Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the upside. Singapore, India and Taiwan did well; China and Malaysia were weak. Europe is currently mostly up. Norway, Greece and Italy are up more than 1%; the UK, France, the Netherlands, Sweden, Poland, Denmark, Hungary and Portugal are also doing well. Futures in the States point towards a positive open for the cash market.

—————

List of Indexes and ETFs – here

—————

The dollar is up. Oil is up huge; copper is up. Gold and silver are down. Bonds are down.

Big news from OPEC – despite a lot of negative headlines recently suggesting there was little chance members would agree on production cuts or a freeze, now there’s optimism a cut will be agreed on. The Iraqi oil minister said OPEC ministers were unanimous in favor of a cut, and even Russia was ready to abandon its previous position and participate in reducing oil production. Crude oil is up more than $3.00 (> 7%). Many oil stocks are up big in premarket trading…some of the small independents are up 10%.

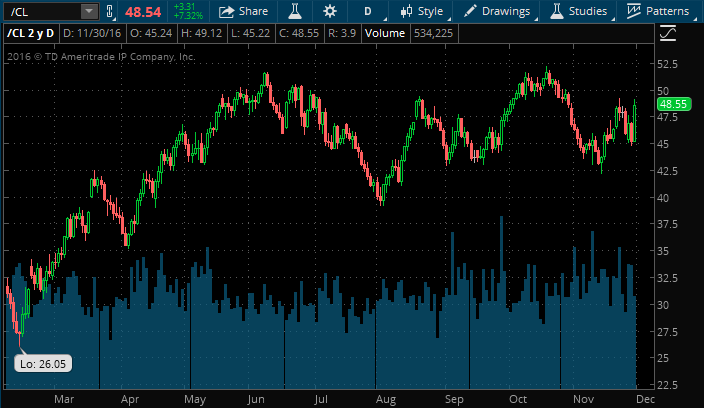

Here’s the daily crude oil chart (including today’s gains)…

My overall opinion of oil will stay the same for now. This could change if OPEC really does cut production and the charts respond favorably for more than just a quick knee-jerk reaction, but for now I consider oil neutral and constantly-playable as long as it’s range bound. Buy dips, sell rallies…repeat, repeat, repeat. That’s what I’ve been doing, and that’s what I’ll continue to do until the character of the commodity changes.

Stock headlines from barchart.com…

Celanese (CE +0.73%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs with a price target of $92.

AmSurg (AMSG +3.85%) will replace Legg Mason in the S&P 500 effective after the close of trading on Thursday, Dec 1.

Mid-America Apartment Communities (MAA +1.68%) will replace Owens-Illinois in the S&P 500 as of the close of trading Thursday, Dec 1.

Shutterfly (SFLY +0.22%) was rated a new ‘Buy’ at Alegis Capital with an 18-month target price of $62.

Advaxis (ADXS -3.82%) was rated a new ‘Buy’ at Cantor Fitzgerald with a 12-month target price of $19.

Splunk (SPLK -0.07%) rallied over 4% in after-hours trading after it reported Q3 adjusted EPS of 12 cents, above consensus of 8 cents, and then raised guidance on fiscal 2017 revenue view to $930 million-$932 million from a prior view of $910 million-$914 million.

Autodesk (ADSK +0.11%) dropped 3% in after-hours trading after it forecast a Q4 adjusted share loss of -32 cents to -39 cents, a larger loss than consensus of -31 cents.

Hyatt Hotels (H -0.08%) slid over 1% in after-hours trading after a 6-million share block of shares was offered.

Guidewire Software (GWRE -1.40%) rose over 2% in after-hours trading after it reported an unexpected Q1 adjusted EPS profit of 2 cents, better than consensus of a -5 cent loss, and then raised guidance on fiscal 2017 revenue to $473 million-$483 million from a September 7 view of $471.5 million-$483.5 million.

Ooma (OOMA +4.40%) climbed over 4% in after-hours trading after it reported a Q3 adjusted loss of -2 cents a share, a smaller loss than consensus of -5 cents, and then raised guidance on 2017 adjusted EP loss to -16 cents to -19 cents from an August 30 view of -20 cents to -25 cents.

Evolent Health (EVH -7.14%) fell 7% in after-hours trading after it said it will offer $110 million in convertible senior notes due on 2021, convertible into Class A shares.

Costamare (CMRE -6.60%) sank 9% in after-hours trading after it announced a public offering of 11 million shares of common stock.

Arrowhead Pharmaceuticals (ARWR -1.57%) plunged 60% in after-hours trading after it said it will discontinue development of clinical stage drug candidates ARC-520, ARC-521 and ARC-AAT and will reduce its workforce by 30%.

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:00 Fed’s Kaplan speech

8:15 ADP Jobs Report

8:30 Personal Income and Outlays

9:15 Fed’s Powell speech

9:45 Chicago PMI

10:00 Pending Home Sales

10:30 EIA Petroleum Inventories

12:35 Fed’s Mester: Monetary Policy and Economic Outlook

2:00 PM Fed’s Beige Book

3:00 Farm Prices

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers