59 cents, above consensus of 52 cents.

CACI International (CACI -3.00%) was rated a new ‘Buy’ at Drexel Hamilton LLC with a 12-month target price of $140.

Flexion Therapeutics (FLXN -3.24%) dropped nearly 8% in after-hours trading after it proposed an offering of stock, with no amount given.

MACOM Technology Solutions Holdings (MTSI +1.74%) fell over 3% in after-hours trading after it reported Q4 adjusted EPS of 54 cents, below consensus of 56 cents.

La-Z-Boy (LZB -0.76%) climbed 5% in after-hours trading after it purchased the UK and Ireland licenses from Furnico and said it bought 9 La-Z-Boy furniture galleries in Pennsylvania and both deals should add $41 million in incremental sales volume.

Aclaris Therapeutics (ACRS +4.04%) gained over 2% in after-hours trading after it is said it met all endpoints in a Phase 3 study of its A-101 40% Topical Solution for seborrheic keratosis.

Invitae (NVTA -1.04%) dropped 6% in after-hours trading after it proposed a $40 million offering of common stock.

Tuesday’s Key Earnings

JD.Com (NASDAQ:JD) +11.4% following strong quarterly revenue.

Depot (NYSE:HD) -2.6% on concerns for U.S. housing.

Teva Pharmaceutical (NASDAQ:TEVA) -8.4% giving lukewarm guidance.

TJX Companies (NYSE:TJX) -1% posting a weak Q4 outlook.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

7:30 Fed’s Kashkari speech

8:30 Producer Price Index

9:15 Industrial Production

10:00 NAHB Housing Market Index

10:00 Atlanta Fed’s Business Inflation Expectations

10:30 EIA Petroleum Inventories

4:00 PM Treasury International Capital

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers