Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Japan, Australia and Indonesia rallied more than 1%; Malaysia, New Zealand, China and Singapore also did well. Europe currently leans to the downside. Turkey is down more than 2%. The UK, Switzerland and Greece are down more than 1%; Germany, France, Belgium and the Netherlands are also weak. Austria, Norway and Russia are doing well. Futures in the States point towards a slight down open for the cash market.

—————

List of Indexes and ETFs – here

—————

The dollar is down. Oil is up; copper is down. Gold and silver are down. Bonds are down.

Yesterday was all about oil. It jumped almost 10%, and many small- and mid-size oil stocks surged 15-30%. All the oil stocks on our list did great. It’s nice when a group as big and as liquid as oil does well because there are lots of opportunities to make money.

Yesterday also marked the end of November, the first month of the “best 6 months of the year.”

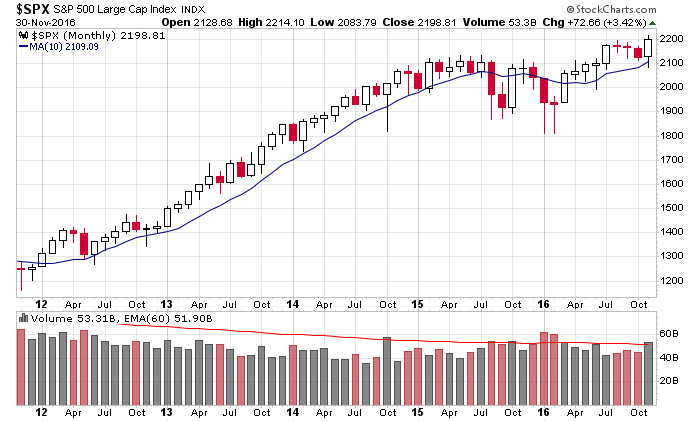

Here’s the S&P 500 monthly. The index fell below its 10-month MA and then rallied to a new high on strong volume. There isn’t much to dislike here.

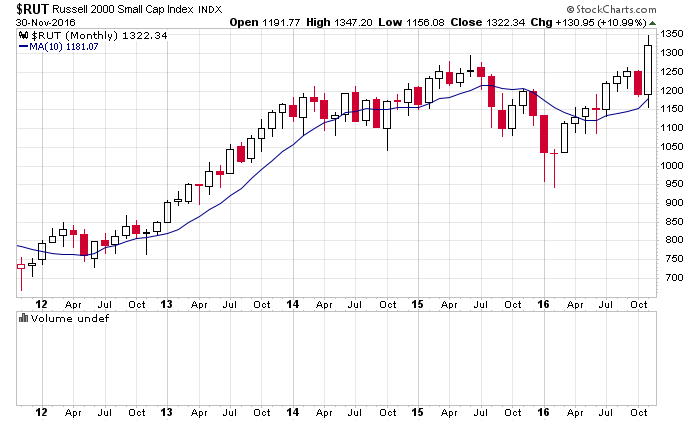

The Russell 2000 sported a much more impressive candle. November’s gain was the biggest in many years, and unless something bad happens in the world, odds favor a couple more positive candles forming the next few months.

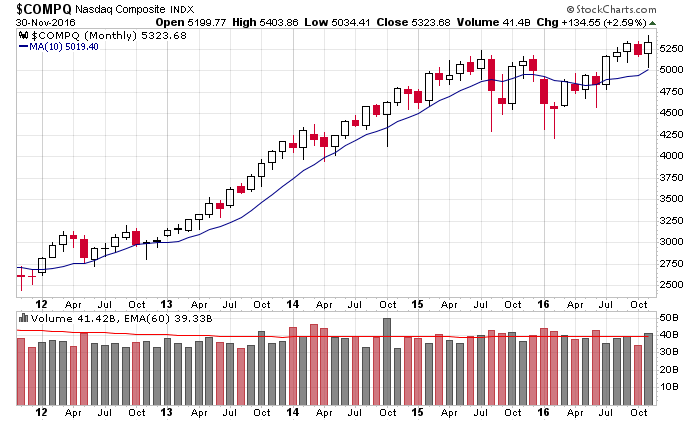

The Nasdaq also bounced off its 10-month MA and moved to a new high, but it’s gain for the month was much less impressive.

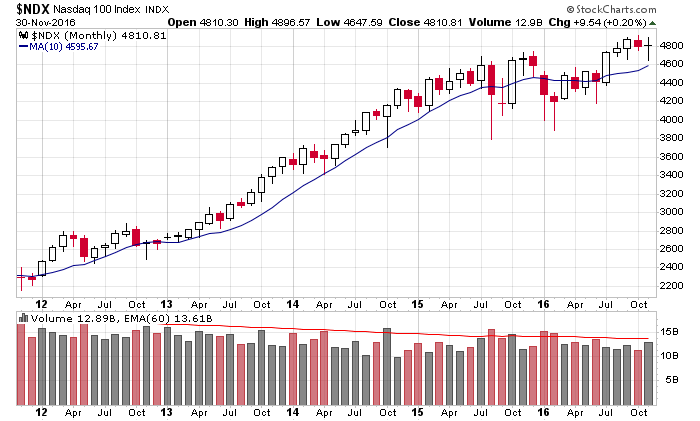

The Nas 100, the highest quality Nasdaq stocks, which include Apple, Google, Facebook, Microsoft, Amazon, Costco and many other household names was even less impressive. The index barely posted a gain for the month and was the only index to not rally to a new high. Many of these big cap tech stocks, which were overvalued to begin with, have been on the wrong side of money rotating to financials and industrial metals since the election. Remember when I noted the FANG stocks were responsible for 90% of the market’s market cap increase since the beginning of 2015 and wondered how the market could move up if they rested. Now we know. These stocks have not been needed, but it’d still be nice if they kept up better.

Overall I continue to like the market. Tomorrow we get the latest employment figures.

Stock headlines from barchart.com…

Wells Fargo (WFC +2.04%) was downgraded to ‘Neutral’ from ‘Positive’ at Susquehanna with a 12-month target price of $56.

Skechers (SKX +6.05%) was upgraded to ‘Buy’ from ‘Neutral’ at Buckingham Research Group with a price target of $31.

Cerner (CERN +0.02%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Leerink Partners with a 12-month target price of $50.

PVH Corp. (PVH -0.08%) fell 2% in after-hours trading after it said it sees Q4 non-GAAP EPS of $1.13-$1.18, below consensus of $1.29.

Rockwell Collins (COL +0.41%) rallied over 3% in after-hours trading after it people familiar with the matter said it is under pressure from Starboard Value LP, one of its three biggest shareholders, to reconsider its $6.4 billion purchase of B/E/ Aerospace and instead explore alternative options, including selling itself.

Pure Storage (PSTG -2.17%) rose over 1% in after-hours trading after it said it added more than 300 customers in Q3 and that it sees Q4 revenue of $219 million-$227 million versus estimates of $221.2 million.

Semtech (SMTC -0.71%) gained 3% in after-hours trading after it reported Q3 adjusted EPS of 37 cents, better than consensus of 36 cents, and said it sees Q4 adjusted EPS of 33 cents-37 cents, above consensus of 33 cents.

Box Inc. (BOX -0.46%) gained almost 1% in after-hours trading after it reported a Q3 adjusted loss of -14 cents a share, narrower than consensus of -19 cents, and then raised its 2017 revenue view to $397 million-$398 million from an August 31 view of $394 million-$396 million.

Guess? (GES -1.54%) tumbled over 10% in after-hours trading after it reported Q3 EPS of 11 cents, weaker than consensus of 14 cents, and then cut its fiscal 2017 adjusted EPS view to 42 cents-52 cents from a prior view of 62 cents-75 cents.

Xencor (XNCR -2.96%) slid nearly 4% in after-hours trading after it announced a proposed public offering of common stock but gave no size.

La-Z-Boy (LZB -1.83%) climbed nearly 5% in after-hours trading after it reported Q2 EPS of 42 cents, higher than a preliminary view of 37 cents-39 cents.

Tilly’s (TLYS -4.17%) surged over 15% in after-hours trading after it reported Q3 EPS of 22 cents, double consensus of 11 cents.

Fred’s (FRED +1.01%) rose over 5% in after-hours trading after rescheduling the release of its Q3 results and Nov sales data to Dec 8 from Dec 2.

Rexnord (RXN +3.77%) fell 4% in after-hours trading after it announced a public offering of 7 million shares of preferred stock.

Today’s Economic Calendar

Auto Sales

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Gallup Good Jobs Rate

9:45 PMI Manufacturing Index

9:45 Bloomberg Consumer Comfort Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Today’s Earnings here

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

One thought on “Before the Open (Dec 1)”

Leave a Reply

You must be logged in to post a comment.

Energy is the spot to watch. Guess when and where it goes. Up for a while. Then down when natural gas hits the market.

First time claims 268,000, but Auto payments lagging. Not a great sign.

Right now own the regional banks. The rate increase is 101% sure this month.

Slippery today as window dressing on retirement a/c push in to the market. Cold in Hawaii.